- Hong Kong

- /

- Paper and Forestry Products

- /

- SEHK:8277

Auditors Have Doubts About Steed Oriental (Holdings) (HKG:8277)

When Steed Oriental (Holdings) Company Limited (HKG:8277) reported its results to March 2023 its auditors, BDO LLP could not be sure that it would be able to continue as a going concern in the next year. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So current risks on the balance sheet could have a big impact on how shareholders fare from here. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

Check out our latest analysis for Steed Oriental (Holdings)

What Is Steed Oriental (Holdings)'s Net Debt?

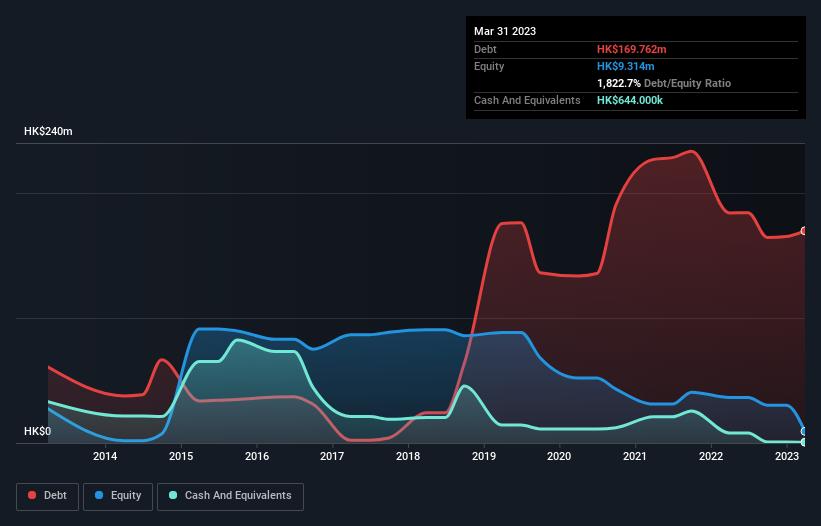

You can click the graphic below for the historical numbers, but it shows that Steed Oriental (Holdings) had HK$169.8m of debt in March 2023, down from HK$184.0m, one year before. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Steed Oriental (Holdings)'s Balance Sheet?

According to the last reported balance sheet, Steed Oriental (Holdings) had liabilities of HK$223.2m due within 12 months, and liabilities of HK$3.19m due beyond 12 months. On the other hand, it had cash of HK$644.0k and HK$18.2m worth of receivables due within a year. So its liabilities total HK$207.5m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the HK$29.1m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Steed Oriental (Holdings) would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Steed Oriental (Holdings) will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Steed Oriental (Holdings) made a loss at the EBIT level, and saw its revenue drop to HK$13m, which is a fall of 87%. That makes us nervous, to say the least.

Caveat Emptor

While Steed Oriental (Holdings)'s falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable HK$10m at the EBIT level. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Sure, the company might have a nice story about how they are going on to a brighter future. But the reality is that it is low on liquid assets relative to liabilities, and it lost HK$29m in the last year. So we think buying this stock is risky. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Steed Oriental (Holdings) has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Steed Oriental (Holdings), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8277

Steed Oriental (Holdings)

An investment holding company, sources, manufactures, and sells wooden products in Mainland China.

Moderate and slightly overvalued.

Market Insights

Community Narratives