- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3939

Shareholders Will Probably Not Have Any Issues With Wanguo International Mining Group Limited's (HKG:3939) CEO Compensation

Performance at Wanguo International Mining Group Limited (HKG:3939) has been reasonably good and CEO Mingqing Gao has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 11 June 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for Wanguo International Mining Group

How Does Total Compensation For Mingqing Gao Compare With Other Companies In The Industry?

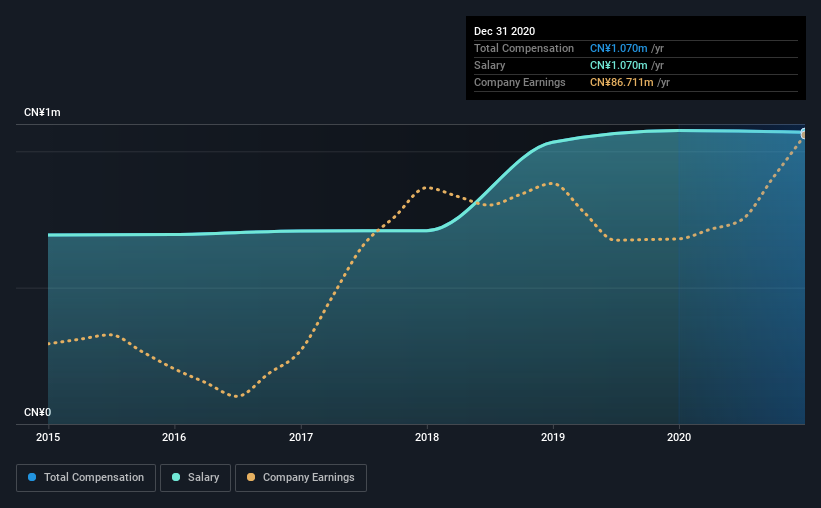

According to our data, Wanguo International Mining Group Limited has a market capitalization of HK$1.8b, and paid its CEO total annual compensation worth CN¥1.1m over the year to December 2020. This means that the compensation hasn't changed much from last year. Notably, the salary of CN¥1.1m is the entirety of the CEO compensation.

On comparing similar companies from the same industry with market caps ranging from HK$776m to HK$3.1b, we found that the median CEO total compensation was CN¥1.1m. So it looks like Wanguo International Mining Group compensates Mingqing Gao in line with the median for the industry. Furthermore, Mingqing Gao directly owns HK$599m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥1.1m | CN¥1.1m | 100% |

| Other | - | - | - |

| Total Compensation | CN¥1.1m | CN¥1.1m | 100% |

Speaking on an industry level, nearly 84% of total compensation represents salary, while the remainder of 16% is other remuneration. At the company level, Wanguo International Mining Group pays Mingqing Gao solely through a salary, preferring to go down a conventional route. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Wanguo International Mining Group Limited's Growth Numbers

Over the past three years, Wanguo International Mining Group Limited has seen its earnings per share (EPS) grow by 1.0% per year. In the last year, its revenue is up 347%.

We like the look of the strong year-on-year improvement in revenue. And in that context, the modest EPS improvement certainly isn't shabby. So while we'd stop short of saying growth is absolutely outstanding, there are definitely some clear positives! We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Wanguo International Mining Group Limited Been A Good Investment?

With a total shareholder return of 20% over three years, Wanguo International Mining Group Limited shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Wanguo International Mining Group rewards its CEO solely through a salary, ignoring non-salary benefits completely. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Wanguo International Mining Group that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wanguo Gold Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3939

Wanguo Gold Group

An investment holding company, engages in mining, ore processing, and sale of concentrate products in the People’s Republic of China and Solomon Islands.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives