- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3330

Lingbao Gold (SEHK:3330) Valuation: Assessing Impact of Convertible Bond Issuance on Stakeholder Value

Reviewed by Simply Wall St

Lingbao Gold Group (SEHK:3330) has completed a HK$1,166 million zero coupon convertible bond issuance, a strategic move that enhances its capital structure. The bonds, due in 2026, are listed on the Vienna MTF.

See our latest analysis for Lingbao Gold Group.

Lingbao Gold Group’s share price has delivered standout momentum, surging 418.8% year-to-date, with the latest 1-day and 7-day returns also showing strong gains. Its 1-year total shareholder return of nearly 498% clearly signals market enthusiasm and interest around its strategic moves, including the recent bond issuance.

If this kind of explosive growth has you rethinking your portfolio, consider broadening your horizons and discover fast growing stocks with high insider ownership.

But after such impressive gains, investors may be asking whether Lingbao Gold Group’s recent rally is underpinned by continued undervaluation, or if the market has already priced in all the anticipated future growth, leaving little room for further upside.

Price-to-Earnings of 16.5x: Is it justified?

Lingbao Gold Group is currently trading at a price-to-earnings (P/E) ratio of 16.5x. This valuation is above the Hong Kong Metals and Mining industry average and suggests the market may have high expectations built into the stock at its current price of HK$17.07.

The P/E ratio reflects how much investors are willing to pay for each dollar of earnings, making it a widely used gauge for valuing companies in this sector. For mining groups like Lingbao, the ratio can indicate whether the market expects substantial future growth or if current profitability is being rewarded with a premium.

At 16.5x, Lingbao appears more expensive than both the industry average (15.8x) and the estimated fair P/E based on regression trends (15.8x). This suggests that investors are currently pricing in continued strong performance or future earnings growth. However, if sentiment changes or results do not meet expectations, the market could re-evaluate the premium assigned to these shares.

Explore the SWS fair ratio for Lingbao Gold Group

Result: Price-to-Earnings of 16.5x (OVERVALUED)

However, risks remain if growth slows or if the shares re-rate closer to the HK$13.75 analyst target. Both of these factors could challenge recent momentum.

Find out about the key risks to this Lingbao Gold Group narrative.

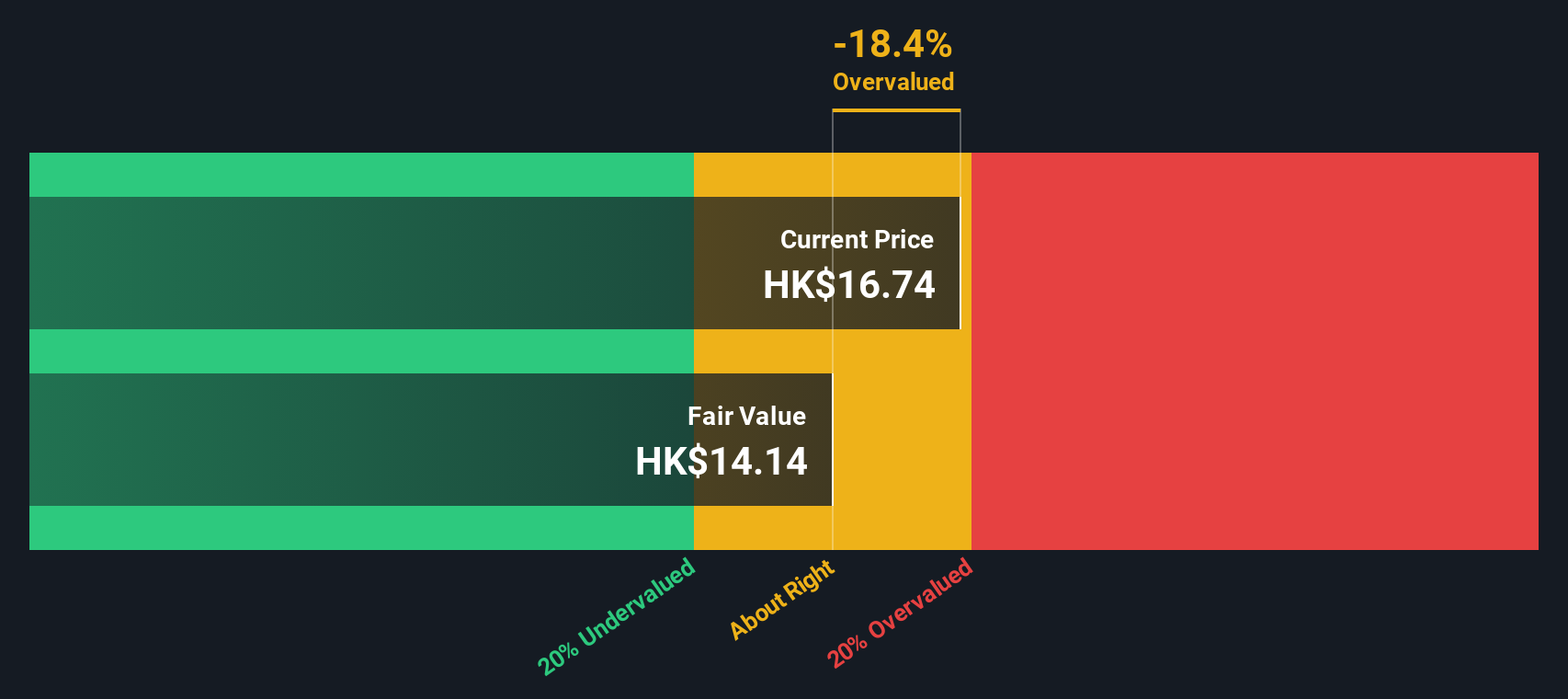

Another View: Discounted Cash Flow Signals Overvaluation

To challenge the conclusions drawn from P/E ratio analysis, let’s look at our SWS DCF model. This model suggests Lingbao Gold Group’s shares may actually be overvalued, trading at HK$17.07 while its estimated fair value is HK$14.18. That creates a notable gap and casts doubt on the upside implied by multiples.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lingbao Gold Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lingbao Gold Group Narrative

If you have a different perspective or want to dive into the numbers yourself, you can build your own Lingbao Gold Group narrative in just a few minutes and Do it your way.

A great starting point for your Lingbao Gold Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities move quickly in the market, and the next big winner could be closer than you think. Boost your portfolio with fresh, data-driven investment ideas from the Simply Wall Street Screener.

- Unlock value and performance by targeting these 923 undervalued stocks based on cash flows selected for their attractive prices compared to underlying cash flows.

- Start earning more with stability by focusing on these 14 dividend stocks with yields > 3% recognized for delivering yields above 3% and consistent income potential.

- Ride the disruptive wave of innovation with these 25 AI penny stocks supported by artificial intelligence breakthroughs and rapid sector growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3330

Lingbao Gold Group

Primarily engages in mining, processing, smelting, refining, and sale of gold products in the People’s Republic of China.

Outstanding track record with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026