- China

- /

- Paper and Forestry Products

- /

- SHSE:600963

3 Promising Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with U.S. stocks ending the week lower due to tariff uncertainties and mixed economic data, while European indices showed resilience despite trade policy concerns. In this context of fluctuating market conditions, investors often seek opportunities in less conventional areas like penny stocks, which despite their somewhat outdated name, remain relevant for those interested in smaller or newer companies. These stocks can offer surprising value and potential growth when backed by strong financial health; thus, we will explore several promising penny stocks that may present compelling opportunities with notable balance sheet strength.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.55 | MYR2.71B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £329.19M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.345 | MYR1.13B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$43.97B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.922 | £146.94M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR417.12M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.03M | ★★★★☆☆ |

Click here to see the full list of 5,708 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Meitu (SEHK:1357)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Meitu, Inc. is an investment holding company that creates products to enhance image, video, and design production with beauty-related solutions for digitalization in China and globally, with a market cap of HK$20.92 billion.

Operations: The company's revenue is generated from its Internet Business segment, totaling CN¥3.06 billion.

Market Cap: HK$20.92B

Meitu, Inc. has shown resilience despite recent negative earnings growth, with a forecasted annual earnings increase of 26.99%. The company maintains strong financial health, with short-term assets exceeding both long-term and short-term liabilities. Its debt is well-covered by operating cash flow, and it holds more cash than total debt. However, its return on equity remains low at 10.3%. The stock trades below estimated fair value but exhibits high volatility compared to other Hong Kong stocks. Recently, Meitu announced a special dividend of HK$0.109 per share to be paid from the share premium account in February 2025.

- Jump into the full analysis health report here for a deeper understanding of Meitu.

- Explore Meitu's analyst forecasts in our growth report.

Novautek Technologies Group (SEHK:519)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Novautek Technologies Group Limited is an investment holding company involved in resort and property development, as well as property investment in the People’s Republic of China and Hong Kong, with a market cap of HK$268.85 million.

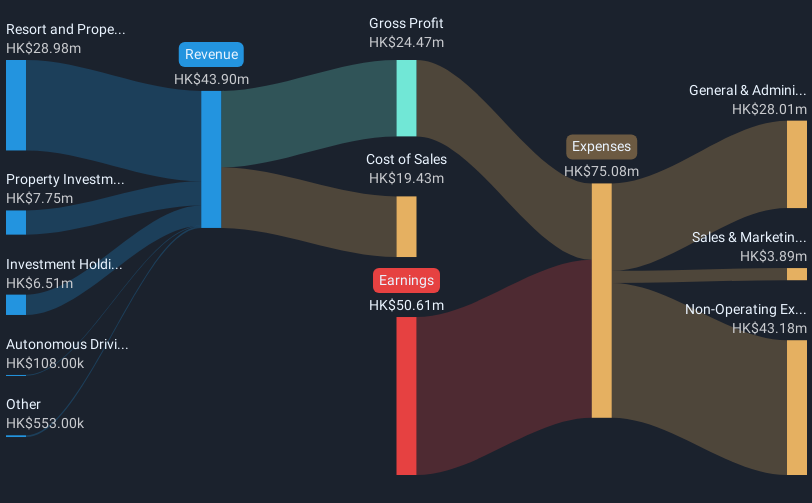

Operations: The company's revenue is primarily driven by resort and property development at HK$28.98 billion, followed by property investment at HK$7.75 billion, with additional contributions from investment holding at HK$6.51 million and autonomous driving at HK$0.11 million.

Market Cap: HK$268.85M

Novautek Technologies Group Limited, with a market cap of HK$268.85 million, is involved in resort and property development and has recently ventured into AI robotics. Despite being unprofitable, the company has reduced its losses by 23% annually over five years and maintains a satisfactory net debt to equity ratio of 6.3%. Its short-term assets exceed both short- and long-term liabilities, ensuring financial stability. Novautek's autonomous robots are gaining traction in Hong Kong's smart city initiatives, enhancing cleaning efficiency in shopping centers and providing innovative security solutions for public estates through AI-driven technologies.

- Unlock comprehensive insights into our analysis of Novautek Technologies Group stock in this financial health report.

- Explore historical data to track Novautek Technologies Group's performance over time in our past results report.

Yueyang Forest & Paper (SHSE:600963)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yueyang Forest & Paper Co., Ltd. manufactures and sells cultural, industrial, and packaging paper products in China and internationally, with a market cap of CN¥8.97 billion.

Operations: The company generates revenue of CN¥7.18 billion from its operations in China.

Market Cap: CN¥8.97B

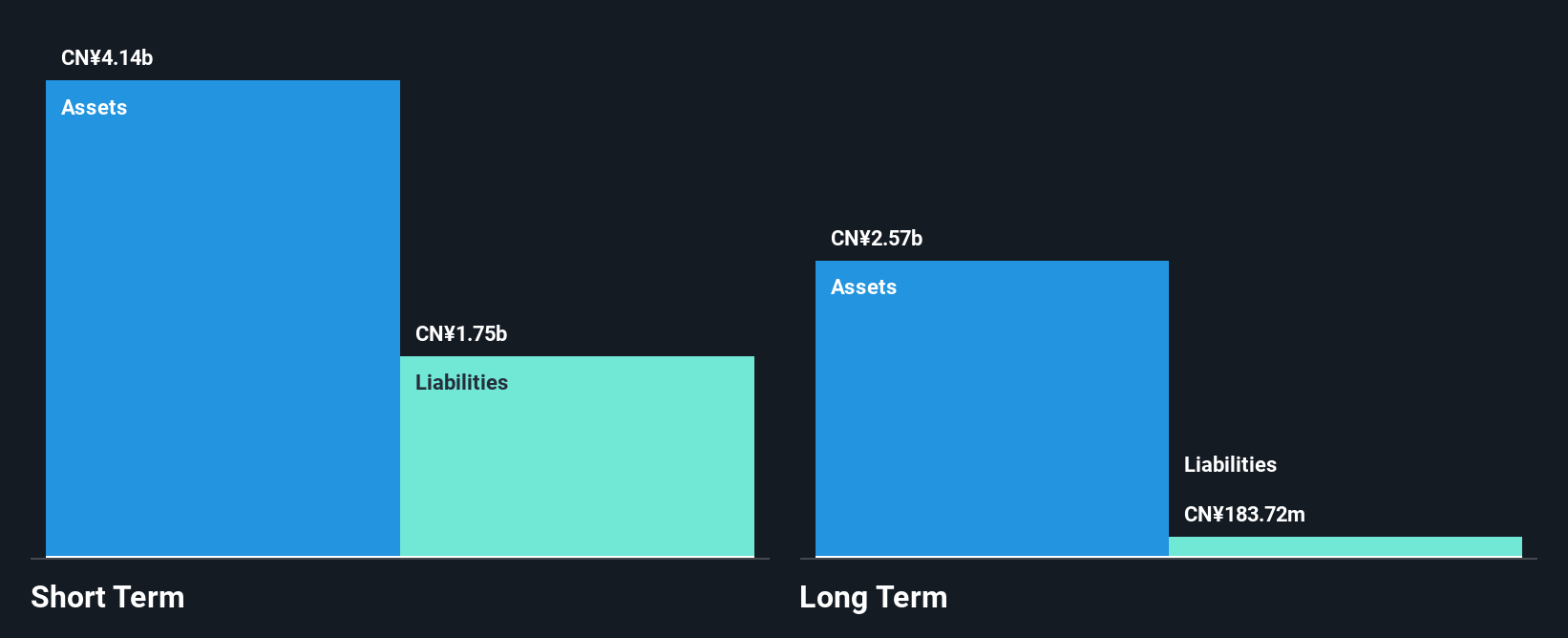

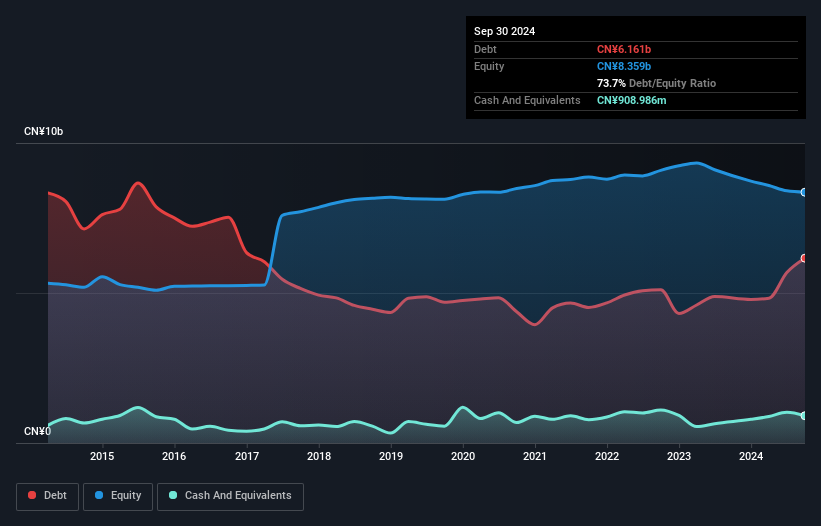

Yueyang Forest & Paper Co., Ltd., with a market cap of CN¥8.97 billion, operates in the paper industry but is currently unprofitable, with losses increasing annually by 30.9% over the past five years. Despite this, its short-term assets of CN¥9.3 billion exceed both short- and long-term liabilities, indicating a solid financial position. The company has high debt levels with a net debt to equity ratio of 62.8%, though interest payments are well covered by earnings. Yueyang trades at a significant discount to its estimated fair value and benefits from an experienced management team averaging 5.6 years in tenure.

- Dive into the specifics of Yueyang Forest & Paper here with our thorough balance sheet health report.

- Examine Yueyang Forest & Paper's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Unlock more gems! Our Penny Stocks screener has unearthed 5,705 more companies for you to explore.Click here to unveil our expertly curated list of 5,708 Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600963

Yueyang Forest & Paper

Manufactures and sells cultural, industrial, and packaging paper products in China and internationally.

Moderate risk second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026