- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1357

Exploring High Growth Tech Stocks In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by accelerating U.S. inflation and climbing stock indexes, small-cap stocks have notably lagged behind their larger counterparts, with the Russell 2000 Index trailing the S&P 500 by a significant margin. In this environment, investors often seek high-growth tech stocks that can potentially outperform in dynamic conditions, focusing on companies with strong innovation capabilities and adaptability to changing economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| AVITA Medical | 29.97% | 53.77% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

Click here to see the full list of 1210 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Alibaba Pictures Group (SEHK:1060)

Simply Wall St Growth Rating: ★★★★☆☆

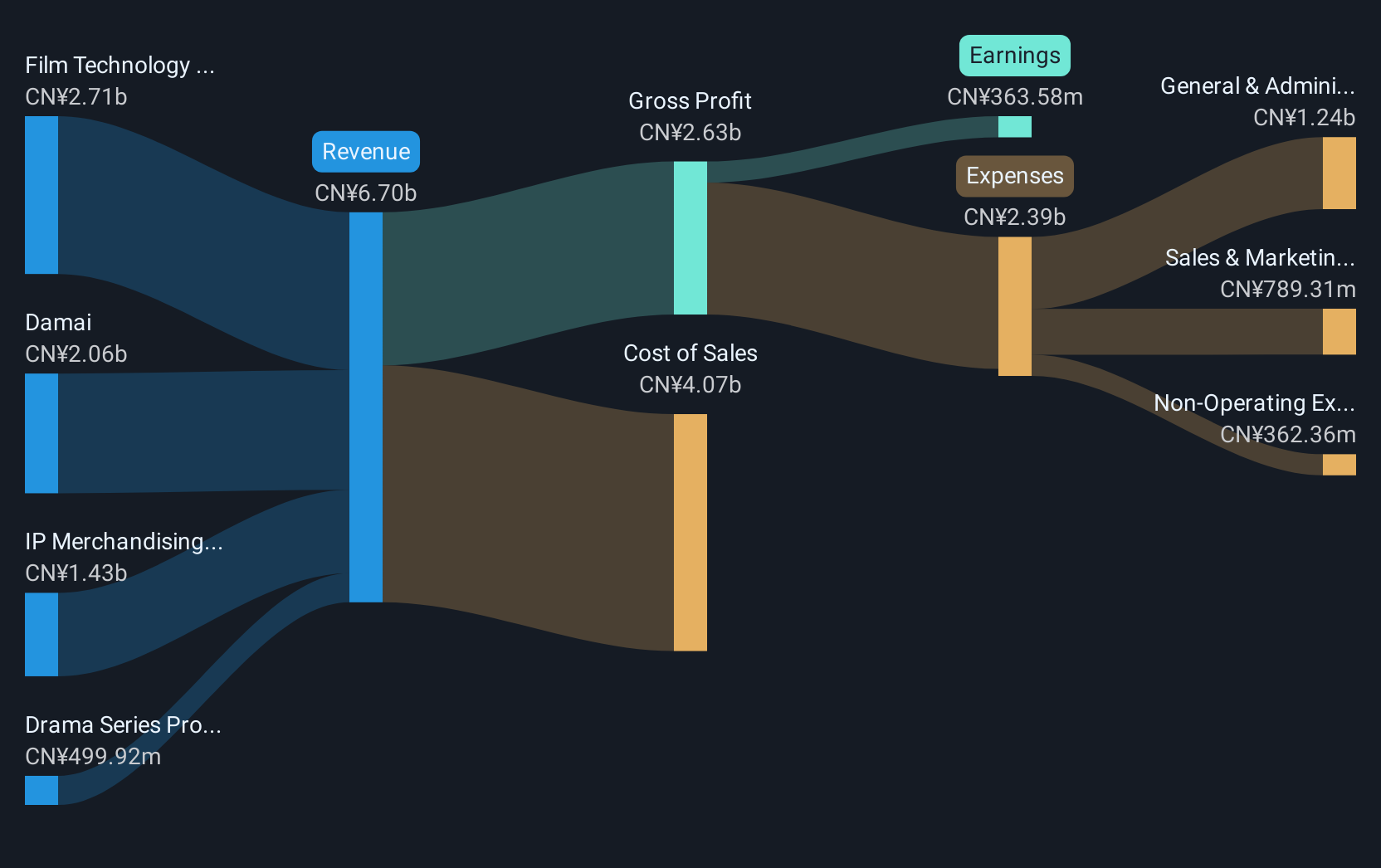

Overview: Alibaba Pictures Group Limited is an investment holding company engaged in content creation, technology, and IP merchandising and commercialization in Hong Kong and the People's Republic of China, with a market cap of approximately HK$18.72 billion.

Operations: Alibaba Pictures Group focuses on content creation, technology, and IP merchandising in Hong Kong and China. The company derives its revenue primarily from these segments, with a market cap of around HK$18.72 billion.

Despite facing a significant one-off loss of CN¥480.9M last year, Alibaba Pictures Group is poised for robust future growth with earnings expected to surge by 45.5% annually. This growth trajectory starkly outpaces the Hong Kong market's average of 11.7%. Additionally, the company's revenue is also on an upward trend, forecasted to grow at 15% per year, which exceeds the local market's growth rate of 7.8%. Recent strategic shifts are evident as Mr. Tung Pen Hung stepped down from his director role early this year to focus on other business ventures, signaling a potential reshaping of the company’s leadership and strategic direction. With these dynamics at play, Alibaba Pictures Group demonstrates a promising blend of recovery potential and aggressive pursuit of market expansion despite recent financial hiccups.

- Click to explore a detailed breakdown of our findings in Alibaba Pictures Group's health report.

Learn about Alibaba Pictures Group's historical performance.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★☆☆

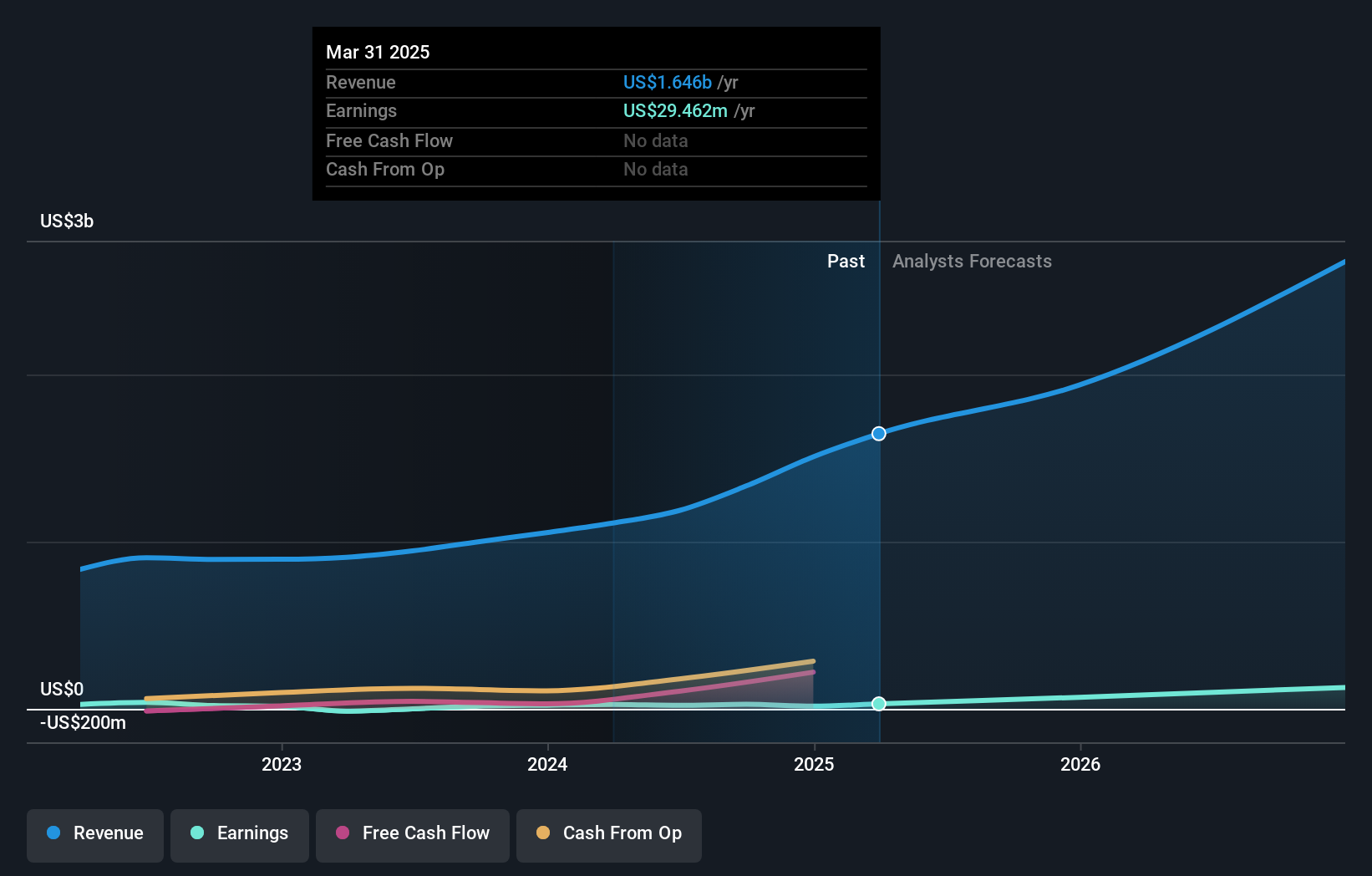

Overview: Meitu, Inc. is an investment holding company focused on creating products that enhance the digitalization of industries through beauty-related solutions for image, video, and design in China and globally, with a market capitalization of approximately HK$26.66 billion.

Operations: The company generates revenue primarily from its Internet Business segment, which contributed CN¥3.06 billion.

Meitu, Inc. recently approved a special dividend of HKD 0.109 per share, reflecting its ability to return value to shareholders amidst robust financial health. This move coincides with an impressive forecasted annual revenue growth of 19.6%, outpacing the Hong Kong market's average of 7.8%. Despite a challenging past with earnings growth lagging at -22.8%, Meitu's future looks promising with expected earnings growth surging by 27% annually, significantly above the market norm of 11.7%. This financial rejuvenation is underpinned by substantial investments in R&D, which have historically aligned closely with revenue increases, ensuring Meitu remains at the forefront of technological innovation in its sector.

- Click here to discover the nuances of Meitu with our detailed analytical health report.

Gain insights into Meitu's past trends and performance with our Past report.

Mobvista (SEHK:1860)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mobvista Inc. provides advertising and marketing technology services to support the development of the mobile internet ecosystem globally, with a market cap of HK$18.02 billion.

Operations: The company focuses on delivering advertising and marketing technology solutions to enhance the mobile internet ecosystem worldwide. It operates through various subsidiaries, leveraging its technological expertise to serve a diverse global clientele.

Mobvista showcases a dynamic trajectory in the high-growth tech sector, with an annual revenue increase of 30.0% and earnings growth at an impressive rate of 67.6%. This performance is bolstered by substantial investments in R&D, which have been strategically aligned with its revenue streams; specifically, R&D expenses are now at 15% of total revenues. These figures highlight Mobvista's commitment to innovation and its ability to adapt swiftly to evolving market demands. The company's focus on expanding its technological capabilities could significantly influence future industry standards and practices, especially as digital marketing landscapes continue to evolve rapidly.

- Click here and access our complete health analysis report to understand the dynamics of Mobvista.

Review our historical performance report to gain insights into Mobvista's's past performance.

Where To Now?

- Navigate through the entire inventory of 1210 High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1357

Meitu

An investment holding company, engages in the development and provision of products that streamline the production of photo, video, and design with other AI-powered products in Mainland China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives