With EPS Growth And More, CPMC Holdings (HKG:906) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like CPMC Holdings (HKG:906). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for CPMC Holdings

How Fast Is CPMC Holdings Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that CPMC Holdings has managed to grow EPS by 19% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

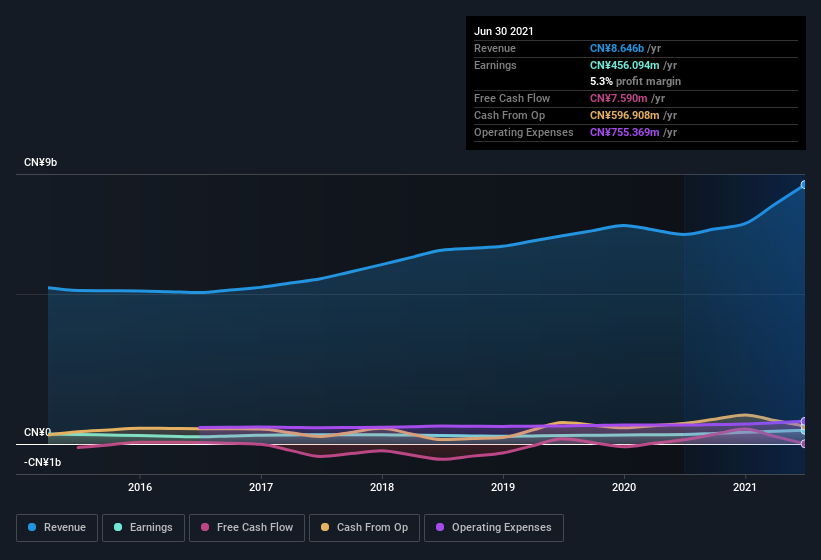

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note CPMC Holdings's EBIT margins were flat over the last year, revenue grew by a solid 24% to CN¥8.6b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check CPMC Holdings's balance sheet strength, before getting too excited.

Are CPMC Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for CPMC Holdings is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction Wei Zhang paid HK$4.5m, for stock at HK$4.46 per share. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

The good news, alongside the insider buying, for CPMC Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at CN¥1.1b. That equates to 22% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Ye Zhang is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like CPMC Holdings with market caps between CN¥2.5b and CN¥10b is about CN¥2.9m.

The CPMC Holdings CEO received CN¥1.7m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is CPMC Holdings Worth Keeping An Eye On?

For growth investors like me, CPMC Holdings's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. However, before you get too excited we've discovered 2 warning signs for CPMC Holdings (1 is potentially serious!) that you should be aware of.

The good news is that CPMC Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:906

CPMC Holdings

An investment holding company, manufactures and sells packaging products for various consumer goods in the People’s Republic of China.

Questionable track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives