Global markets have been navigating a landscape marked by significant political shifts and economic data releases, which have influenced investor sentiment and sector performance. Amidst this backdrop, penny stocks continue to capture interest as they represent smaller or newer companies that can offer unique growth opportunities. Despite being an outdated term, these stocks remain relevant for investors seeking potential value in companies with strong fundamentals and promising prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.23 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.39B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$70.33M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.195 | £827M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$148.62M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.2325 | £105.22M | ★★★★★★ |

Click here to see the full list of 5,792 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

SSI Group (PSE:SSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SSI Group, Inc., along with its subsidiaries, operates as a specialty retailer mainly in the Philippines and has a market cap of ₱9.58 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: ₱9.58B

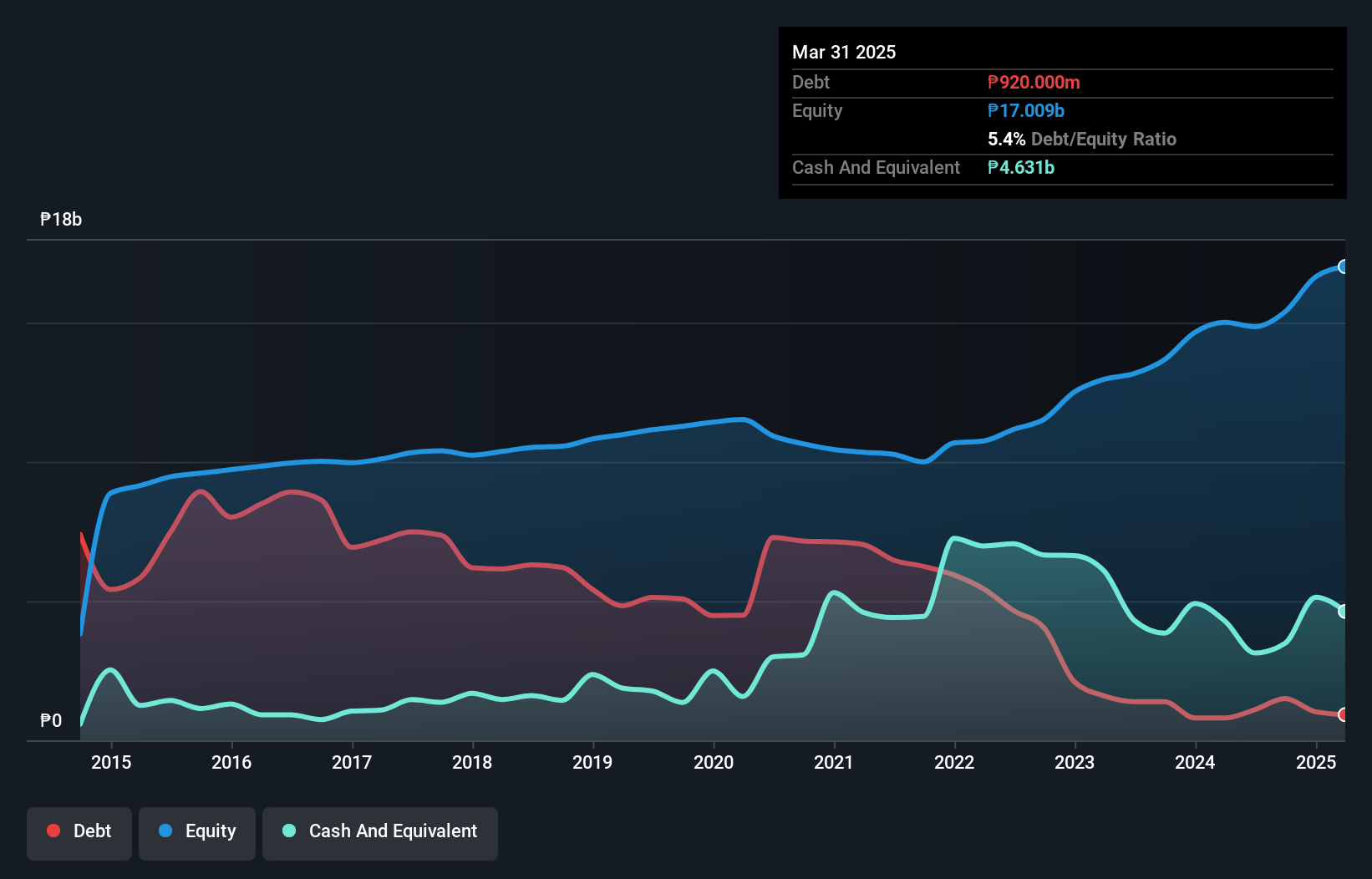

SSI Group, Inc. recently reported a modest increase in third-quarter sales to ₱6.97 billion, with net income rising slightly to ₱537.18 million compared to the previous year. Despite lower current net profit margins and negative earnings growth over the past year, SSI maintains high-quality earnings and a strong balance sheet, with short-term assets exceeding both short- and long-term liabilities significantly. The company's debt is well covered by operating cash flow and interest payments are comfortably managed by EBIT. SSI's price-to-earnings ratio suggests it may offer good value relative to the broader Philippine market average.

- Click here and access our complete financial health analysis report to understand the dynamics of SSI Group.

- Learn about SSI Group's historical performance here.

C-MER Medical Holdings (SEHK:3309)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: C-MER Medical Holdings Limited is an investment holding company that offers ophthalmic services under the C-MER Dennis Lam brand in Hong Kong and Mainland China, with a market cap of HK$2.50 billion.

Operations: The company generates revenue through its Hong Kong Medical Business (HK$889.68 million), Mainland China Ophthalmic Business (HK$565.70 million), and Mainland China Dental Business (HK$440.81 million).

Market Cap: HK$2.5B

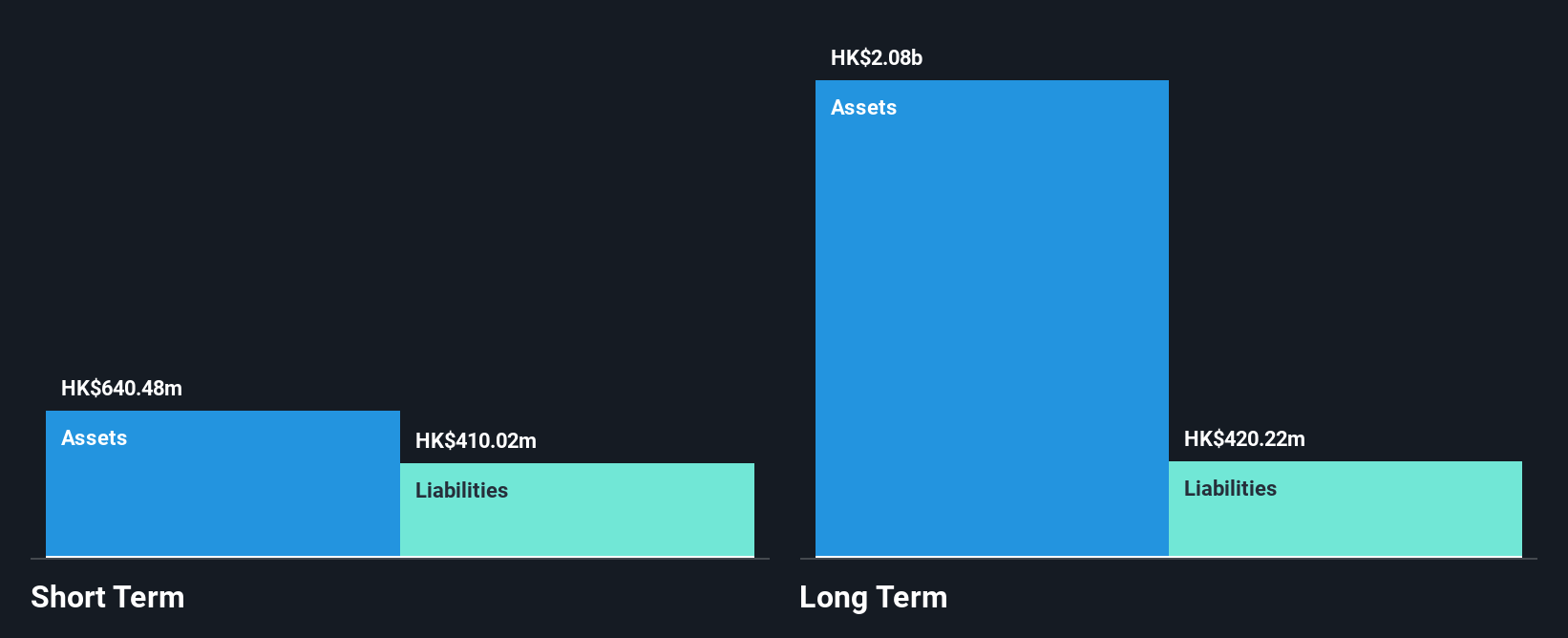

C-MER Medical Holdings Limited has demonstrated financial stability with short-term assets of HK$700.7 million surpassing both short- and long-term liabilities, indicating a solid balance sheet. The company recently achieved profitability, reporting net income of HK$30.76 million for the first half of 2024, slightly up from the previous year. Earnings per share have improved marginally, reflecting stable operational performance despite a slight dip in sales to HK$922.5 million. The ongoing share buyback program could enhance shareholder value by potentially increasing net asset value per share and earnings per share as authorized repurchases continue through 2024.

- Jump into the full analysis health report here for a deeper understanding of C-MER Medical Holdings.

- Gain insights into C-MER Medical Holdings' historical outcomes by reviewing our past performance report.

Greatview Aseptic Packaging (SEHK:468)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greatview Aseptic Packaging Company Limited is an investment holding company offering packaging solutions to the liquid food industry both in China and internationally, with a market cap of HK$3.28 billion.

Operations: The company generates its revenue from the Packaging & Containers segment, amounting to CN¥3.55 billion.

Market Cap: HK$3.28B

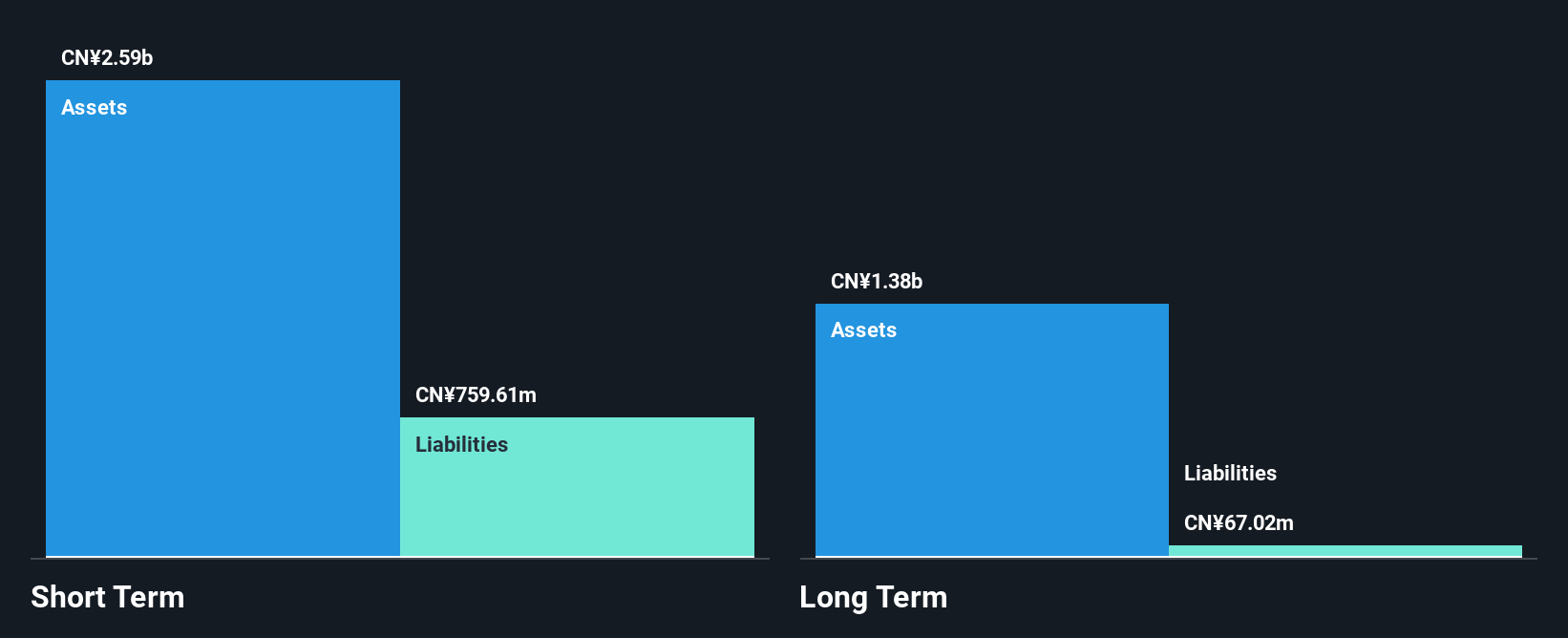

Greatview Aseptic Packaging Company Limited, with a market cap of HK$3.28 billion, has shown improved financial performance through higher net profit margins of 7.3% compared to last year's 5.3%. Despite a history of declining earnings over five years, recent growth at 20.6% indicates potential recovery. The company maintains a strong balance sheet with short-term assets significantly exceeding liabilities and cash surpassing total debt, suggesting financial stability. However, shareholder dilution and low return on equity at 8.3% may concern investors seeking high returns. Recent board changes and auditor uncertainties could introduce additional volatility in the near term.

- Take a closer look at Greatview Aseptic Packaging's potential here in our financial health report.

- Understand Greatview Aseptic Packaging's earnings outlook by examining our growth report.

Where To Now?

- Reveal the 5,792 hidden gems among our Penny Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:468

Greatview Aseptic Packaging

An investment holding company, provides packaging solutions to the liquid food industry in the People's Republic of China and internationally.

Flawless balance sheet and fair value.