- Hong Kong

- /

- Entertainment

- /

- SEHK:136

3 SEHK Growth Companies With High Insider Ownership Expecting 28% Profit Growth

Reviewed by Simply Wall St

The Hong Kong market has recently experienced a downturn, with the Hang Seng Index retreating by 2.28% amid broader economic concerns and policy uncertainties. Despite this, growth companies with high insider ownership continue to attract attention due to their potential for robust profit growth and alignment of interests between insiders and shareholders. In this environment, stocks that exhibit strong profit growth expectations alongside substantial insider ownership can be particularly appealing as they suggest confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Fenbi (SEHK:2469) | 31.1% | 42.8% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73% |

| DPC Dash (SEHK:1405) | 38.2% | 91.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Beijing Airdoc Technology (SEHK:2251) | 28.6% | 83.9% |

| Ocumension Therapeutics (SEHK:1477) | 23.3% | 93.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meitu, Inc. is an investment holding company that creates products for enhancing image, video, and design production with beauty-related solutions in China and internationally, with a market cap of HK$11.70 billion.

Operations: The company's revenue from its Internet Business segment is CN¥2.70 billion.

Insider Ownership: 36.6%

Earnings Growth Forecast: 26.4% p.a.

Meitu's earnings grew 301.8% over the past year and are forecast to grow 26.4% annually, outpacing the Hong Kong market's 11.3%. Despite no substantial insider buying in the last three months, Meitu trades at 75.7% below its estimated fair value. Recent guidance suggests a net profit increase of no less than 30%, though significant one-off items impact financial results. Changes in board composition were also announced, with new appointments enhancing governance expertise.

- Unlock comprehensive insights into our analysis of Meitu stock in this growth report.

- Our comprehensive valuation report raises the possibility that Meitu is priced higher than what may be justified by its financials.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Ruyi Holdings Limited, with a market cap of HK$25.63 billion, is an investment holding company involved in content production and online streaming across the People's Republic of China, Hong Kong, Europe, and internationally.

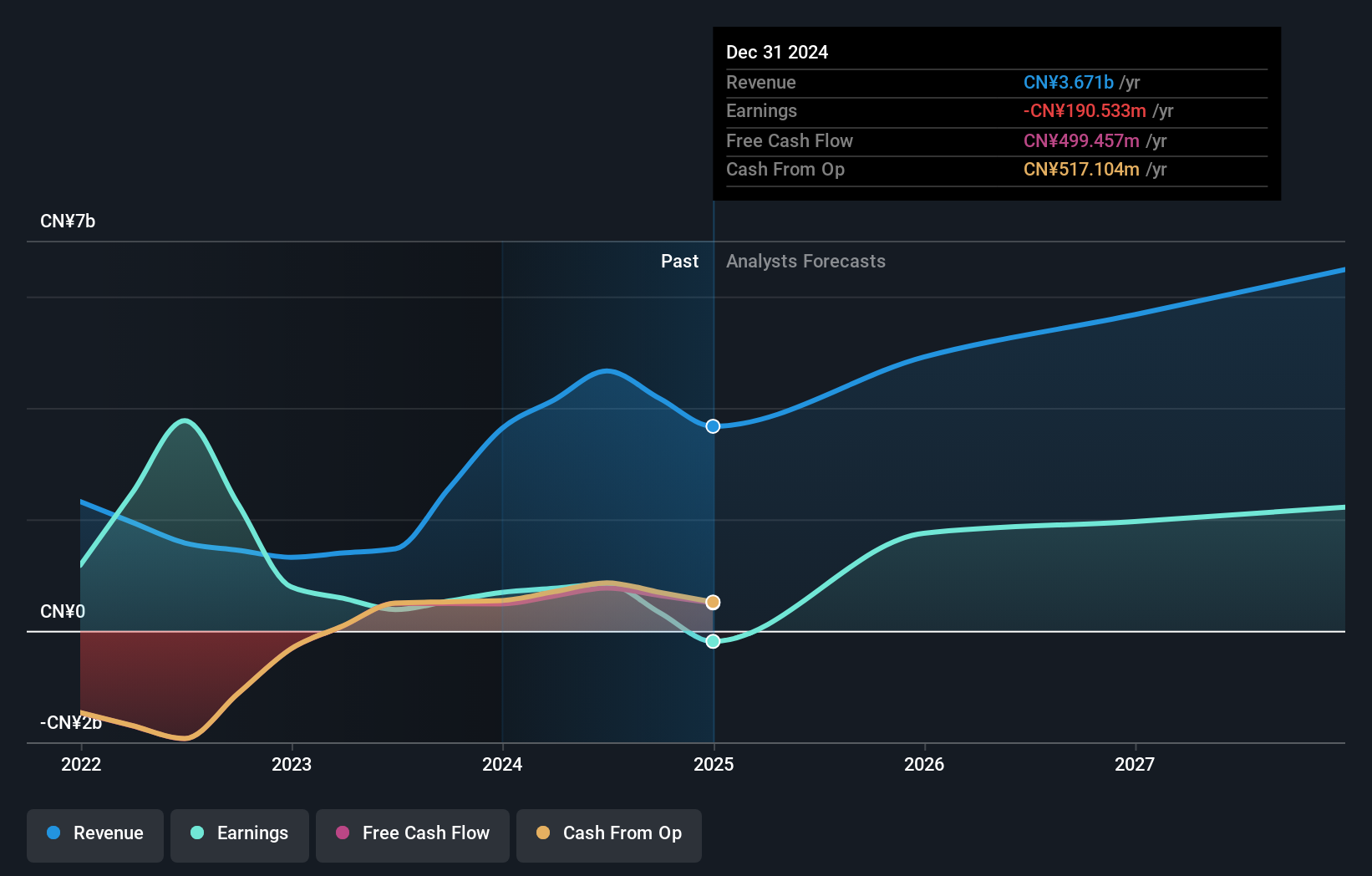

Operations: The company generates revenue primarily from its content production business (CN¥2.23 billion) and online streaming and gaming businesses (CN¥1.38 billion).

Insider Ownership: 15.1%

Earnings Growth Forecast: 14.8% p.a.

China Ruyi Holdings is forecast to see substantial revenue growth at 27.7% annually, significantly outpacing the Hong Kong market's 7.4%. However, profit margins have declined from 59.8% to 19%, and shareholders experienced dilution over the past year. Despite these challenges, the company trades at a significant discount to its estimated fair value. Recent events include a HK$4 billion follow-on equity offering and amendments to company bylaws approved at their AGM in June 2024.

- Navigate through the intricacies of China Ruyi Holdings with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that China Ruyi Holdings' current price could be inflated.

Adicon Holdings (SEHK:9860)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Adicon Holdings Limited operates medical laboratories in the People’s Republic of China and has a market cap of HK$7.22 billion.

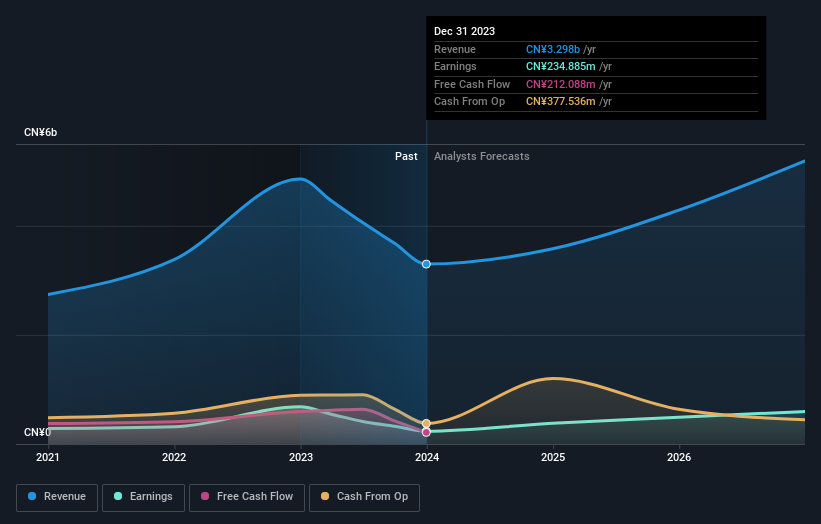

Operations: The company's revenue segment primarily consists of Healthcare Facilities & Services, generating CN¥3.30 billion.

Insider Ownership: 22.4%

Earnings Growth Forecast: 28.3% p.a.

Adicon Holdings is forecast to achieve significant earnings growth of 28.3% annually, outpacing the Hong Kong market's 11.3%. Despite a decline in profit margins from 14% to 7.1%, its revenue is expected to grow at 14.3% per year. The company recently announced a share repurchase program authorized by shareholders, aiming to buy back up to 10% of its issued share capital, potentially boosting net asset value and earnings per share.

- Click here and access our complete growth analysis report to understand the dynamics of Adicon Holdings.

- The analysis detailed in our Adicon Holdings valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Delve into our full catalog of 53 Fast Growing SEHK Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:136

China Ruyi Holdings

An investment holding company, engages in content production and online streaming business in the People's Republic of China, Hong Kong, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.