- Hong Kong

- /

- Basic Materials

- /

- SEHK:914

We Think You Should Be Aware Of Some Concerning Factors In Anhui Conch Cement's (HKG:914) Earnings

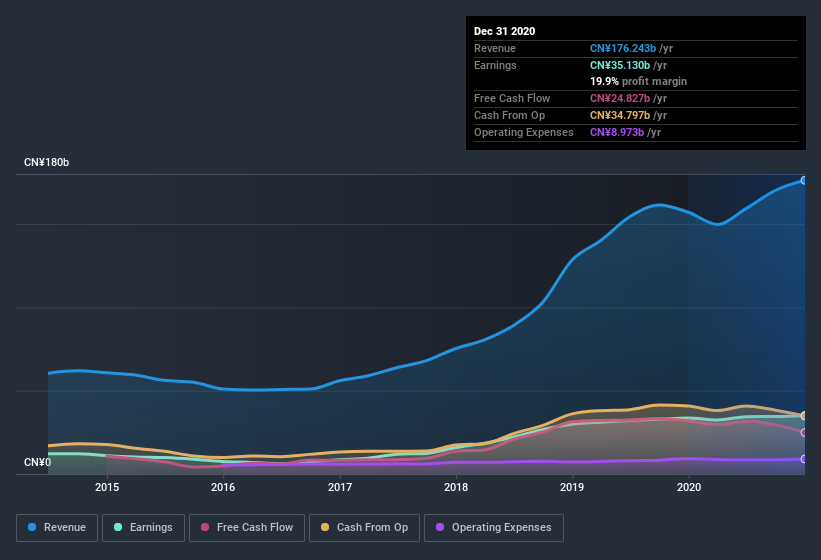

Anhui Conch Cement Company Limited's (HKG:914) robust recent earnings didn't do much to move the stock. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

View our latest analysis for Anhui Conch Cement

Operating Revenue Or Not?

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Where possible, we prefer rely on operating revenue to get a better understanding of how the business is functioning. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. It's worth noting that Anhui Conch Cement saw a big increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from CN¥8.84b to CN¥28.3b. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Anhui Conch Cement's Profit Performance

Since Anhui Conch Cement saw a big increase in its non-operating revenue over the last twelve months, we'd be very cautious about relying too heavily on the statutory profit number, which would have benefitted from this potentially unsustainable change. As a result, we think it may well be the case that Anhui Conch Cement's underlying earnings power is lower than its statutory profit. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. To that end, you should learn about the 2 warning signs we've spotted with Anhui Conch Cement (including 1 which is a bit concerning).

Today we've zoomed in on a single data point to better understand the nature of Anhui Conch Cement's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Anhui Conch Cement, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Anhui Conch Cement, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:914

Anhui Conch Cement

Manufactures, sells, and trades in clinker and cement products in China and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives