- Hong Kong

- /

- Entertainment

- /

- SEHK:2400

SEHK's Estimated Value Opportunities For September 2024

Reviewed by Simply Wall St

As global markets continue to navigate mixed economic signals and inflation concerns, the Hong Kong market has shown resilience with the Hang Seng Index gaining 2.14% recently. This environment presents potential opportunities for investors seeking undervalued stocks that may offer significant value in September 2024. In such a market, identifying good stocks often involves looking for companies with strong fundamentals that are trading below their intrinsic value, particularly in sectors poised to benefit from current economic trends.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bosideng International Holdings (SEHK:3998) | HK$3.74 | HK$6.76 | 44.6% |

| CIMC Enric Holdings (SEHK:3899) | HK$6.05 | HK$10.48 | 42.3% |

| Zhaojin Mining Industry (SEHK:1818) | HK$11.90 | HK$21.37 | 44.3% |

| WuXi XDC Cayman (SEHK:2268) | HK$20.15 | HK$39.16 | 48.5% |

| Pacific Textiles Holdings (SEHK:1382) | HK$1.47 | HK$2.85 | 48.4% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$11.00 | HK$19.83 | 44.5% |

| Innovent Biologics (SEHK:1801) | HK$42.95 | HK$80.12 | 46.4% |

| United Company RUSAL International (SEHK:486) | HK$2.34 | HK$4.25 | 44.9% |

| Vobile Group (SEHK:3738) | HK$1.51 | HK$2.63 | 42.6% |

| DPC Dash (SEHK:1405) | HK$68.65 | HK$134.81 | 49.1% |

Let's uncover some gems from our specialized screener.

XD (SEHK:2400)

Overview: XD Inc. (SEHK:2400) is an investment holding company that develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally with a market cap of HK$8.82 billion.

Operations: The company's revenue segments are comprised of CN¥2.43 billion from games and CN¥1.43 billion from the TapTap platform.

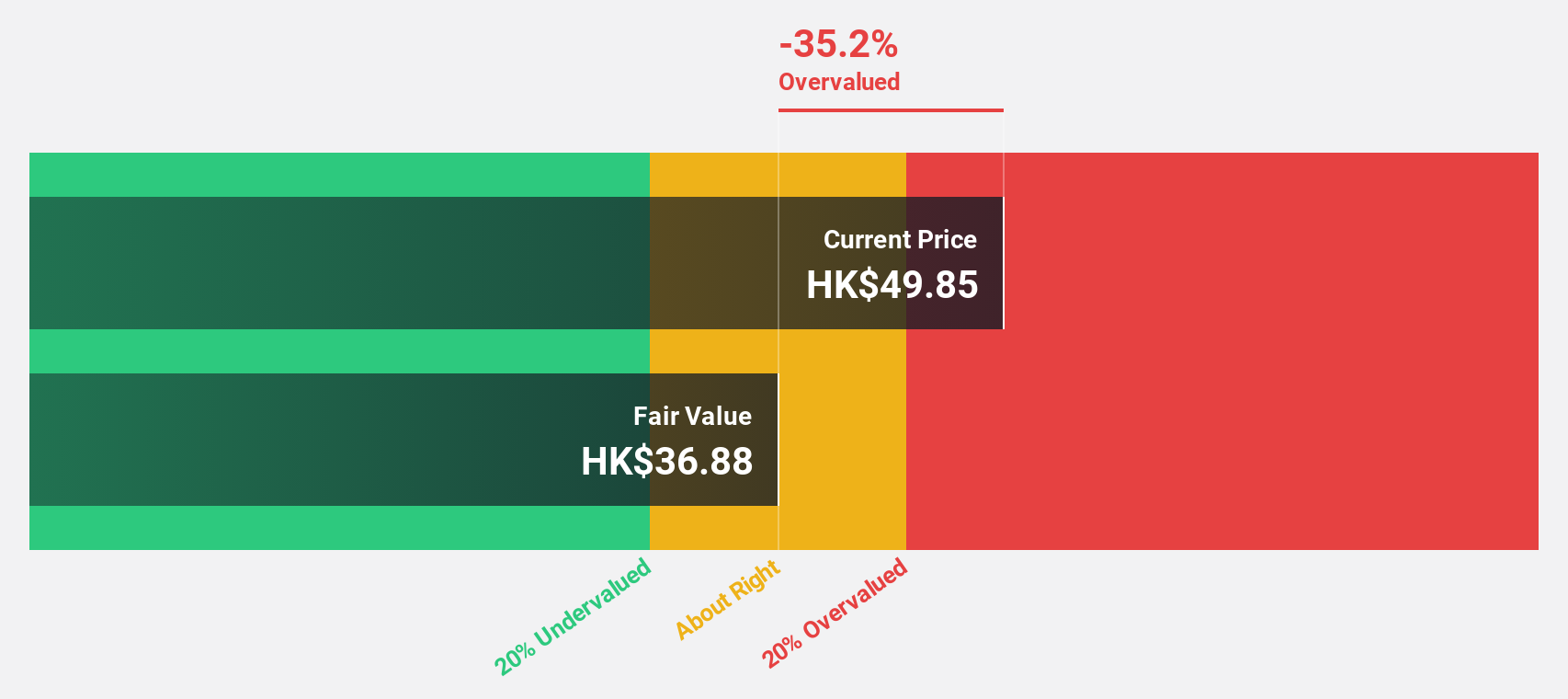

Estimated Discount To Fair Value: 40%

XD Inc. reported strong earnings for the first half of 2024, with net income rising to CNY 205.1 million from CNY 90.19 million a year ago, driven by new game launches and increased information services revenue from TapTap PRC. Trading at HK$18.68, it is significantly below its estimated fair value of HK$31.11, making it highly undervalued based on cash flows despite higher marketing expenses and slower-than-20% revenue growth forecasts.

- In light of our recent growth report, it seems possible that XD's financial performance will exceed current levels.

- Click here to discover the nuances of XD with our detailed financial health report.

Vobile Group (SEHK:3738)

Overview: Vobile Group Limited, with a market cap of HK$3.41 billion, provides software as a service for digital content assets protection and transaction across the United States, Japan, Mainland China, and internationally.

Operations: The company generates revenue of HK$2.18 billion from its SaaS offerings for digital content assets protection and transaction services across various regions including the United States, Japan, Mainland China, and internationally.

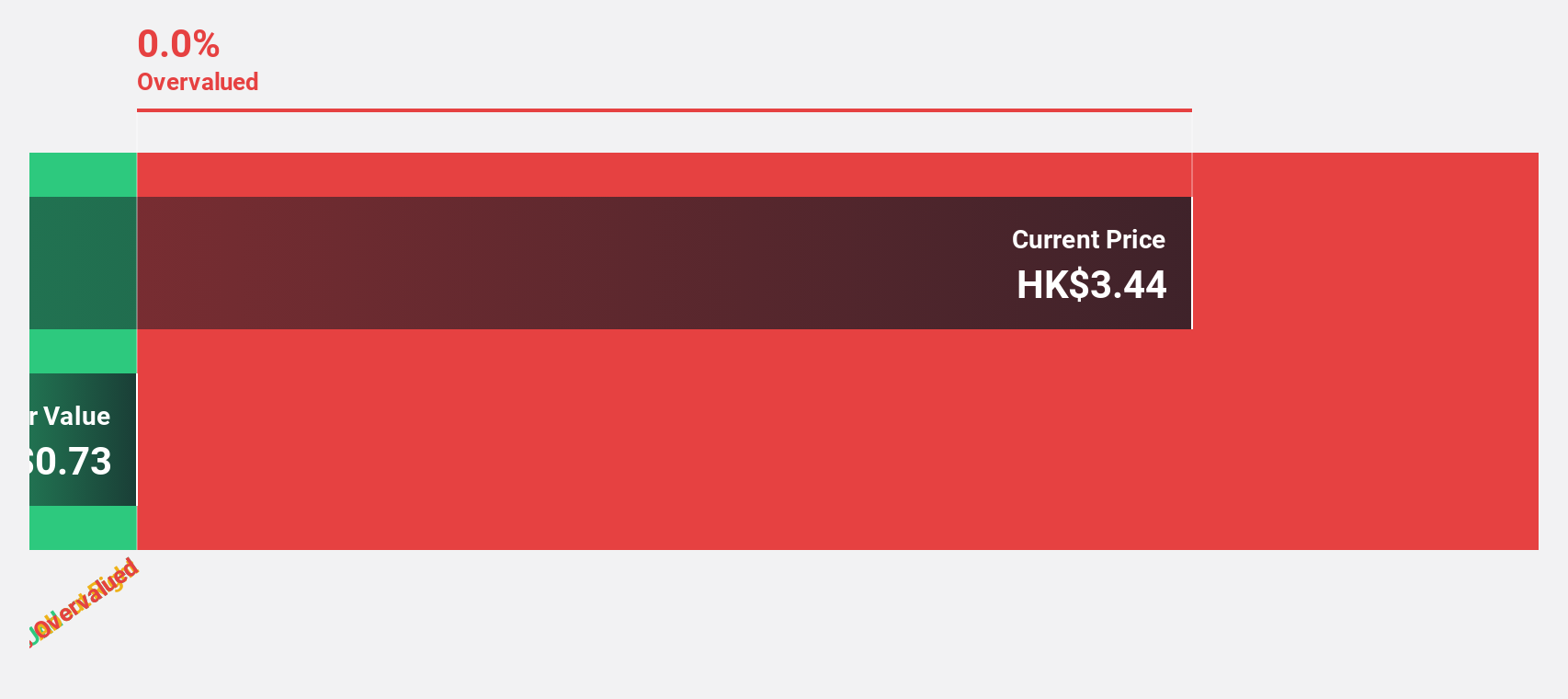

Estimated Discount To Fair Value: 42.6%

Vobile Group Limited's recent earnings report for H1 2024 shows significant growth, with sales increasing to HK$1.18 billion from HK$1 billion a year ago and net income rising to HK$41.47 million from HK$29.16 million. Despite lower profit margins compared to last year, the stock is trading at HK$1.51, well below its fair value estimate of HK$2.63, making it undervalued based on discounted cash flow analysis and expected high annual earnings growth of 69.6%.

- The analysis detailed in our Vobile Group growth report hints at robust future financial performance.

- Dive into the specifics of Vobile Group here with our thorough financial health report.

United Company RUSAL International (SEHK:486)

Overview: United Company RUSAL International Public Joint-Stock Company specializes in the production and trading of aluminium and related products in Russia, with a market cap of approximately HK$35.62 billion.

Operations: United Company RUSAL generates revenue primarily from the production and trading of aluminium and related products in Russia.

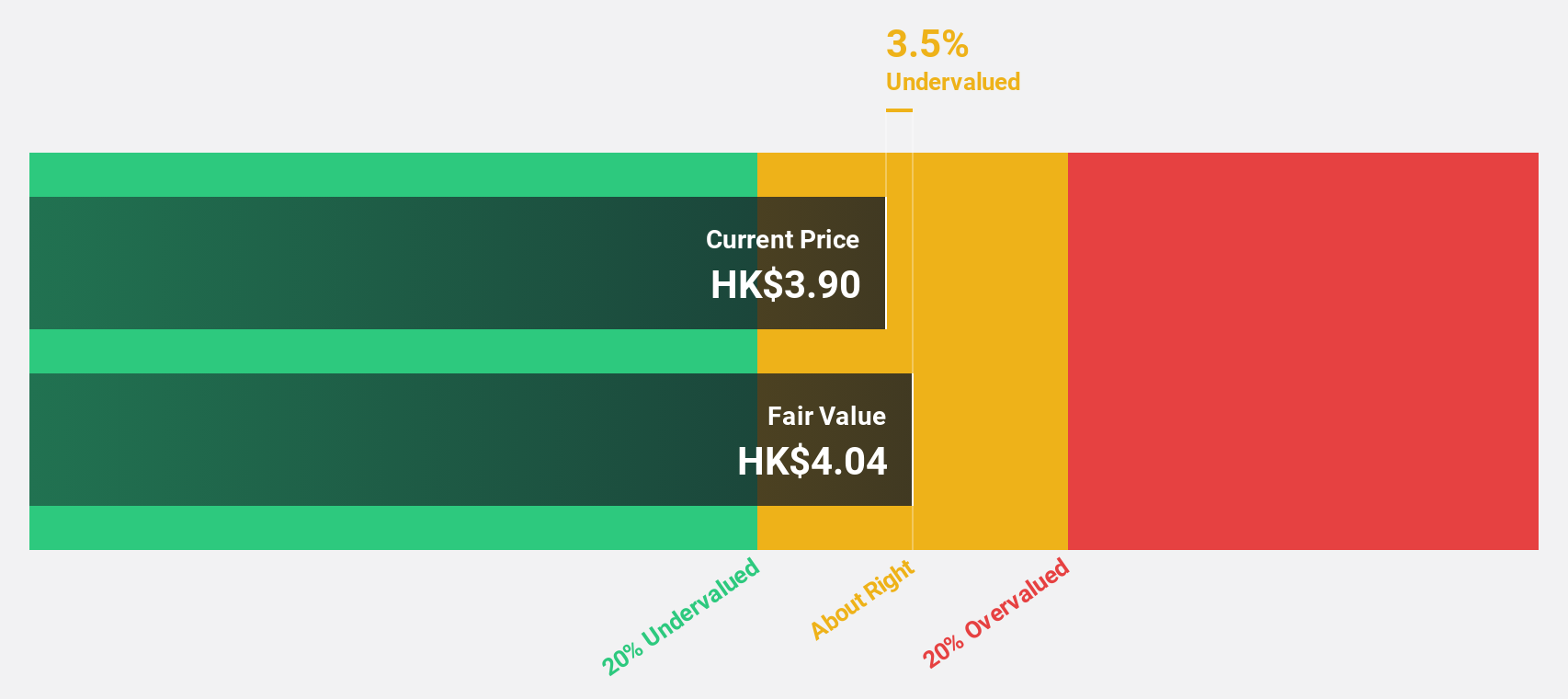

Estimated Discount To Fair Value: 44.9%

United Company RUSAL International reported H1 2024 earnings with net income rising to US$565 million from US$420 million a year ago, despite a slight dip in sales. The stock is trading at HK$2.34, significantly below its estimated fair value of HK$4.25, making it undervalued based on discounted cash flow analysis. While debt coverage by operating cash flow is weak and one-off items impact results, earnings are forecast to grow substantially over the next three years.

- Our growth report here indicates United Company RUSAL International may be poised for an improving outlook.

- Navigate through the intricacies of United Company RUSAL International with our comprehensive financial health report here.

Summing It All Up

- Click this link to deep-dive into the 32 companies within our Undervalued SEHK Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2400

XD

An investment holding company, develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally.

High growth potential with excellent balance sheet.