- Hong Kong

- /

- Metals and Mining

- /

- SEHK:639

3 Top Hong Kong Dividend Stocks Yielding From 4% to 8.7%

Reviewed by Simply Wall St

Amid a backdrop of global economic fluctuations and localized pressures, the Hong Kong market has shown resilience, with particular interest in sectors offering stable returns. Dividend stocks remain a focal point for investors seeking yield in uncertain times, making them an attractive option for those looking to balance risk with potential income generation.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.10% | ★★★★★★ |

| CITIC Telecom International Holdings (SEHK:1883) | 9.66% | ★★★★★★ |

| China Construction Bank (SEHK:939) | 7.45% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 8.33% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.96% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.60% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.21% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.24% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 8.09% | ★★★★★☆ |

Click here to see the full list of 86 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

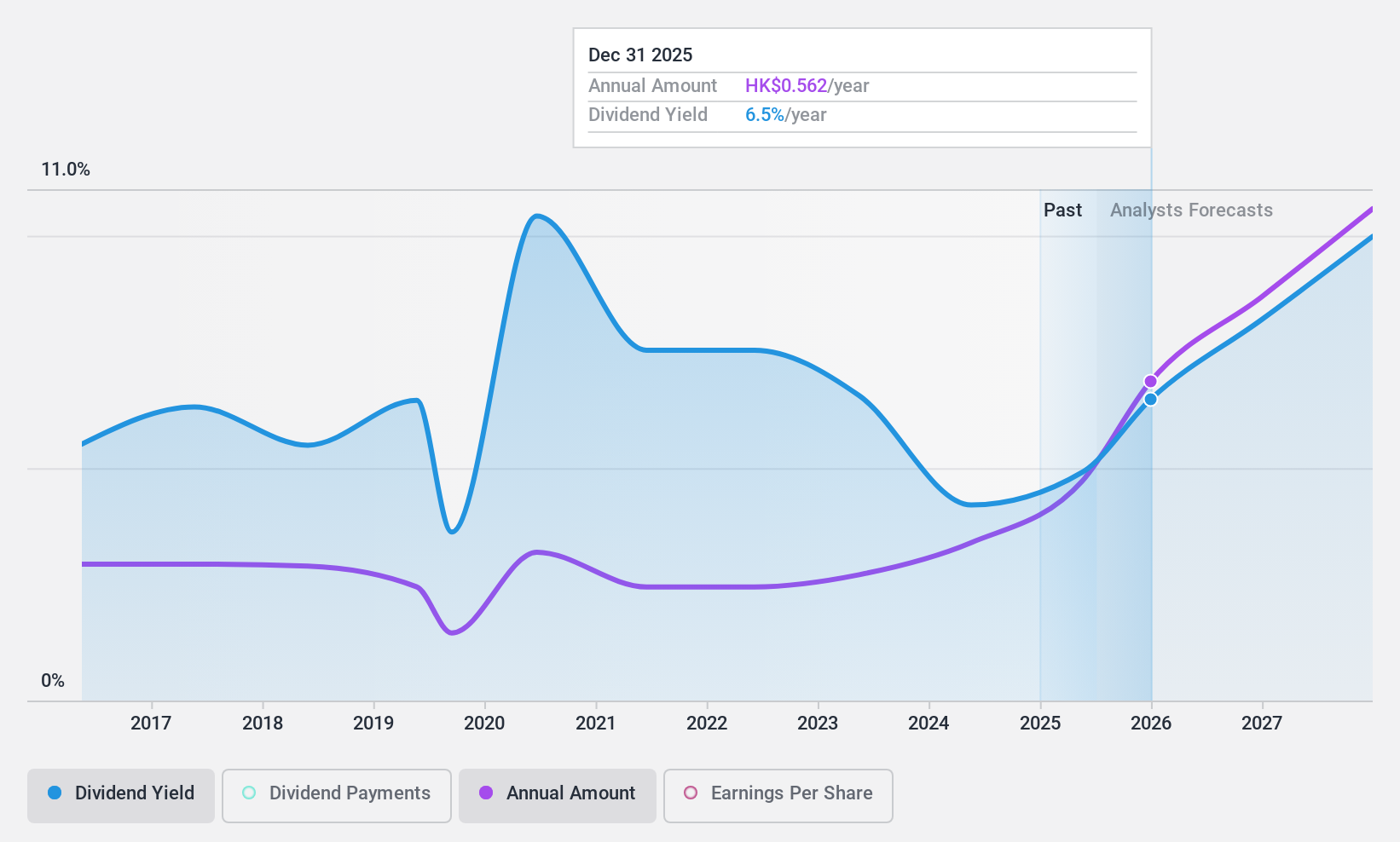

Wasion Holdings (SEHK:3393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that specializes in the development, production, and sale of energy metering and energy efficiency management solutions across China, Africa, the US, Europe, and other Asian regions, with a market capitalization of approximately HK$6.81 billion.

Operations: Wasion Holdings Limited generates its revenue primarily through three segments: Advanced Distribution Operations (CN¥2.48 billion), Power Advanced Metering Infrastructure (CN¥2.67 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion).

Dividend Yield: 4.1%

Wasion Holdings Limited, despite a volatile dividend history over the past decade, declared a final dividend of HK$0.28 per share for 2023. The company's dividends are well-covered by earnings and cash flows, with payout ratios at 48.9% and 27.6% respectively. Recent contract wins totaling approximately HK$445.79 million bolster its financial position, although its dividend yield of 4.05% remains below the Hong Kong market's top quartile average of 7.98%.

- Dive into the specifics of Wasion Holdings here with our thorough dividend report.

- Our expertly prepared valuation report Wasion Holdings implies its share price may be lower than expected.

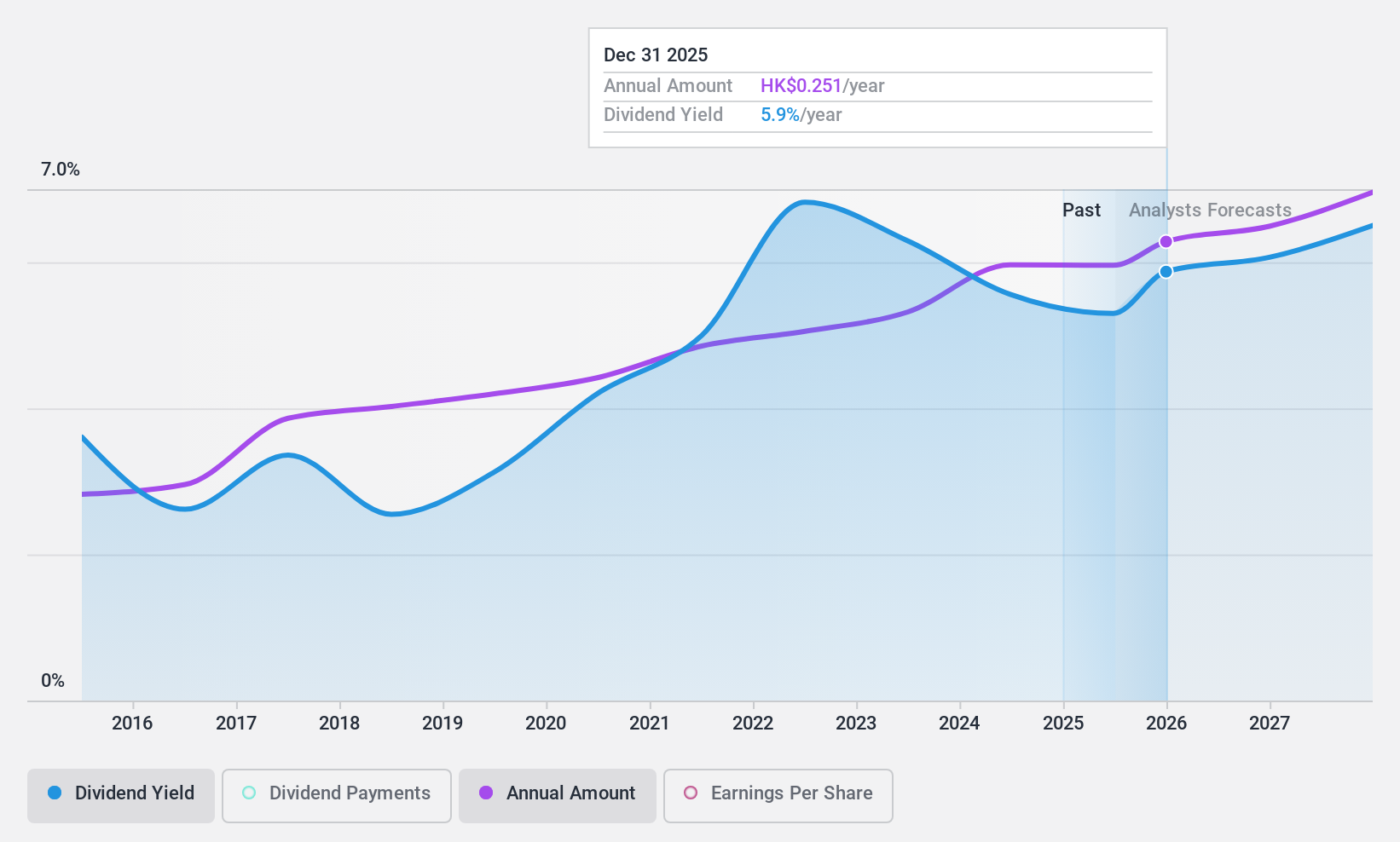

China Communications Services (SEHK:552)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Communications Services Corporation Limited offers telecommunications support services globally, with a market capitalization of approximately HK$29.16 billion.

Operations: China Communications Services Corporation Limited generates revenue primarily through the provision of integrated comprehensive solutions, totaling CN¥148.61 billion.

Dividend Yield: 5.5%

China Communications Services recently declared a final dividend of RMB 0.2174 per share for 2023, payable on August 16, 2024. Despite this increase, the company's dividends have shown volatility over the past decade and its current yield of 5.55% is below Hong Kong's top quartile average. The dividend coverage is strong with a payout ratio of 42% and cash payout ratio of 36.4%, supported by last year’s earnings growth of 6.7%. However, its historical dividend unreliability poses a concern for stability-focused investors.

- Unlock comprehensive insights into our analysis of China Communications Services stock in this dividend report.

- The analysis detailed in our China Communications Services valuation report hints at an deflated share price compared to its estimated value.

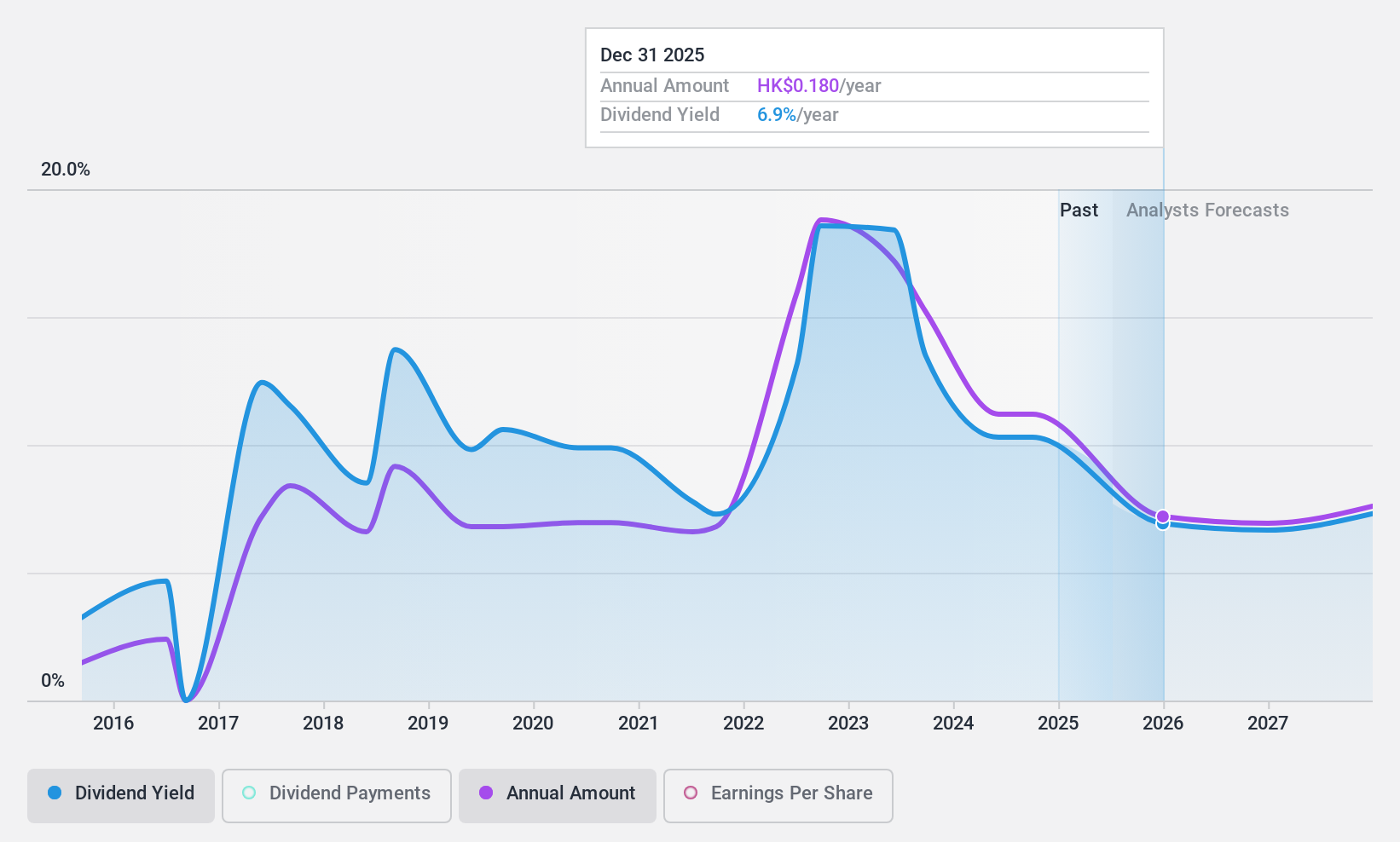

Shougang Fushan Resources Group (SEHK:639)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shougang Fushan Resources Group Limited is an investment holding company focused on mining and processing raw coal, as well as selling raw and clean coal in the People's Republic of China, with a market capitalization of approximately HK$15.77 billion.

Operations: Shougang Fushan Resources Group primarily generates revenue through its coking coal mining segment, which produced HK$5.89 billion in sales.

Dividend Yield: 8.7%

Shougang Fushan Resources Group offers a dividend yield of 8.75%, ranking it among the top 25% in Hong Kong's market. Despite its appealing price-to-earnings ratio of 8.3x, which is below the market average, dividends have shown volatility and unreliability over the past decade. The company maintains a sustainable payout with earnings covering 74.4% and cash flows covering 34.2% of dividends, though earnings are projected to decline by an average of 6.8% annually over the next three years.

- Delve into the full analysis dividend report here for a deeper understanding of Shougang Fushan Resources Group.

- Our comprehensive valuation report raises the possibility that Shougang Fushan Resources Group is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 83 Top Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:639

Shougang Fushan Resources Group

An investment holding company, engages in the business of coking coal mining and production and sales of coking coal products in the People's Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion