- Hong Kong

- /

- Entertainment

- /

- SEHK:1046

Universe Entertainment and Culture Group Company Limited's (HKG:1046) Shares Bounce 39% But Its Business Still Trails The Industry

Despite an already strong run, Universe Entertainment and Culture Group Company Limited (HKG:1046) shares have been powering on, with a gain of 39% in the last thirty days. The last 30 days bring the annual gain to a very sharp 47%.

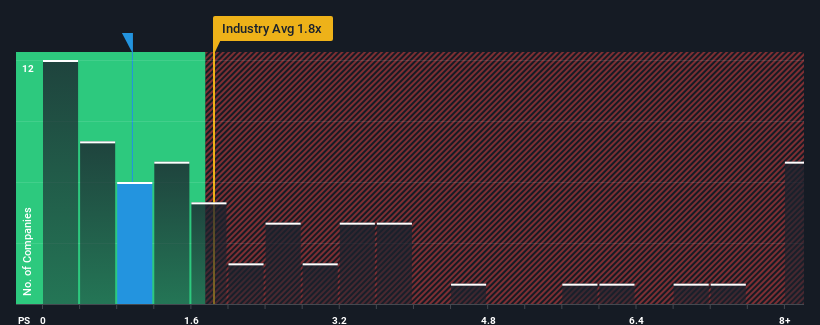

Even after such a large jump in price, Universe Entertainment and Culture Group may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Entertainment industry in Hong Kong have P/S ratios greater than 1.8x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Universe Entertainment and Culture Group

How Has Universe Entertainment and Culture Group Performed Recently?

Universe Entertainment and Culture Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Universe Entertainment and Culture Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Universe Entertainment and Culture Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Universe Entertainment and Culture Group's to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen an excellent 91% overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 45% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we can see why Universe Entertainment and Culture Group is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Universe Entertainment and Culture Group's P/S

Universe Entertainment and Culture Group's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Universe Entertainment and Culture Group confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Universe Entertainment and Culture Group (at least 1 which is potentially serious), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1046

Universe Entertainment and Culture Group

An investment holding company, engages in the video and film distribution and exhibition; and film rights and television series licensing and sub-licensing businesses in Hong Kong, the People’s Republic of China, rest of Asia, and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives