- China

- /

- Electrical

- /

- SZSE:300835

Exploring Undiscovered Gems in Asia for July 2025

Reviewed by Simply Wall St

As global markets continue to show mixed signals, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 experiencing notable gains, investors are increasingly turning their attention to emerging opportunities in Asia. In this dynamic landscape, identifying promising stocks often involves looking for companies that demonstrate resilience and adaptability amid fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sinopower Semiconductor | NA | 1.45% | -4.33% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.24% | -15.32% | 17.90% | ★★★★★★ |

| Zhejiang Sling Automobile Bearing | NA | 6.76% | 24.26% | ★★★★★★ |

| Hokkan Holdings | 66.84% | -5.71% | 18.42% | ★★★★★☆ |

| Wholetech System Hitech | 3.31% | 15.16% | 19.61% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 39.11% | 5.91% | 0.76% | ★★★★★☆ |

| KinjiroLtd | 22.32% | 10.69% | 21.02% | ★★★★★☆ |

| Qingdao Daneng Environmental Protection Equipment | 65.76% | 31.58% | 23.66% | ★★★★☆☆ |

| Techno Smart | 10.18% | 12.81% | 17.66% | ★★★★☆☆ |

| ASRock Rack Incorporation | 26.93% | 225.32% | 6287.64% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

China Hanking Holdings (SEHK:3788)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Hanking Holdings Limited operates in the exploration, mining, processing, smelting, and sale of mineral resources across China, Australia, and Japan with a market capitalization of approximately HK$5.80 billion.

Operations: The company's primary revenue streams are derived from its High-Purity Iron Business, generating CN¥2.28 billion, and the Iron Ore Business, contributing CN¥966.18 million.

China Hanking Holdings, a player in the metals and mining sector, has shown resilience despite facing challenges. Over the past five years, its net debt to equity ratio improved significantly from 87.4% to 62.6%, indicating prudent financial management. The company boasts high-quality earnings and maintains a satisfactory net debt to equity ratio of 37.6%. Although earnings have dropped by 25.5% annually over five years, recent growth of 19.2% suggests potential recovery momentum is building up even if it lags behind industry peers at 40.2%. A final dividend of HKD 0.02 per share was recently declared, reflecting shareholder confidence amidst executive board changes.

Sinomag Technology (SZSE:300835)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sinomag Technology Co., Ltd. is involved in the global research, development, production, and sale of permanent ferrite magnets and soft magnetic cores and components, with a market capitalization of CN¥5.39 billion.

Operations: Sinomag derives its revenue from the production and sale of permanent ferrite magnets and soft magnetic cores. The company's financial performance is characterized by a focus on these core product lines, contributing to its market presence globally.

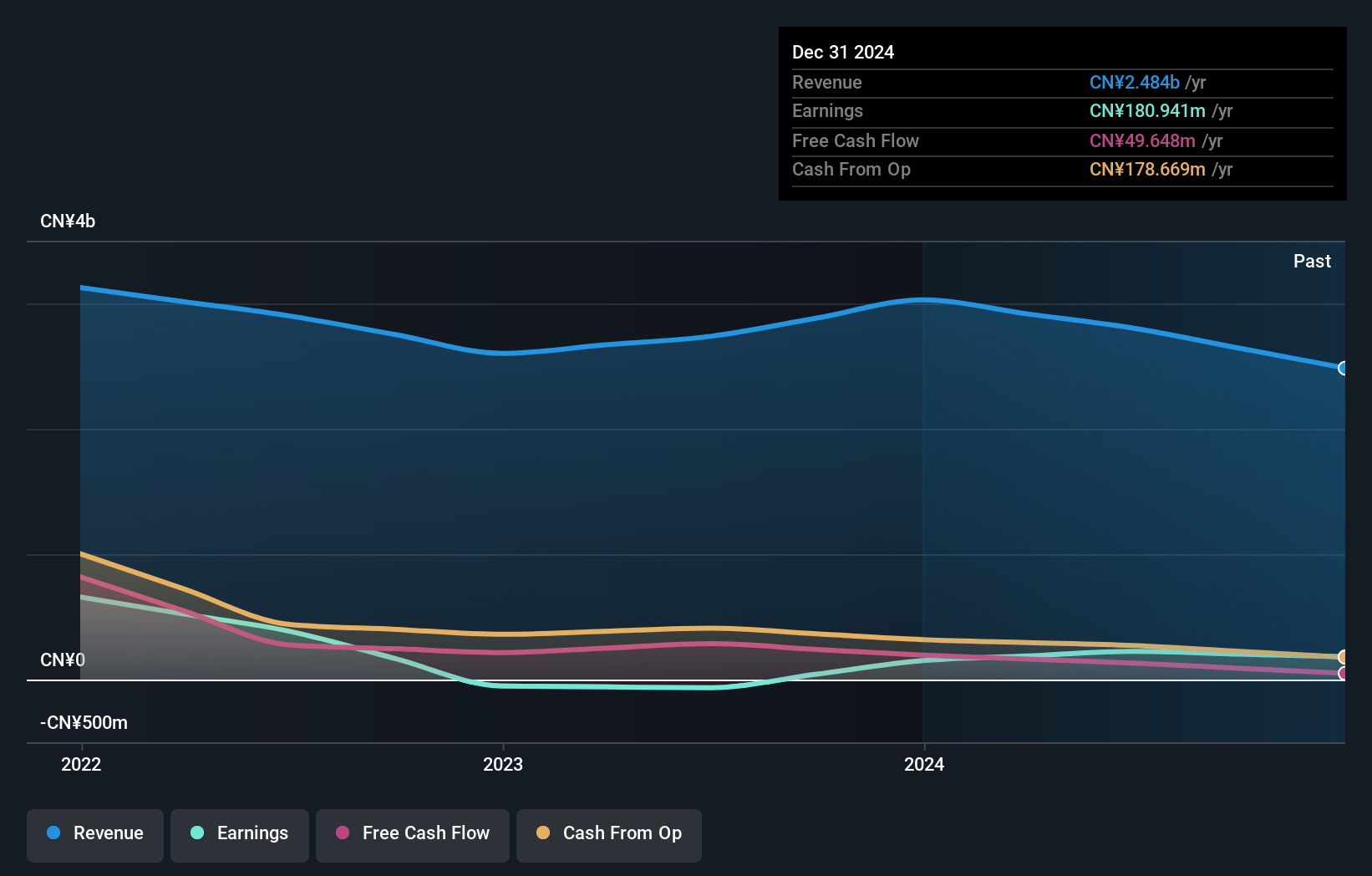

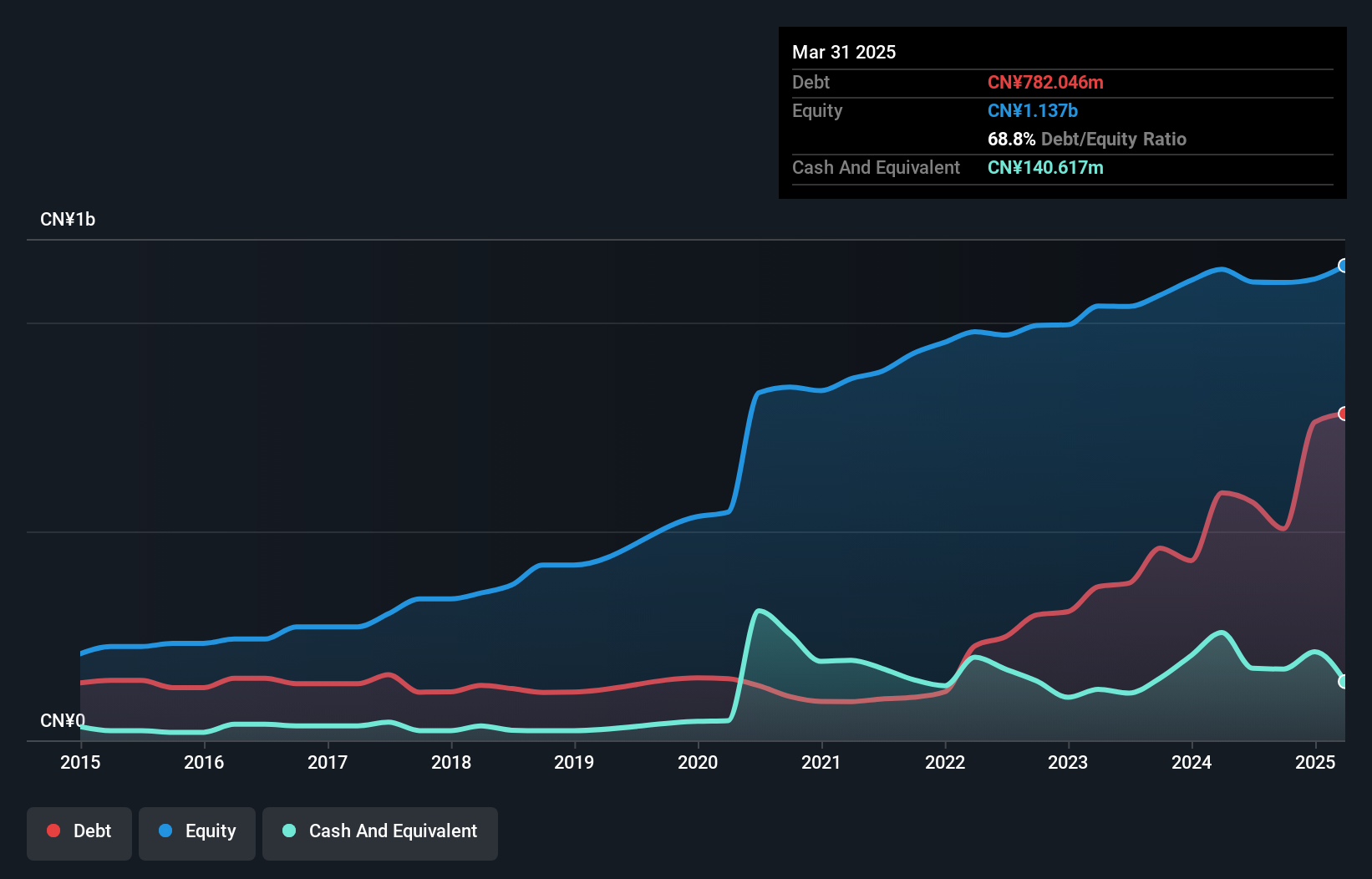

Sinomag Technology, a nimble player in the electrical industry, has seen its earnings grow by 21.7% over the past year, outpacing the sector's -1.4% trend. Despite a debt to equity ratio climbing from 27% to 68.8% over five years and a high net debt to equity of 56.4%, interest payments are well covered with EBIT at 9.3x interest repayments, showcasing financial resilience amidst volatility. Recent results show sales of CNY 256 million for Q1 2025 and net income of CNY 28 million, slightly down from last year’s figures but maintaining solid performance with high-quality earnings acknowledged by stakeholders through approved dividends at their AGM.

- Delve into the full analysis health report here for a deeper understanding of Sinomag Technology.

Examine Sinomag Technology's past performance report to understand how it has performed in the past.

Hazama Ando (TSE:1719)

Simply Wall St Value Rating: ★★★★★★

Overview: Hazama Ando Corporation operates in the construction and construction-related sectors both in Japan and internationally, with a market capitalization of ¥247.22 billion.

Operations: Hazama Ando generates revenue primarily from its construction and construction-related activities in Japan and abroad. The company focuses on optimizing its cost structure to enhance profitability, as reflected in a net profit margin of 2.5%.

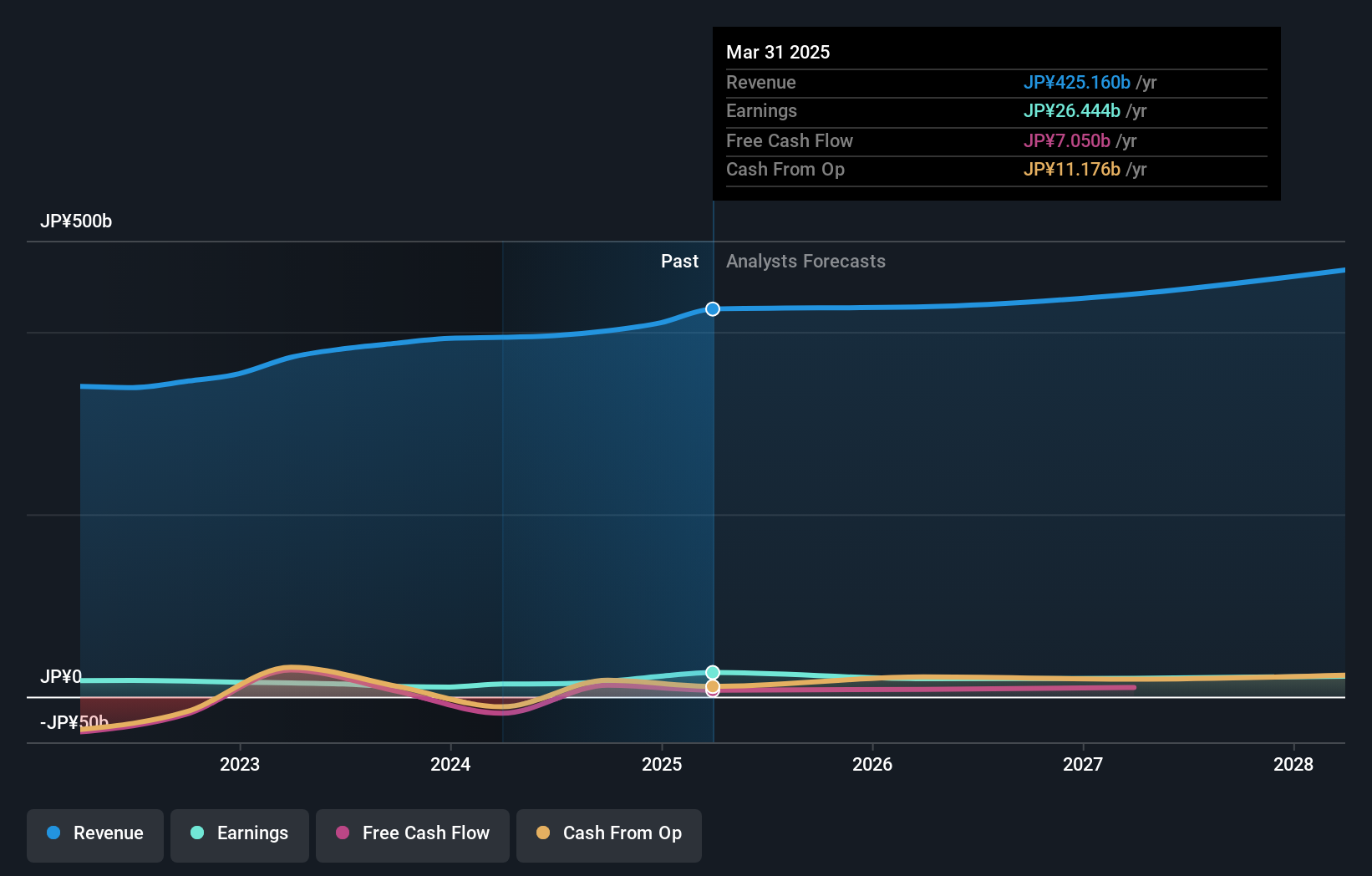

Hazama Ando, a construction player in Japan, showcases strong financial health with earnings growth of 90.5% last year, outpacing the industry average of 19.7%. The company has reduced its debt-to-equity ratio from 19.8% to 16.2% over five years and maintains a favorable price-to-earnings ratio at 9.3x compared to the JP market's 13.3x, indicating good value for investors. Recently, Hazama Ando announced an increased dividend of JPY 40 per share for fiscal year-end March 2025 and provided guidance for stable dividends in the upcoming fiscal period, reinforcing its commitment to shareholder returns despite an anticipated earnings dip over three years by an average of 6.5%.

- Click here and access our complete health analysis report to understand the dynamics of Hazama Ando.

Understand Hazama Ando's track record by examining our Past report.

Summing It All Up

- Click this link to deep-dive into the 2608 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300835

Sinomag Technology

Engages in the research and development, production, and sale of permanent ferrite magnets and soft magnetic cores and components worldwide.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives