- Hong Kong

- /

- Metals and Mining

- /

- SEHK:8299

Here's Why We Think Grand T G Gold Holdings (HKG:8299) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Grand T G Gold Holdings (HKG:8299). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Grand T G Gold Holdings with the means to add long-term value to shareholders.

View our latest analysis for Grand T G Gold Holdings

Grand T G Gold Holdings' Improving Profits

Over the last three years, Grand T G Gold Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, Grand T G Gold Holdings' EPS soared from HK$0.0019 to HK$0.0025, over the last year. That's a fantastic gain of 37%.

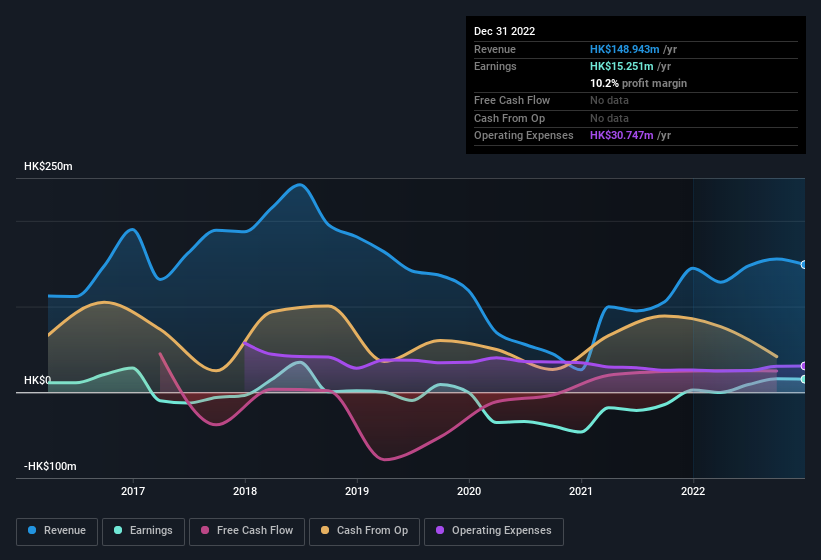

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Grand T G Gold Holdings achieved similar EBIT margins to last year, revenue grew by a solid 2.8% to HK$149m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Grand T G Gold Holdings is no giant, with a market capitalisation of HK$814m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Grand T G Gold Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first, there weren't any reports of insiders selling shares in Grand T G Gold Holdings in the last 12 months. But the really good news is that company insider Qianzhou Ma spent HK$4.4m buying stock, at an average price of around HK$0.27. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Grand T G Gold Holdings will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 74% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about HK$602m riding on the stock, at current prices. So there's plenty there to keep them focused!

Should You Add Grand T G Gold Holdings To Your Watchlist?

For growth investors, Grand T G Gold Holdings' raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. These things considered, this is one stock worth watching. It is worth noting though that we have found 3 warning signs for Grand T G Gold Holdings (2 can't be ignored!) that you need to take into consideration.

Keen growth investors love to see insider buying. Thankfully, Grand T G Gold Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8299

GT Gold Holdings

An investment holding company, engages in the exploration, mining, and processing of gold deposits in the People’s Republic of China.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026