- Hong Kong

- /

- Entertainment

- /

- SEHK:1060

Exploring High Growth Tech Stocks In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are experiencing a positive shift, with major U.S. stock indexes rebounding due to easing core inflation and strong bank earnings, while European markets are buoyed by slower-than-expected inflation raising hopes for continued interest rate cuts. In this environment of cautious optimism and shifting economic indicators, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and adaptability in navigating these evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Alibaba Pictures Group (SEHK:1060)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alibaba Pictures Group Limited is an investment holding company involved in content, technology, and IP merchandising and commercialization across Hong Kong and the People's Republic of China, with a market cap of HK$15.45 billion.

Operations: Alibaba Pictures Group focuses on content production, technology integration, and intellectual property merchandising. Operating primarily in Hong Kong and the People's Republic of China, it leverages its strategic position to generate revenue through diversified entertainment-related ventures.

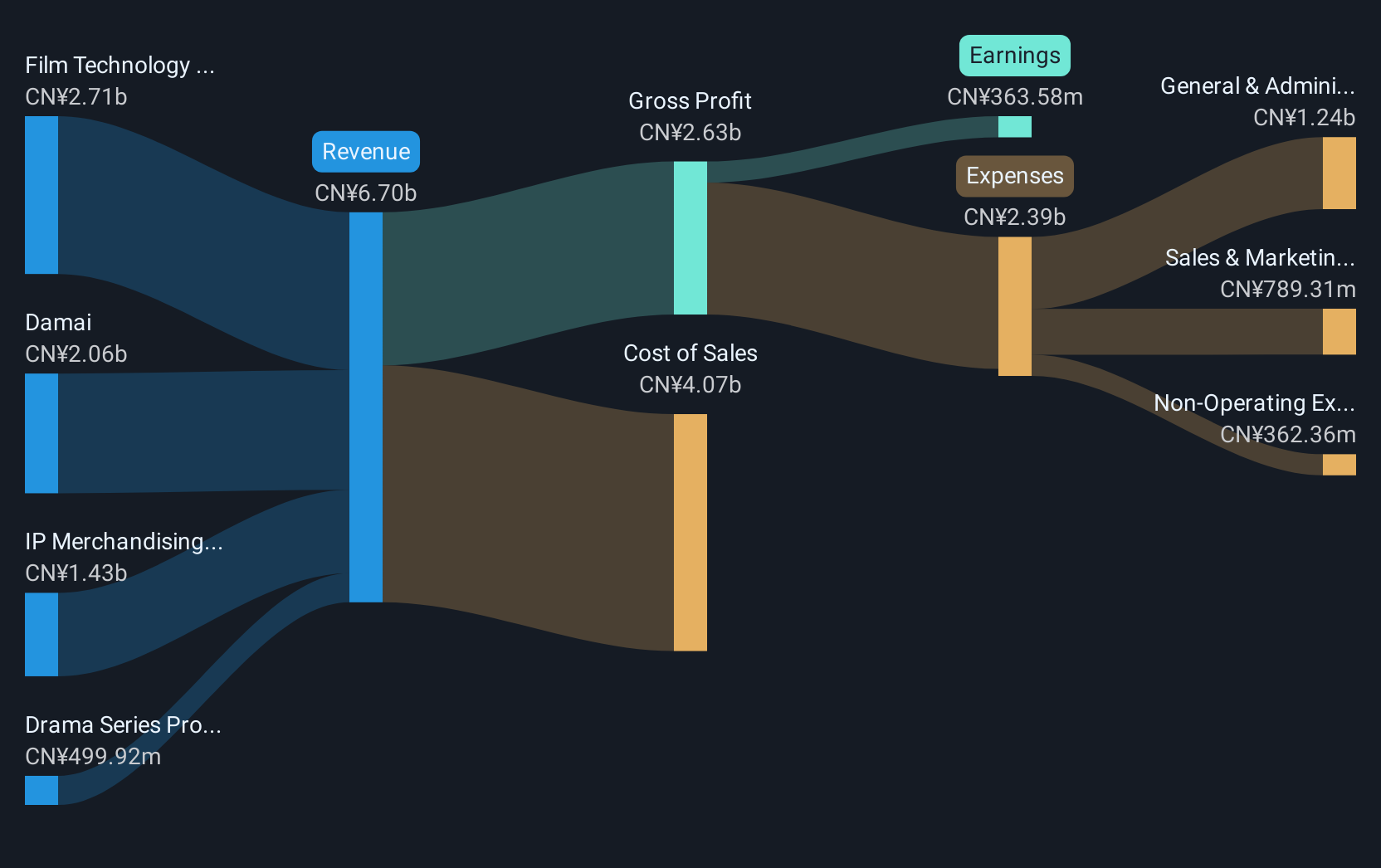

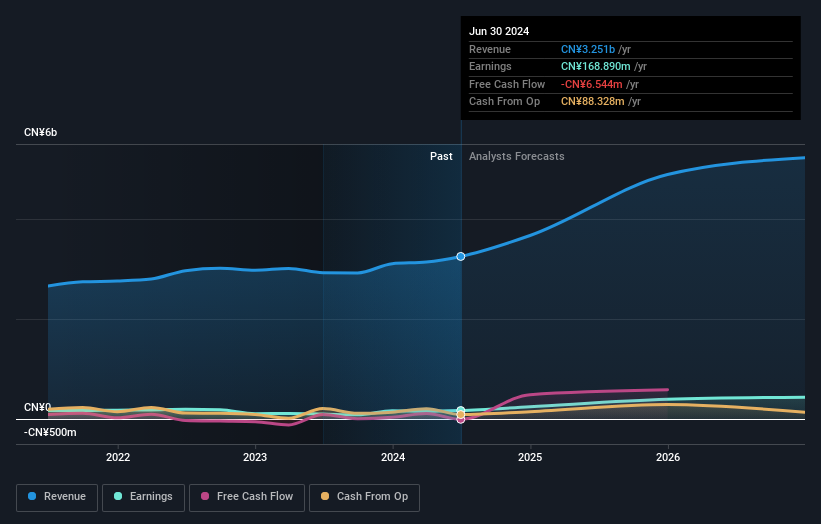

Alibaba Pictures Group, navigating through a transformative phase in the entertainment industry, reported a revenue increase to CNY 3.05 billion, up from CNY 2.62 billion year-over-year for the half year ended September 2024. Despite this growth, net income dipped to CNY 336.6 million from CNY 463.79 million due to significant one-off losses of CN¥480.9M affecting earnings quality and consistency. With an expected annual earnings growth of 45.85%, surpassing Hong Kong's market average of 11.2%, the company is poised for recovery but faces challenges in maintaining consistent profitability amid strategic executive changes and competitive pressures within its sector.

- Unlock comprehensive insights into our analysis of Alibaba Pictures Group stock in this health report.

Assess Alibaba Pictures Group's past performance with our detailed historical performance reports.

Mobvista (SEHK:1860)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mobvista Inc., along with its subsidiaries, provides advertising and marketing technology services to support the mobile internet ecosystem globally, with a market capitalization of HK$12.03 billion.

Operations: Mobvista Inc. focuses on delivering advertising and marketing technology services to enhance the mobile internet ecosystem for a global clientele. The company's revenue streams are primarily derived from its technology solutions that facilitate mobile advertising and app monetization.

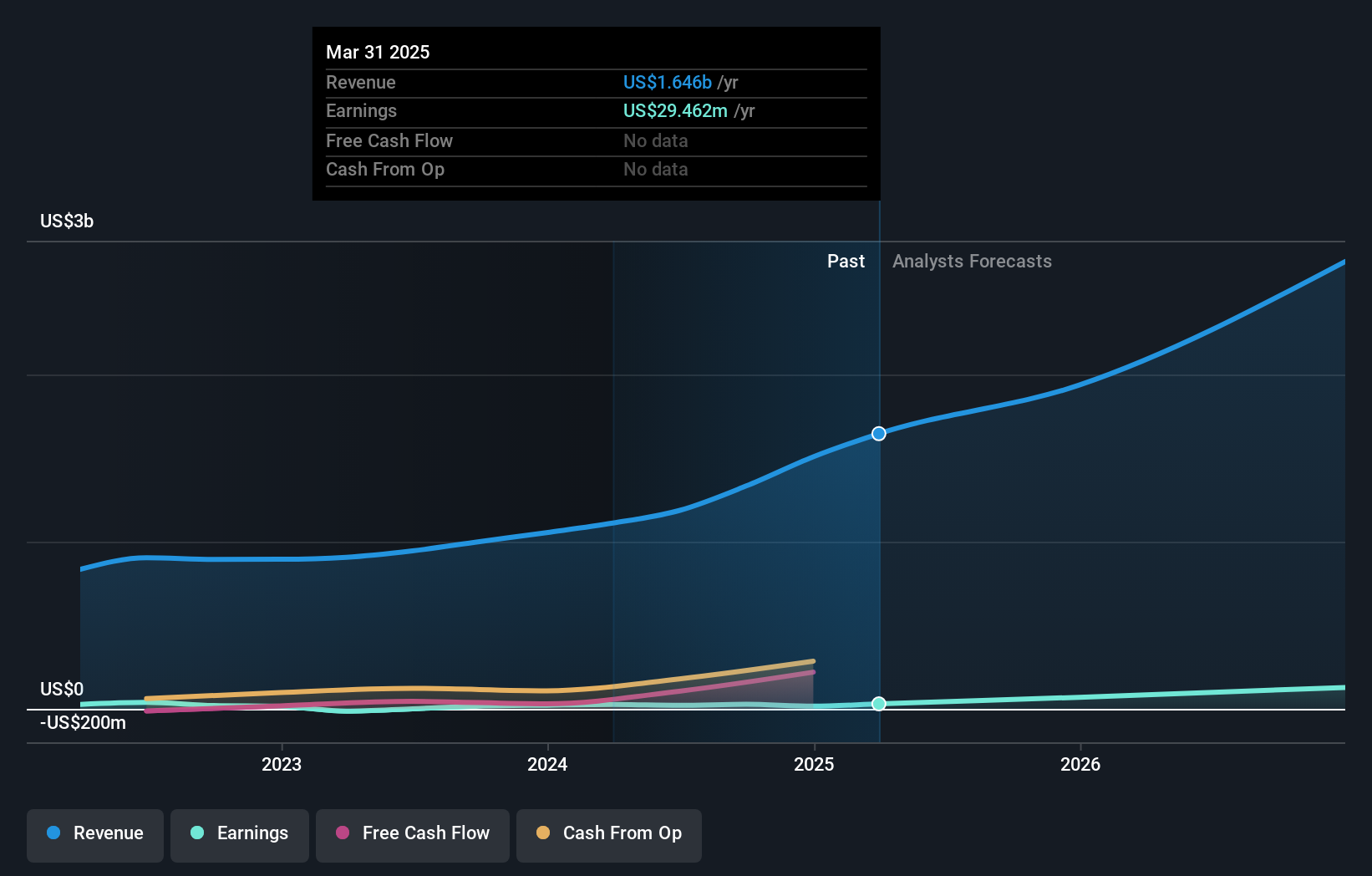

Mobvista has demonstrated robust growth with its Q3 sales soaring to $416.46 million, a significant leap from $269.37 million the previous year, showcasing a dynamic expansion in its market presence. This upward trajectory is further underscored by a net income rise to $9.9 million from $3.78 million in the same quarter last year, reflecting strong operational efficiencies and market adaptation. The firm's commitment to innovation is evident from its substantial R&D investment, ensuring it stays at the forefront of technological advancements and maintains its competitive edge in the fast-evolving tech landscape.

- Take a closer look at Mobvista's potential here in our health report.

Explore historical data to track Mobvista's performance over time in our Past section.

Jiangsu Hoperun Software (SZSE:300339)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Hoperun Software Co., Ltd. is a software company offering products, solutions, and services based on new generation information technology across China, Japan, Southeast Asia, North America, and internationally with a market cap of CN¥38.72 billion.

Operations: Hoperun Software focuses on delivering innovative IT solutions and services globally, leveraging its expertise in new generation technologies. The company caters to diverse markets including China, Japan, Southeast Asia, and North America.

Jiangsu Hoperun Software has shown a notable uptick in its financial performance, with revenue climbing to CNY 2.41 billion from CNY 2.16 billion year-over-year and net income increasing to CNY 110.68 million from CNY 98.17 million, reflecting a solid growth trajectory. This progress is underscored by an impressive annualised revenue growth rate of 19.4% and earnings growth of 113.6% over the past year, significantly outpacing the broader software industry's average decline of -11.2%. Despite challenges such as high share price volatility and a forecasted low return on equity at 9.6%, the company's strong earnings expansion positions it well within a competitive market landscape where technological innovation and strategic client relationships are critical for sustained growth.

- Get an in-depth perspective on Jiangsu Hoperun Software's performance by reading our health report here.

Learn about Jiangsu Hoperun Software's historical performance.

Summing It All Up

- Dive into all 1227 of the High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1060

Alibaba Pictures Group

An investment holding company, operates in the content, technology, and IP merchandising and commercialization businesses in Hong Kong and the People's Republic of China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives