- Hong Kong

- /

- Entertainment

- /

- SEHK:1046

Optimistic Investors Push Universe Entertainment and Culture Group Company Limited (HKG:1046) Shares Up 33% But Growth Is Lacking

The Universe Entertainment and Culture Group Company Limited (HKG:1046) share price has done very well over the last month, posting an excellent gain of 33%. Looking back a bit further, it's encouraging to see the stock is up 35% in the last year.

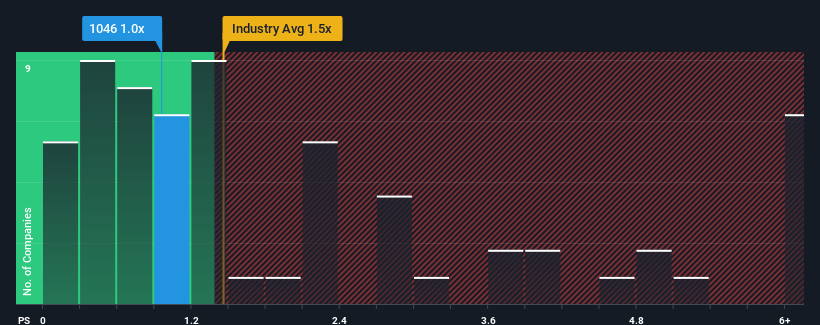

Although its price has surged higher, it's still not a stretch to say that Universe Entertainment and Culture Group's price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" compared to the Entertainment industry in Hong Kong, where the median P/S ratio is around 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Universe Entertainment and Culture Group

What Does Universe Entertainment and Culture Group's P/S Mean For Shareholders?

Recent times have been quite advantageous for Universe Entertainment and Culture Group as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Universe Entertainment and Culture Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Universe Entertainment and Culture Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Universe Entertainment and Culture Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 84% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 39% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 12% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Universe Entertainment and Culture Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Universe Entertainment and Culture Group's P/S Mean For Investors?

Universe Entertainment and Culture Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Universe Entertainment and Culture Group revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Universe Entertainment and Culture Group (1 doesn't sit too well with us) you should be aware of.

If you're unsure about the strength of Universe Entertainment and Culture Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1046

Universe Entertainment and Culture Group

An investment holding company, engages in the video and film distribution and exhibition, and film rights and television series licensing and sub-licensing businesses.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026