- Hong Kong

- /

- Basic Materials

- /

- SEHK:914

What Anhui Conch Cement Company Limited's (HKG:914) 29% Share Price Gain Is Not Telling You

Anhui Conch Cement Company Limited (HKG:914) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

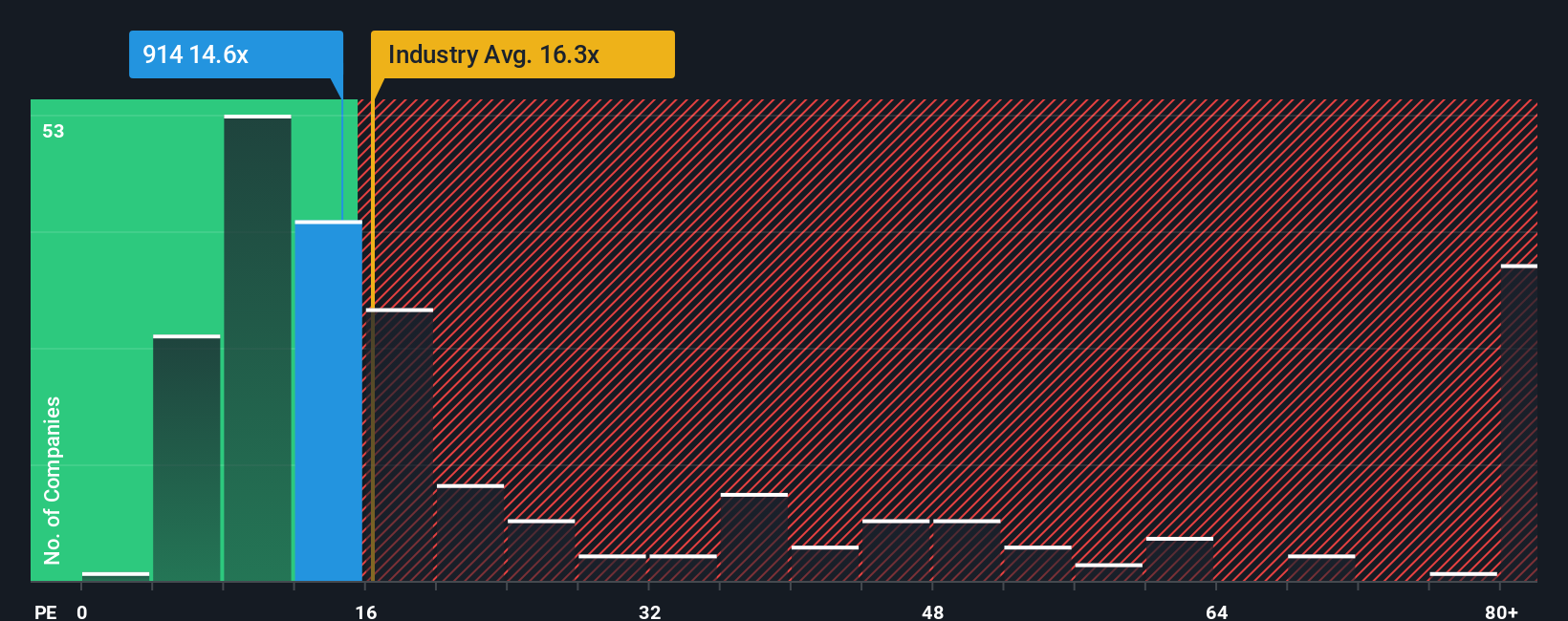

Following the firm bounce in price, Anhui Conch Cement may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.6x, since almost half of all companies in Hong Kong have P/E ratios under 11x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

While the market has experienced earnings growth lately, Anhui Conch Cement's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Anhui Conch Cement

How Is Anhui Conch Cement's Growth Trending?

Anhui Conch Cement's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 75% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 16% per year during the coming three years according to the ten analysts following the company. That's shaping up to be similar to the 15% per annum growth forecast for the broader market.

In light of this, it's curious that Anhui Conch Cement's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From Anhui Conch Cement's P/E?

Anhui Conch Cement's P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Anhui Conch Cement currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Anhui Conch Cement has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Anhui Conch Cement, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:914

Anhui Conch Cement

Manufactures, sells, and trades in clinker and cement products in China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives