- Hong Kong

- /

- Entertainment

- /

- SEHK:1060

Exploring Three High Growth Tech Stocks In Hong Kong

Reviewed by Simply Wall St

In the context of global market dynamics, Hong Kong's tech sector has been a focal point amidst broader economic shifts, with the Hang Seng Index experiencing fluctuations as investors react to central bank policies and economic data. For those exploring opportunities in high-growth tech stocks within this vibrant market, understanding key indicators such as innovation potential and adaptability to current technological trends can be crucial for identifying promising investments.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 23.30% | 38.78% | ★★★★★☆ |

| RemeGen | 26.23% | 52.03% | ★★★★★☆ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Innovent Biologics | 22.11% | 59.31% | ★★★★★☆ |

| Akeso | 33.50% | 53.12% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Alibaba Pictures Group (SEHK:1060)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alibaba Pictures Group Limited is an investment holding company engaged in content, technology, and IP merchandising and commercialization businesses in Hong Kong and the People's Republic of China, with a market cap of HK$13.97 billion.

Operations: Alibaba Pictures Group generates revenue primarily through its film investment, production, promotion, and distribution segment (CN¥2.07 billion), followed by IP merchandising and commercialization (CN¥1.05 billion) and film ticketing and technology platform (CN¥920.22 million). The company also earns from drama series production (CN¥596.12 million) and Damai (CN¥394.28 million).

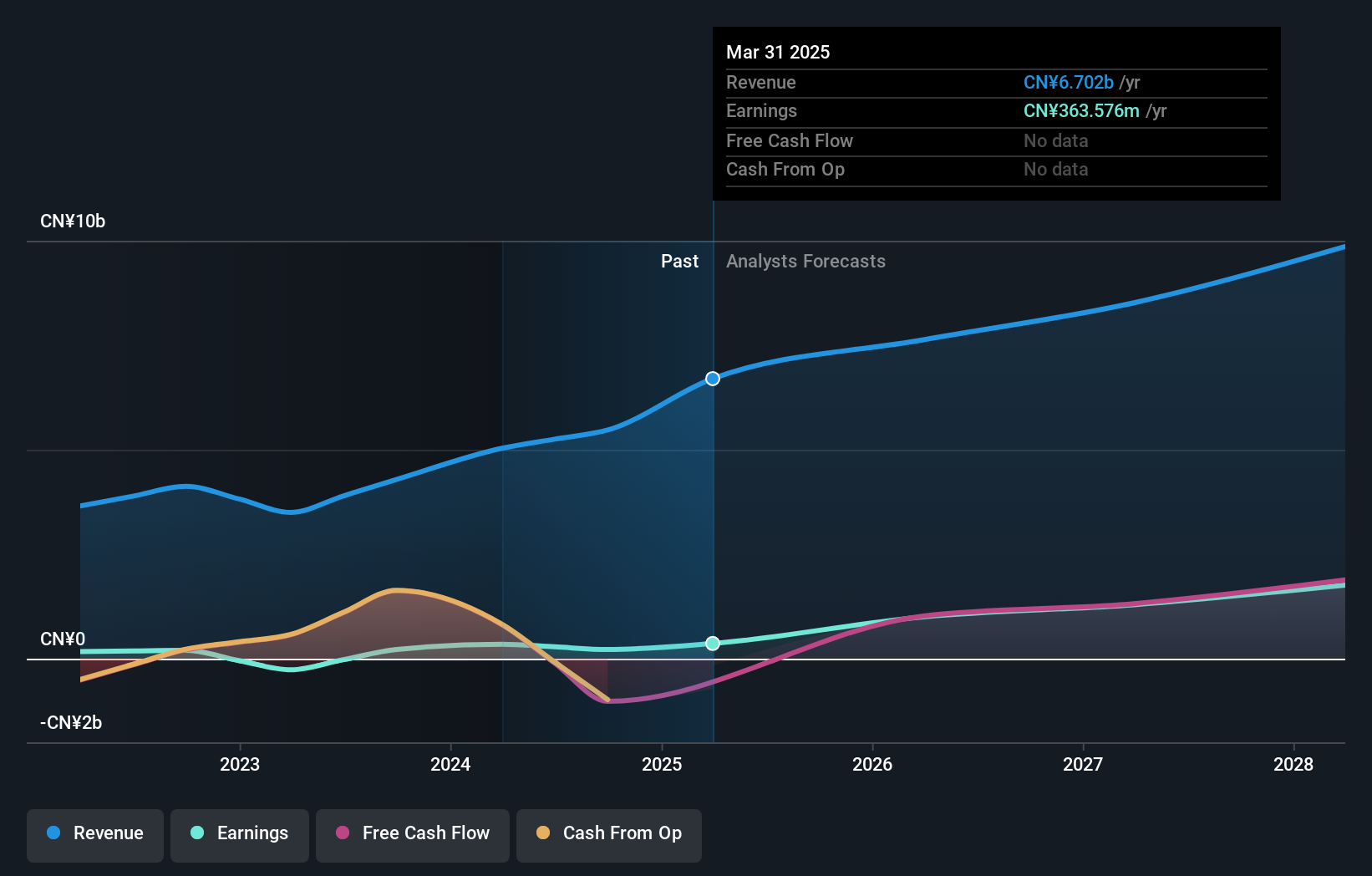

Alibaba Pictures Group, navigating through a dynamic entertainment landscape, shows promising growth with an expected annual earnings increase of 35.5%. This performance outstrips the broader Hong Kong market's forecast growth of 12.1% per year. Despite a significant one-off loss of CN¥353.2M last fiscal year impacting its financials, the company's revenue trajectory remains robust, growing at 13.2% annually—nearly double the local market pace of 7.4%. Recent strategic amendments to its bye-laws suggest proactive governance adjustments aligning with future growth prospects in high-growth tech sectors within Hong Kong's vibrant economic framework.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meitu, Inc. is an investment holding company that creates products to enhance image, video, and design production with beauty-related solutions for digitalization in China and globally, with a market cap of HK$11.52 billion.

Operations: The company generates revenue primarily from its Internet Business segment, which reported CN¥3.06 billion. The focus is on developing products that facilitate digitalization in image, video, and design production with beauty-related solutions.

Meitu, a player in Hong Kong's tech scene, has shown notable financial performance with its revenue and earnings growth outpacing local market averages. The company's recent half-year report highlighted a revenue increase to CNY 1.62 billion from CNY 1.26 billion year-over-year, and a net income rise to CNY 303.43 million, up from CNY 227.63 million. This reflects an impressive annual revenue growth rate of 19.6% and earnings growth forecast at 26.7%. These figures underscore Meitu's robust position in the competitive landscape, despite broader market challenges and significant insider selling noted over the past quarter. With such momentum, Meitu is poised to maintain its trajectory amidst evolving digital media dynamics.

Mobvista (SEHK:1860)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mobvista Inc. is a company that, along with its subsidiaries, provides advertising and marketing technology services essential for developing the mobile internet ecosystem globally, with a market cap of HK$2.61 billion.

Operations: Mobvista generates revenue primarily from its Advertising Technology Services, contributing $1.17 billion, and Marketing Technology Business, adding $16.98 million. The company focuses on delivering technology solutions that support the global mobile internet ecosystem.

Mobvista, navigating the competitive tech landscape of Hong Kong, reported a robust half-year performance with sales surging to USD 638.29 million from USD 506.13 million, marking a significant growth trajectory despite a slight dip in net income to USD 9.27 million from USD 10.16 million previously. This growth is underpinned by strategic R&D investments which are crucial for fostering innovation and maintaining competitive edge in high-growth markets; such expenditures have been pivotal in driving the company's product development and market expansion efforts. With earnings projected to grow at an impressive rate of 66% annually, Mobvista is poised to capitalize on emerging tech trends, although it faces challenges like share price volatility and the need for continuous innovation to sustain its growth momentum in a rapidly evolving industry.

- Navigate through the intricacies of Mobvista with our comprehensive health report here.

Explore historical data to track Mobvista's performance over time in our Past section.

Turning Ideas Into Actions

- Gain an insight into the universe of 43 SEHK High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1060

Damai Entertainment Holdings

An investment holding company, operates in the content, technology, and IP merchandising and commercialization businesses in Hong Kong and the People's Republic of China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives