Read This Before Buying Yusei Holdings Limited (HKG:96) For Its Dividend

Could Yusei Holdings Limited (HKG:96) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

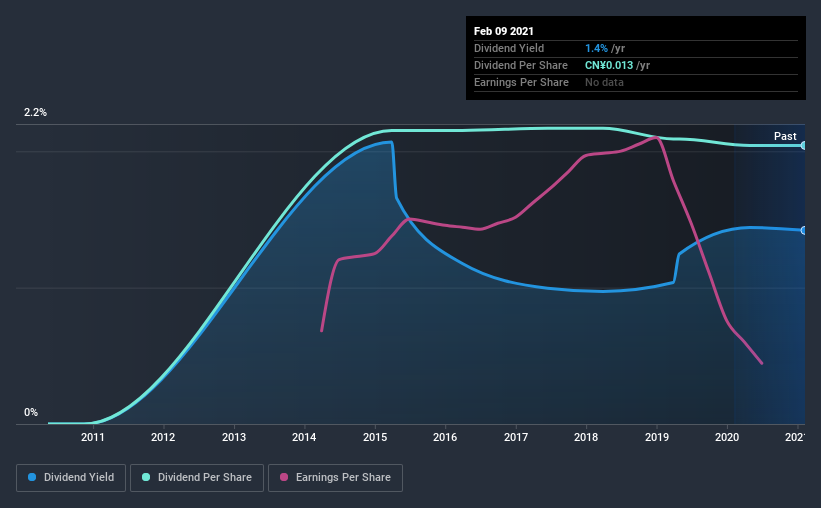

Investors might not know much about Yusei Holdings's dividend prospects, even though it has been paying dividends for the last six years and offers a 1.4% yield. A low yield is generally a turn-off, but if the prospects for earnings growth were strong, investors might be pleasantly surprised by the long-term results. There are a few simple ways to reduce the risks of buying Yusei Holdings for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Yusei Holdings!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Yusei Holdings paid out 40% of its profit as dividends, over the trailing twelve month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Yusei Holdings paid out 25% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

We update our data on Yusei Holdings every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the data, we can see that Yusei Holdings has been paying a dividend for the past six years. The dividend has been quite stable over the past six years, which is great to see - although we usually like to see the dividend maintained for a decade before giving it full marks, though. During the past six-year period, the first annual payment was CN¥0.01 in 2015, compared to CN¥0.01 last year. Dividend payments have shrunk at a rate of less than 1% per annum over this time frame.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Yusei Holdings' EPS have fallen by approximately 22% per year during the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Yusei Holdings' earnings per share, which support the dividend, have been anything but stable.

We'd also point out that Yusei Holdings issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

To summarise, shareholders should always check that Yusei Holdings' dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. It's great to see that Yusei Holdings is paying out a low percentage of its earnings and cash flow. Earnings per share are down, and to our mind Yusei Holdings has not been paying a dividend long enough to demonstrate its resilience across economic cycles. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Yusei Holdings out there.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Yusei Holdings (of which 1 makes us a bit uncomfortable!) you should know about.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

When trading Yusei Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:96

Yusei Holdings

An investment holding company, primarily engages in the design, development, and fabrication of precision plastic injection moulds in the People’s Republic of China.

Good value second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026