Further Upside For Changmao Biochemical Engineering Company Limited (HKG:954) Shares Could Introduce Price Risks After 25% Bounce

Changmao Biochemical Engineering Company Limited (HKG:954) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

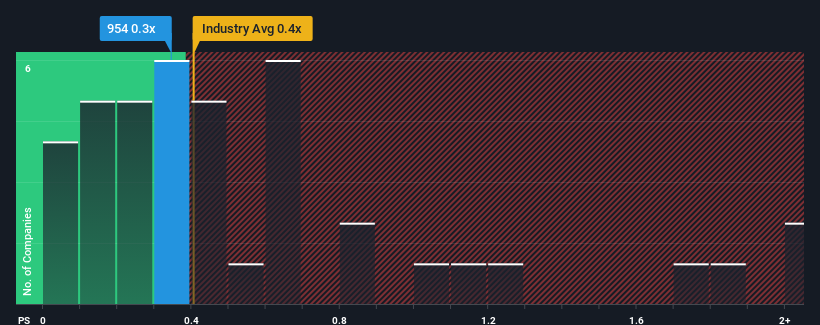

In spite of the firm bounce in price, there still wouldn't be many who think Changmao Biochemical Engineering's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Chemicals industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Changmao Biochemical Engineering

What Does Changmao Biochemical Engineering's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Changmao Biochemical Engineering's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Changmao Biochemical Engineering's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Changmao Biochemical Engineering's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

This is in contrast to the rest of the industry, which is expected to grow by 6.2% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Changmao Biochemical Engineering is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Its shares have lifted substantially and now Changmao Biochemical Engineering's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Changmao Biochemical Engineering currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Changmao Biochemical Engineering (2 can't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on Changmao Biochemical Engineering, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:954

Changmao Biochemical Engineering

Produces and sells organic acids for food additive, chemical, and pharmaceutical industries in Mainland China, Europe, the Asia Pacific, the United States, and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives