Huashi Group Holdings' (HKG:1111) Earnings Are Weaker Than They Seem

Huashi Group Holdings Limited (HKG:1111) announced strong profits, but the stock was stagnant. Our analysis suggests that shareholders have noticed something concerning in the numbers.

See our latest analysis for Huashi Group Holdings

A Closer Look At Huashi Group Holdings' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

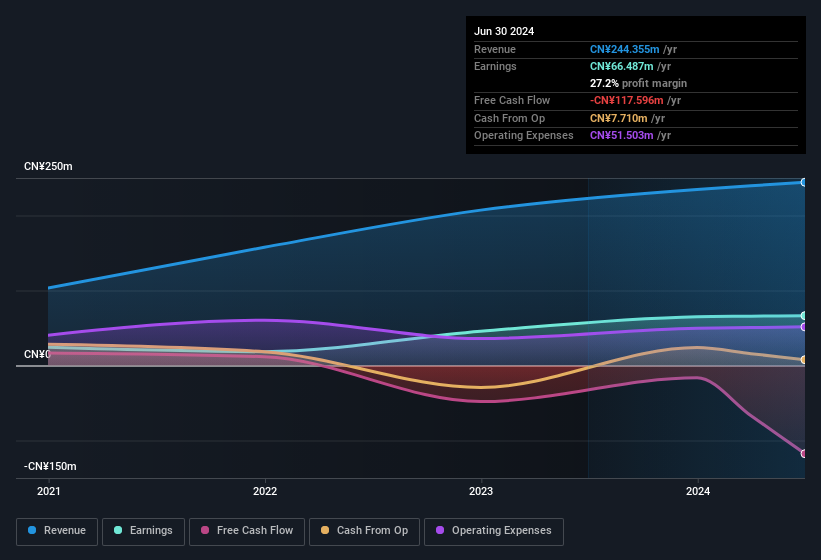

For the year to June 2024, Huashi Group Holdings had an accrual ratio of 0.74. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. In the last twelve months it actually had negative free cash flow, with an outflow of CN¥118m despite its profit of CN¥66.5m, mentioned above. We also note that Huashi Group Holdings' free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of CN¥118m.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Huashi Group Holdings.

Our Take On Huashi Group Holdings' Profit Performance

As we discussed above, we think Huashi Group Holdings' earnings were not supported by free cash flow, which might concern some investors. As a result, we think it may well be the case that Huashi Group Holdings' underlying earnings power is lower than its statutory profit. The good news is that, its earnings per share increased by 8.7% in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Be aware that Huashi Group Holdings is showing 2 warning signs in our investment analysis and 1 of those can't be ignored...

This note has only looked at a single factor that sheds light on the nature of Huashi Group Holdings' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Huashi Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1111

Huashi Group Holdings

Operates as a branding, advertising, and marketing service provider in the People’s Republic of China.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives