With EPS Growth And More, Yik Wo International Holdings (HKG:8659) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Yik Wo International Holdings (HKG:8659). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Yik Wo International Holdings

Yik Wo International Holdings's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. It's good to see that Yik Wo International Holdings's EPS have grown from CN¥0.043 to CN¥0.053 over twelve months. That's a 24% gain; respectable growth in the broader scheme of things.

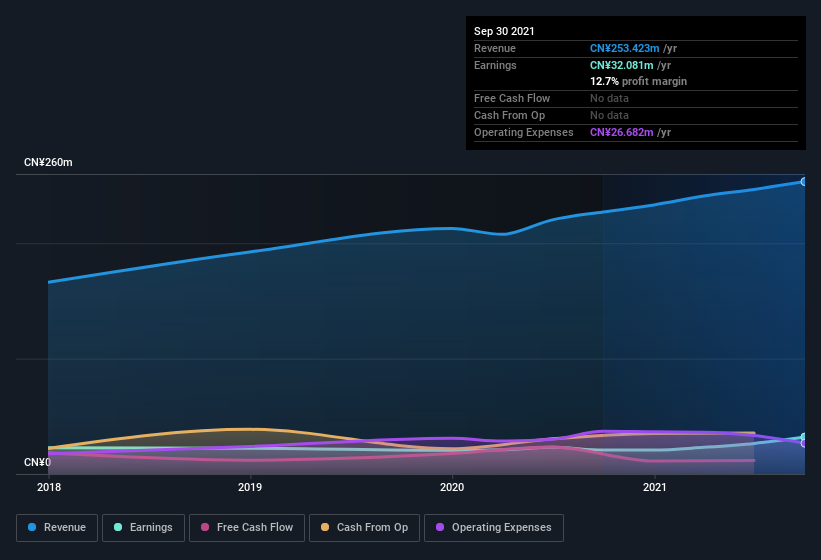

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Yik Wo International Holdings is growing revenues, and EBIT margins improved by 5.5 percentage points to 18%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Yik Wo International Holdings is no giant, with a market capitalization of HK$132m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Yik Wo International Holdings Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Yik Wo International Holdings insiders own a meaningful share of the business. In fact, they own 71% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Valued at only HK$132m Yik Wo International Holdings is really small for a listed company. So despite a large proportional holding, insiders only have CN¥93m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does Yik Wo International Holdings Deserve A Spot On Your Watchlist?

One important encouraging feature of Yik Wo International Holdings is that it is growing profits. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Yik Wo International Holdings that you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8659

Yik Wo International Holdings

An investment holding company, designs, develops, manufactures, and sells disposable plastic food storage containers under the JAZZIT brand name in the People's Republic of China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives