- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1357

High Growth Tech Stocks To Watch For Potential Opportunities

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate cuts from the ECB and SNB, alongside expectations of another Fed cut, major stock indexes have mostly declined with the exception of the technology-focused Nasdaq Composite, which has reached a new milestone. In this environment where growth stocks are outpacing value stocks, identifying high-growth tech companies with strong fundamentals and innovative potential can present intriguing opportunities for investors seeking to capitalize on market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meitu, Inc. is an investment holding company that focuses on developing products to enhance image, video, and design production for beauty-related solutions, promoting industry digitalization in China and globally, with a market cap of approximately HK$14.65 billion.

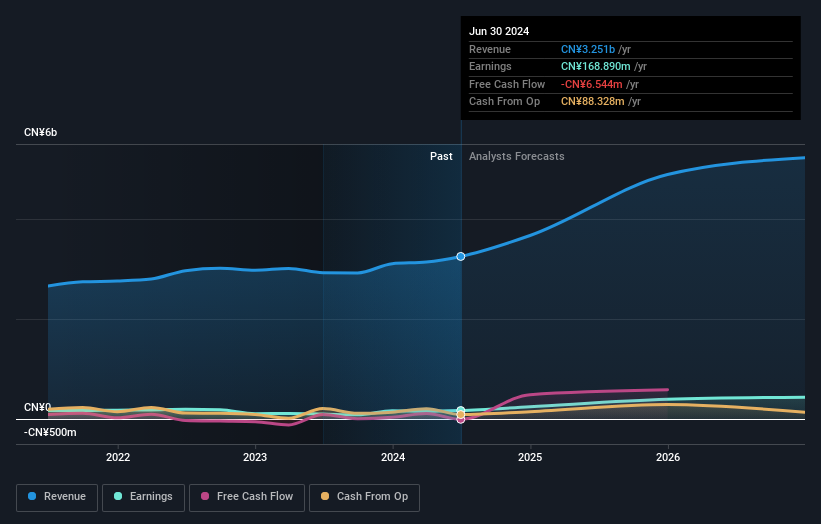

Operations: Meitu generates revenue primarily from its Internet Business segment, which contributed CN¥3.06 billion. The company focuses on digital solutions in the beauty industry both in China and internationally.

Meitu's strategic focus on R&D, with a notable allocation of its revenue towards innovation, underscores its commitment to staying competitive in the tech landscape. Despite a dip in net profit margins from 24.8% to 14.9% over the past year, Meitu is set for robust growth with earnings expected to surge by 31.6% annually and revenue projected to increase by 22.1% per year, outpacing both industry and Hong Kong market averages significantly. The recent announcement of a special dividend also reflects confidence in its financial health and commitment to shareholder value.

- Unlock comprehensive insights into our analysis of Meitu stock in this health report.

Evaluate Meitu's historical performance by accessing our past performance report.

Mobvista (SEHK:1860)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mobvista Inc. and its subsidiaries offer advertising and marketing technology services to support the development of the mobile internet ecosystem globally, with a market cap of HK$12.99 billion.

Operations: The company generates revenue primarily through its advertising and marketing technology services, catering to the mobile internet ecosystem. It focuses on providing solutions that enhance user acquisition and monetization for app developers and advertisers worldwide.

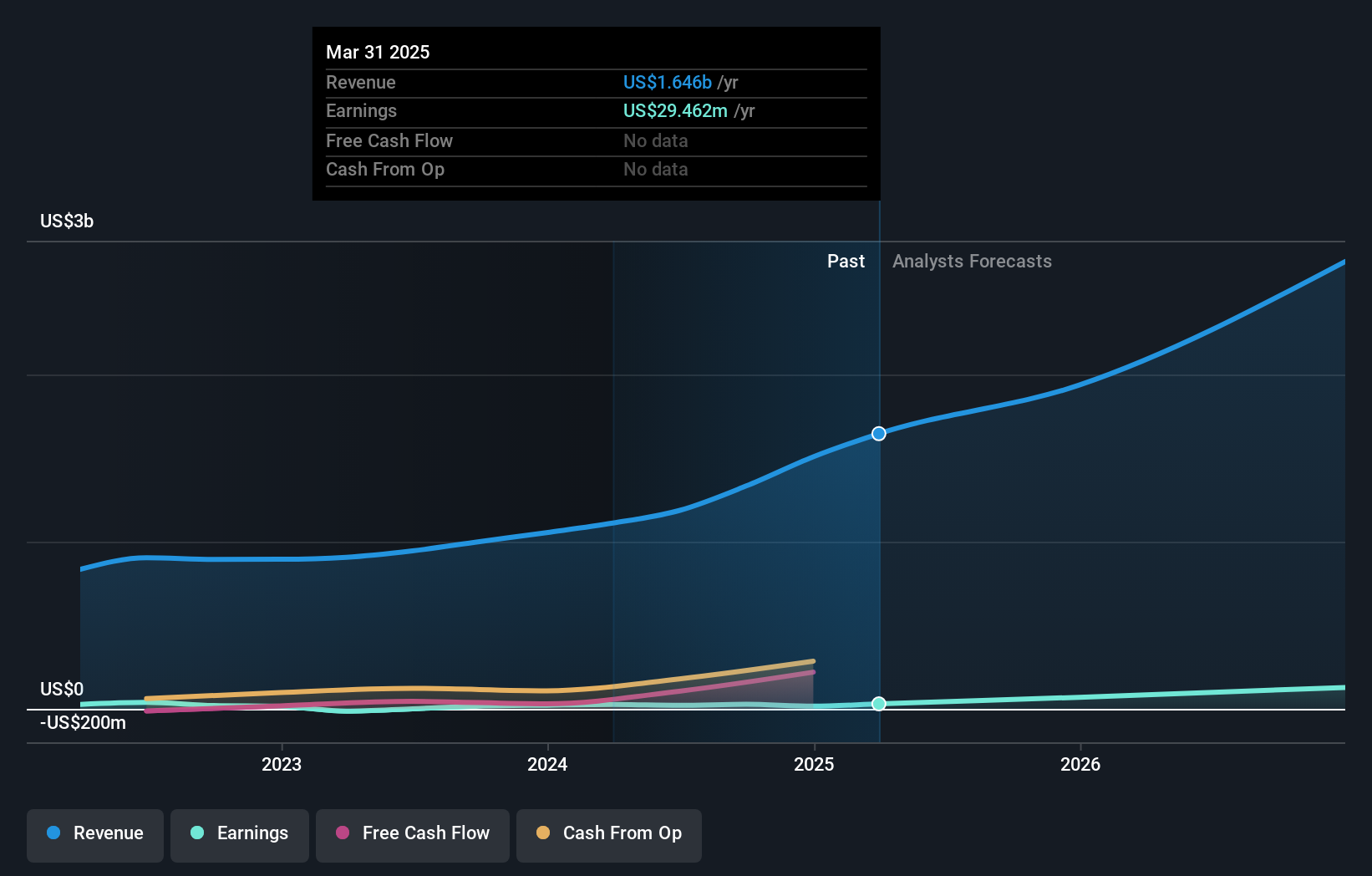

Mobvista's recent financial performance highlights its robust position in the tech industry, with a significant surge in sales from $269.37 million to $416.46 million in the third quarter of 2024 alone, marking an impressive annual growth rate of 30%. This growth trajectory is complemented by an earnings increase from $3.78 million to $9.9 million over the same period, reflecting a remarkable annualized earnings growth of 67.6%. The company's strategic emphasis on R&D is evident as it continues to invest heavily, ensuring its competitive edge and innovation in high-demand tech sectors. These financial indicators not only demonstrate Mobvista's strong market presence but also suggest potential for sustained future growth amidst evolving digital landscapes.

- Click to explore a detailed breakdown of our findings in Mobvista's health report.

Understand Mobvista's track record by examining our Past report.

Jiangsu Hoperun Software (SZSE:300339)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Hoperun Software Co., Ltd. is a software company that offers products, solutions, and services leveraging new generation information technology across China, Japan, Southeast Asia, North America, and globally with a market capitalization of CN¥42.35 billion.

Operations: Hoperun Software generates revenue through its diverse offerings in software products, IT solutions, and related services across multiple regions. The company focuses on leveraging advanced information technology to cater to a global clientele.

Jiangsu Hoperun Software's recent financial results underscore its dynamic growth within the tech sector, with earnings soaring by 113.6% over the past year and revenue reaching CNY 2.41 billion, up from CNY 2.16 billion a year prior. This performance is bolstered by an aggressive R&D strategy, with substantial investments aimed at fostering innovation and securing a competitive edge in software development—a sector increasingly dominated by SaaS models. Despite a volatile share price in recent months, the company's robust earnings growth of 36.4% per annum outpaces the Chinese market projection of 25.7%, positioning it well for future advancements amidst shifting digital landscapes.

Make It Happen

- Dive into all 1280 of the High Growth Tech and AI Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1357

Meitu

An investment holding company, develops products that streamline the production of image, video, and design to advance industry digitalization through beauty-related solutions in the People’s Republic of China and internationally.

High growth potential with excellent balance sheet.