- Hong Kong

- /

- Metals and Mining

- /

- SEHK:486

United Company RUSAL International's (HKG:486) investors will be pleased with their respectable 42% return over the last five years

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the United Company RUSAL International share price has climbed 35% in five years, easily topping the market return of 13% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 13% in the last year.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

United Company RUSAL International's earnings per share are down 6.5% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

On the other hand, United Company RUSAL International's revenue is growing nicely, at a compound rate of 6.5% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

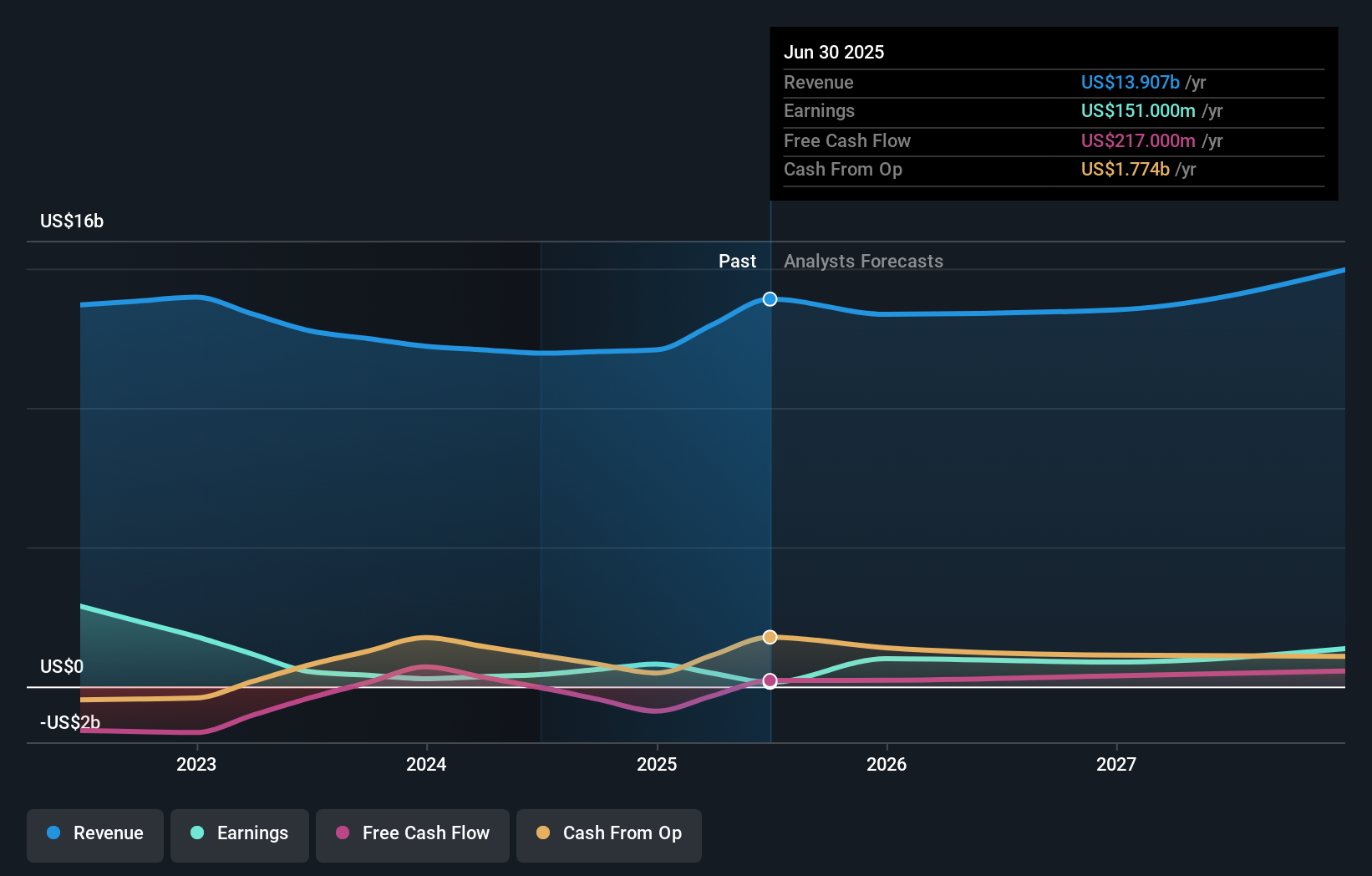

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at United Company RUSAL International's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between United Company RUSAL International's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that United Company RUSAL International's TSR of 42% over the last 5 years is better than the share price return.

A Different Perspective

United Company RUSAL International shareholders gained a total return of 13% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 7% over half a decade It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with United Company RUSAL International (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:486

United Company RUSAL International

Engages in production and sale of aluminium and related products in Russia.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives