- Hong Kong

- /

- Metals and Mining

- /

- SEHK:358

Jiangxi Copper (SEHK:358): Assessing Valuation After Morgan Stanley Upgrade on Metal Price Strength and Supply Tightness

Reviewed by Kshitija Bhandaru

Morgan Stanley’s recent upgrade on Jiangxi Copper (SEHK:358) came as global metal prices climb and copper concentrate supply remains tight. Investors are now focusing on the company’s exposure to two key resources: copper and tungsten.

See our latest analysis for Jiangxi Copper.

Shares of Jiangxi Copper have been on a remarkable run lately, capped by a 6.02% jump in the past day and a 45.45% share price return over 30 days. Momentum has been building all year, with a standout 184.33% share price return year-to-date and robust total shareholder returns of 154.33% over one year and 373.03% over five years. This suggests investors are increasingly confident in the company’s growth prospects and market positioning.

If you’re looking to discover what else is gaining traction in the market, now’s a great time to explore fast growing stocks with high insider ownership.

But after such a rapid rally, is Jiangxi Copper still trading at a discount, or is the market already baking in every bit of future growth and leaving little room for further upside?

Price-to-Earnings of 14.8x: Is it justified?

Jiangxi Copper’s current valuation sits at a price-to-earnings (P/E) ratio of 14.8x, a signal that investors are factoring in improved earnings but perhaps also some optimism about future growth. The last close price of HK$35.2 sits above analyst targets. Through this lens, the multiple offers perspective against industry and peer averages.

The price-to-earnings ratio compares a company’s share price to its earnings per share, reflecting how much investors are willing to pay for each dollar of earnings. In metals and mining, this metric helps judge whether the market is pricing in near-term commodity cycles or longer-term earning stability.

Jiangxi Copper trades at 14.8x, lower than the Hong Kong Metals and Mining industry average of 18.8x, and well below the peer group’s 46.6x. This suggests the stock is cheaper than its industry and peers, potentially offering an attractive entry point if the quality of earnings and growth outlook are sustained. However, our fair ratio analysis suggests the fair price-to-earnings should be around 14x, signaling the market price is only slightly above what models imply it should be and any further premium assumes ongoing performance.

Explore the SWS fair ratio for Jiangxi Copper

Result: Price-to-Earnings of 14.8x (ABOUT RIGHT)

However, risks remain, including further commodity price volatility and a significant discount to analyst price targets. These factors could pressure the current valuation narrative.

Find out about the key risks to this Jiangxi Copper narrative.

Another View: SWS DCF Model Suggests Deep Discount

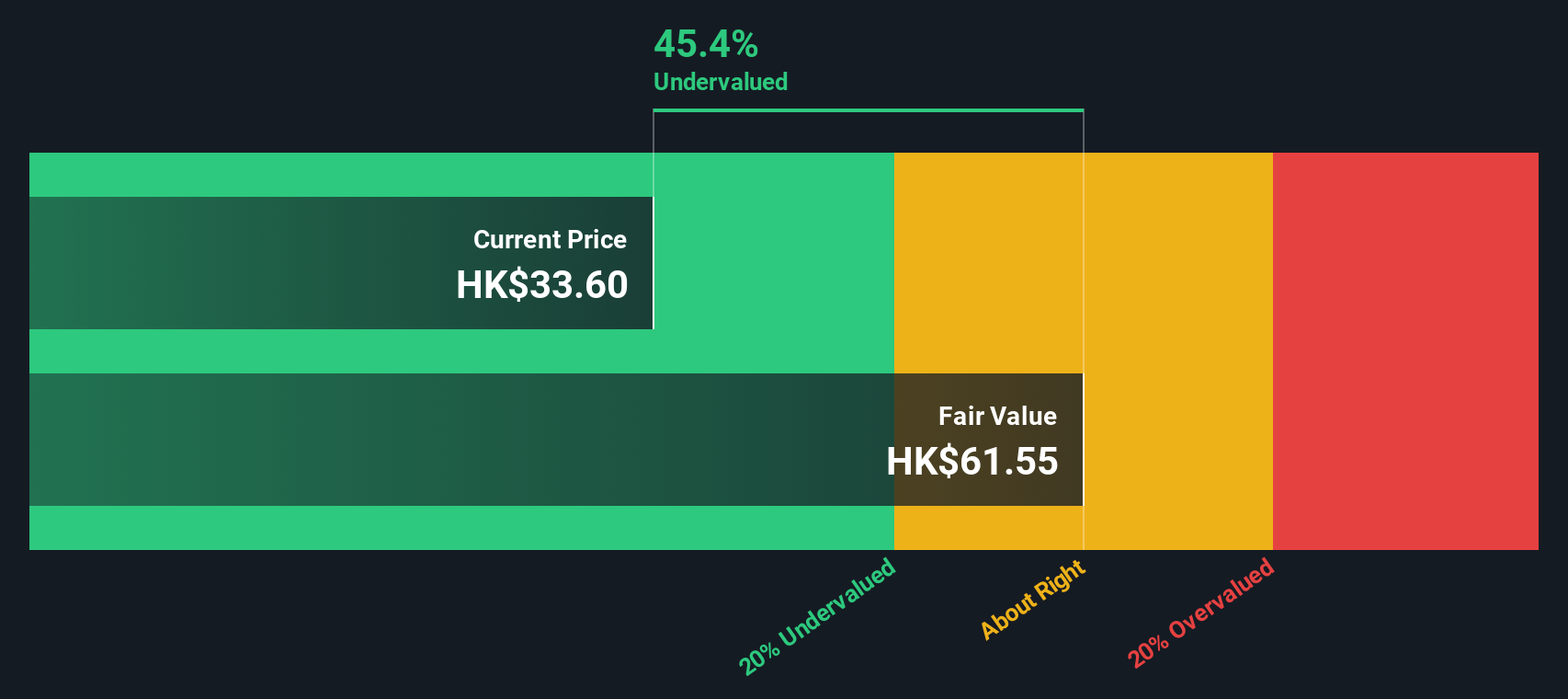

While the price-to-earnings ratio implies Jiangxi Copper is fairly valued or even a touch expensive, our SWS DCF model presents a sharply different picture. The discounted cash flow estimate puts fair value at HK$60.65, which is far above the current trading price. This indicates the shares may be undervalued by a significant margin. Does this wide valuation gap hint at market caution or present an overlooked opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jiangxi Copper for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jiangxi Copper Narrative

If you see the story playing out differently or want to dig into the numbers personally, you can build your own take in just a few minutes, with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Jiangxi Copper.

Looking for more investment ideas?

Smart investors never stand still, and the best opportunities often hide in plain sight. Don’t let potential winners slip through your fingers.

- Unlock powerful growth by targeting income potential within these 19 dividend stocks with yields > 3%, where high-yield stocks can boost your portfolio’s resilience and returns.

- Spot the next technology trailblazer by focusing on these 25 AI penny stocks, which are applying AI to redefine entire industries and set new market standards.

- Tap into tomorrow’s market leaders early by reviewing these 3579 penny stocks with strong financials, which offer compelling fundamentals and momentum that could deliver breakthrough gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:358

Jiangxi Copper

Engages in mining, smelting, and processing of copper and gold in Chinese Mainland, China, Hong Kong, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives