- Hong Kong

- /

- Metals and Mining

- /

- SEHK:769

Imagine Owning China Rare Earth Holdings (HKG:769) While The Price Tanked 61%

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. Zooming in on an example, the China Rare Earth Holdings Limited (HKG:769) share price dropped 61% in the last half decade. We certainly feel for shareholders who bought near the top. Furthermore, it's down 19% in about a quarter. That's not much fun for holders.

See our latest analysis for China Rare Earth Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

China Rare Earth Holdings became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

Arguably, the revenue drop of 8.7% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

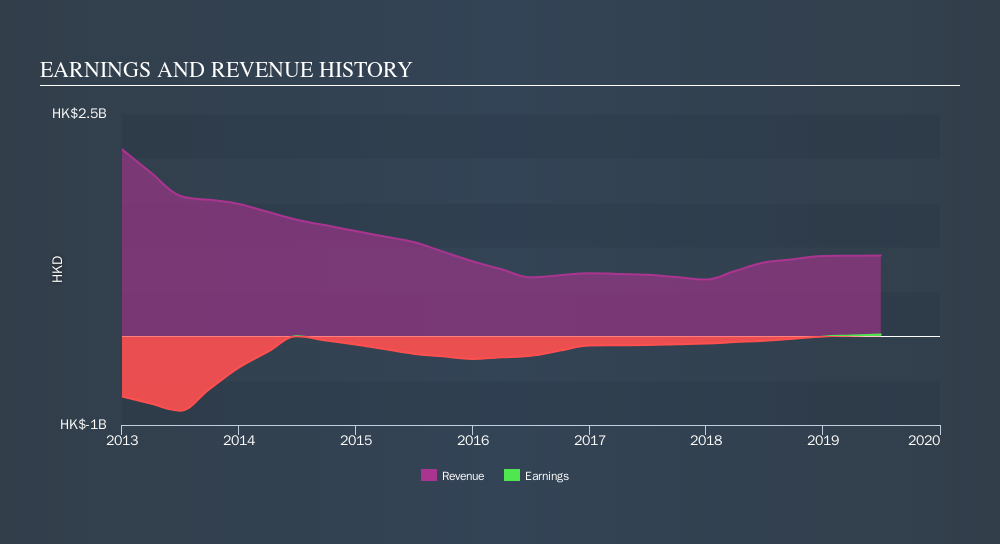

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on China Rare Earth Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between China Rare Earth Holdings's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that China Rare Earth Holdings's TSR, which was a 54% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

It's nice to see that China Rare Earth Holdings shareholders have received a total shareholder return of 13% over the last year. Notably the five-year annualised TSR loss of 14% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before deciding if you like the current share price, check how China Rare Earth Holdings scores on these 3 valuation metrics.

We will like China Rare Earth Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:769

China Rare Earth Holdings

An investment holding company, engages in manufacturing and selling rare earth products and refractory products in the People’s Republic of China, Japan, Europe, and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives