- China

- /

- Aerospace & Defense

- /

- SZSE:300045

3 Growth Companies With Insider Ownership Up To 36%

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty marked by inflation concerns and fluctuating interest rates, U.S. equities have experienced notable volatility, with growth stocks particularly under pressure. In such an environment, companies that demonstrate strong insider ownership can be appealing to investors who seek alignment between company management and shareholder interests, as insiders often have a vested interest in the company's long-term success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We'll examine a selection from our screener results.

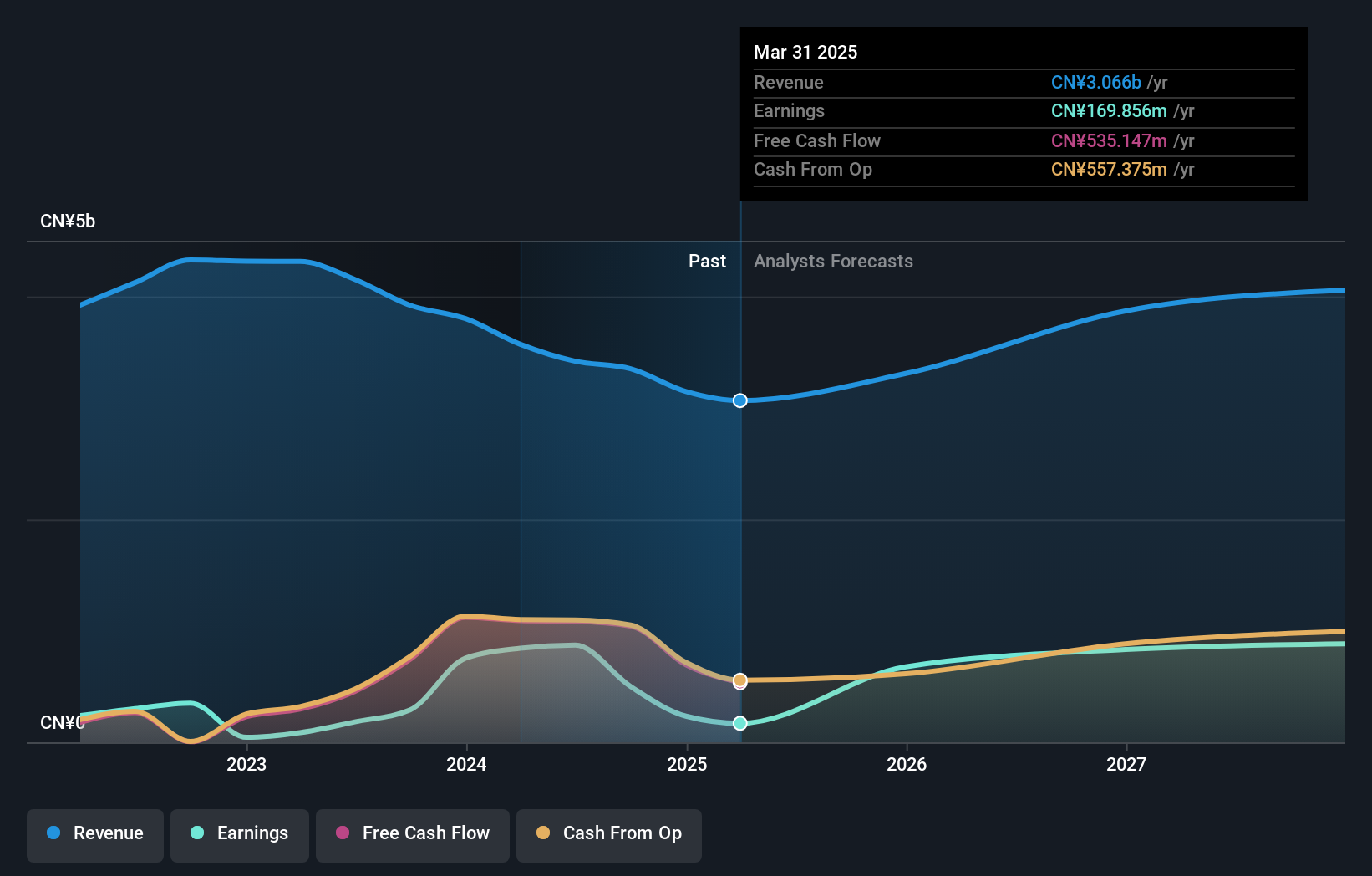

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meitu, Inc. is an investment holding company that develops beauty-related digital solutions for image, video, and design production in the People's Republic of China and internationally, with a market cap of HK$12.80 billion.

Operations: The company's revenue primarily comes from its Internet Business segment, which generated CN¥3.06 billion.

Insider Ownership: 36.1%

Meitu's earnings are projected to grow significantly, outpacing the Hong Kong market with a 26.8% annual increase, while revenue is expected to rise by 19.3% per year. Despite lower profit margins compared to last year, the stock trades at a substantial discount of 52.9% below estimated fair value. Recent announcements regarding special dividends highlight potential returns for shareholders, contingent on board approval and financial stability assessments in early 2025.

- Click to explore a detailed breakdown of our findings in Meitu's earnings growth report.

- The valuation report we've compiled suggests that Meitu's current price could be quite moderate.

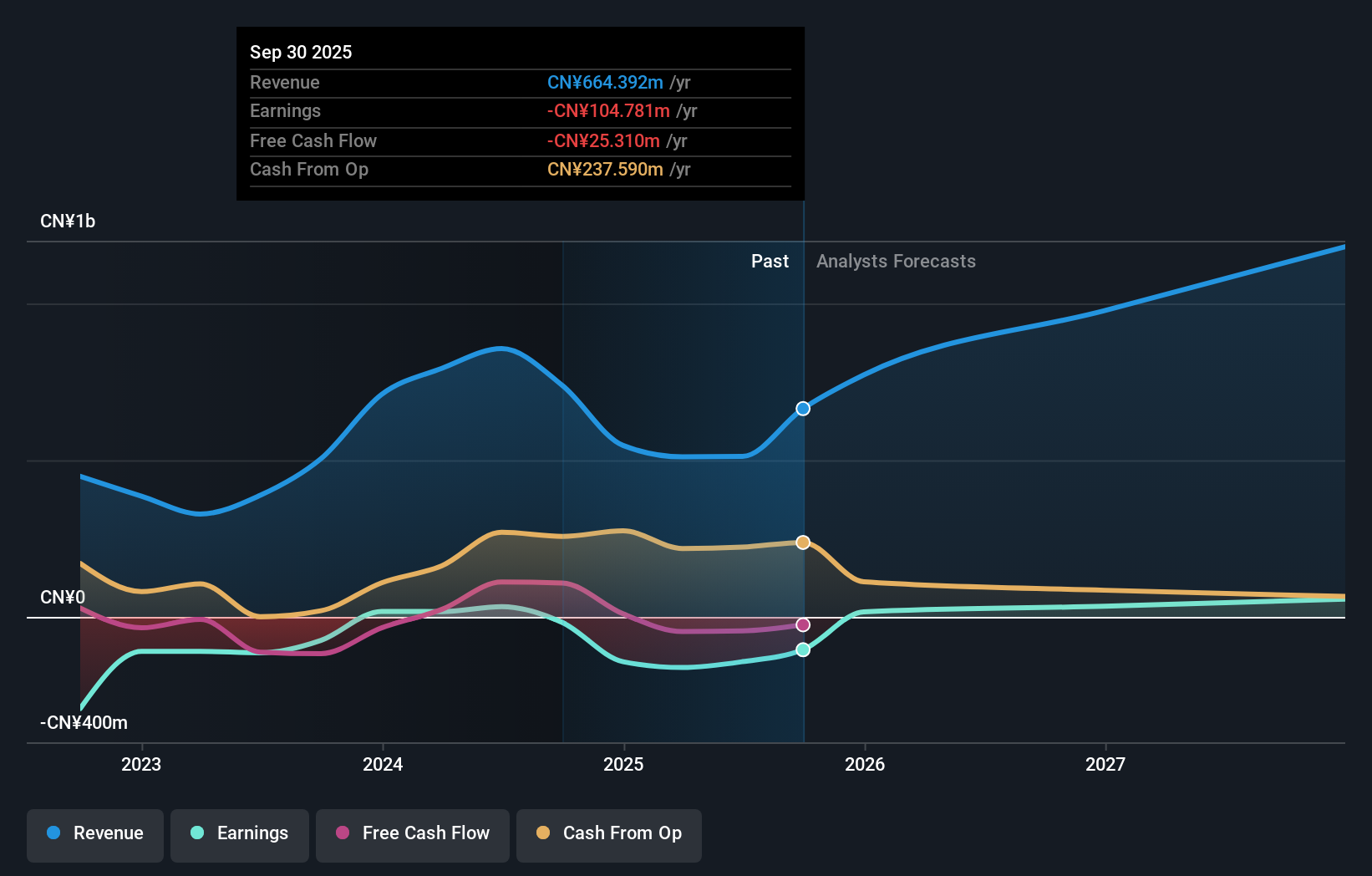

Hwa Create (SZSE:300045)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hwa Create Corporation engages in the research, development, manufacturing, and sale of satellite navigation as well as radar and communication products and technologies, with a market cap of CN¥12.49 billion.

Operations: The company's revenue segments include satellite navigation products and technologies, and radar and communication products and technologies.

Insider Ownership: 34.4%

Hwa Create's revenue is forecast to grow at 34.7% annually, surpassing the Chinese market average of 13.3%, although recent earnings showed a net loss of CNY 28.79 million for the nine months ending September 2024 compared to a profit last year. Despite high insider ownership, no significant insider trading activity was noted recently. The company is expected to become profitable within three years, with earnings growth projected at 82.6% per annum amidst share price volatility.

- Dive into the specifics of Hwa Create here with our thorough growth forecast report.

- Our valuation report unveils the possibility Hwa Create's shares may be trading at a premium.

XGD (SZSE:300130)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: XGD Inc. and its subsidiaries engage in the research, development, manufacturing, sales, and servicing of payment terminals both in China and internationally, with a market cap of CN¥11.06 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 36.5%

XGD Inc. is trading at a significant discount to its estimated fair value, suggesting good relative value compared to peers. Despite high volatility in share price over the past three months, insider ownership remains substantial with no recent insider selling. Revenue and earnings are expected to grow faster than the Chinese market averages, though recent financial results showed declines in sales and net income year-over-year. A dividend was recently affirmed at an extraordinary general meeting.

- Click here to discover the nuances of XGD with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of XGD shares in the market.

Make It Happen

- Embark on your investment journey to our 1442 Fast Growing Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hwa Create might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300045

Hwa Create

Researches and develops, manufactures, and sells satellite navigation, and radar and communication products and technologies.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives