Earnings Not Telling The Story For Migao Group Holdings Limited (HKG:9879) After Shares Rise 27%

Migao Group Holdings Limited (HKG:9879) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

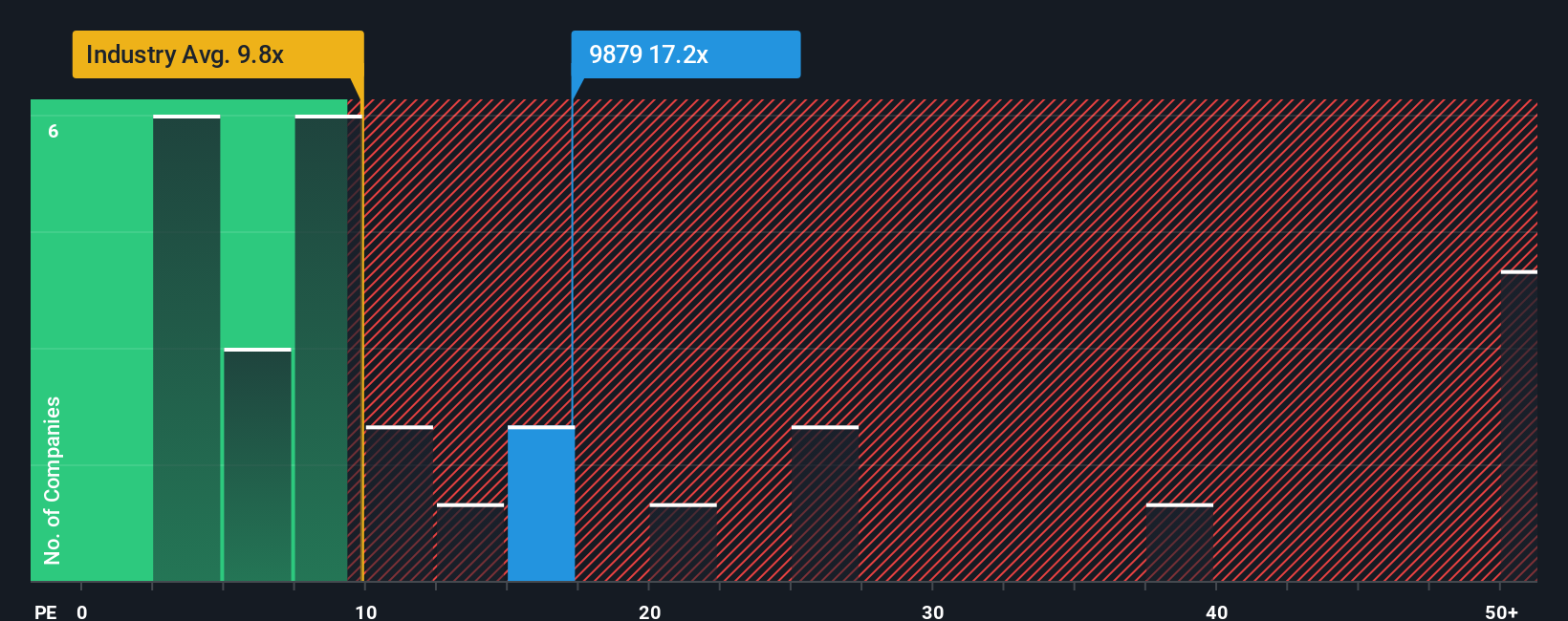

Following the firm bounce in price, Migao Group Holdings may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 17.2x, since almost half of all companies in Hong Kong have P/E ratios under 11x and even P/E's lower than 7x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Migao Group Holdings over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Migao Group Holdings

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Migao Group Holdings' is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 8.6% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 42% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's an unpleasant look.

With this information, we find it concerning that Migao Group Holdings is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From Migao Group Holdings' P/E?

Migao Group Holdings shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Migao Group Holdings revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Migao Group Holdings has 1 warning sign we think you should be aware of.

Of course, you might also be able to find a better stock than Migao Group Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9879

Migao Group Holdings

An investment holding company, engages in sourcing, procuring, processing, manufacturing, and trading of specialty potash-based fertilizers in the People’s Republic of China.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026