- Hong Kong

- /

- Metals and Mining

- /

- SEHK:661

Does China Daye Non-Ferrous Metals Mining (HKG:661) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that China Daye Non-Ferrous Metals Mining Limited (HKG:661) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for China Daye Non-Ferrous Metals Mining

What Is China Daye Non-Ferrous Metals Mining's Net Debt?

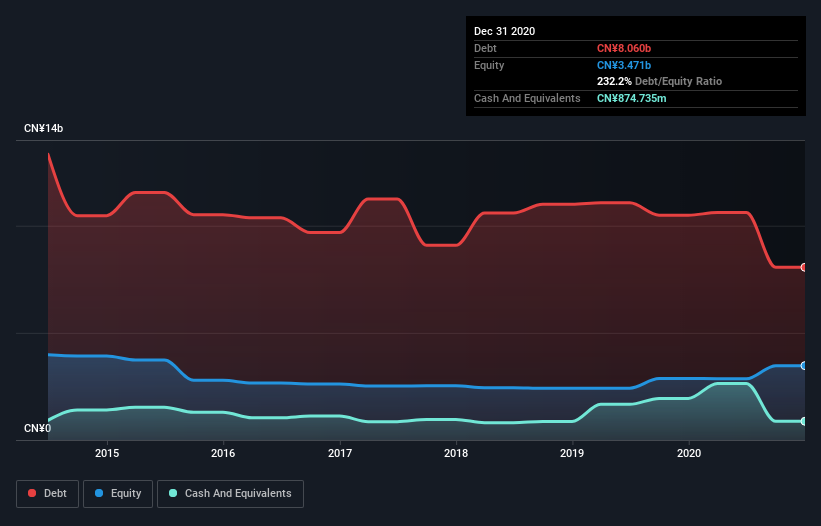

You can click the graphic below for the historical numbers, but it shows that China Daye Non-Ferrous Metals Mining had CN¥8.06b of debt in December 2020, down from CN¥10.5b, one year before. However, it also had CN¥874.7m in cash, and so its net debt is CN¥7.19b.

How Strong Is China Daye Non-Ferrous Metals Mining's Balance Sheet?

The latest balance sheet data shows that China Daye Non-Ferrous Metals Mining had liabilities of CN¥6.33b due within a year, and liabilities of CN¥5.05b falling due after that. Offsetting this, it had CN¥874.7m in cash and CN¥264.6m in receivables that were due within 12 months. So it has liabilities totalling CN¥10.2b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CN¥2.49b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, China Daye Non-Ferrous Metals Mining would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 1.8 times and a disturbingly high net debt to EBITDA ratio of 5.8 hit our confidence in China Daye Non-Ferrous Metals Mining like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. More concerning, China Daye Non-Ferrous Metals Mining saw its EBIT drop by 5.9% in the last twelve months. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since China Daye Non-Ferrous Metals Mining will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, China Daye Non-Ferrous Metals Mining actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

To be frank both China Daye Non-Ferrous Metals Mining's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. We're quite clear that we consider China Daye Non-Ferrous Metals Mining to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that China Daye Non-Ferrous Metals Mining is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:661

China Daye Non-Ferrous Metals Mining

An investment holding company, engages in the mining and processing of mineral ores in China, Hong Kong, Kyrgyzstan, and the Republic of Mongolia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success