- Hong Kong

- /

- Basic Materials

- /

- SEHK:3323

China National Building Material (SEHK:3323) Earnings Surge 630.7%, Challenging Bearish Narratives on Profitability

Reviewed by Simply Wall St

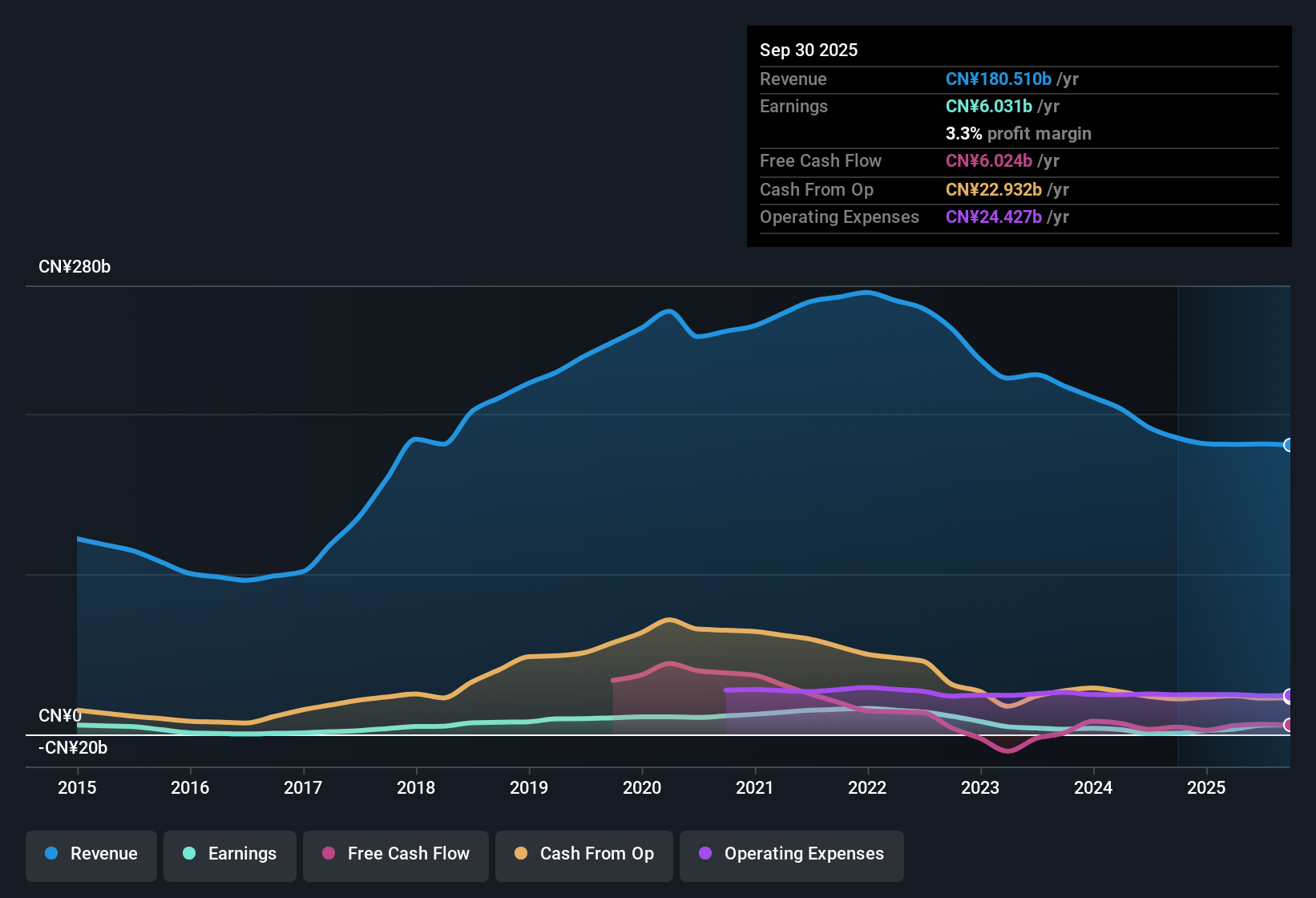

China National Building Material (SEHK:3323) delivered a striking 630.7% earnings growth over the past year, rebounding after averaging a 35.5% annual decline for the prior five years. Net profit margins also climbed sharply, moving from 0.4% a year ago to 3.3%. Despite this headline improvement, current forecasts point to a 0.6% annual decline in future earnings and a modest 3.2% revenue growth rate. Both figures trail the broader Hong Kong market.

See our full analysis for China National Building Material.Next up, we will see how these figures compare to the market narratives that drive investor expectations and sentiment for China National Building Material.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins See Sharp Turnaround

- Net profit margins climbed from 0.4% a year ago to 3.3%, reversing a period where profits were being squeezed and directly supporting the rebound in bottom-line performance.

- Recent momentum in profit margins challenges the notion that sector headwinds make robust operational improvement unlikely.

- The margin jump helps offset weak growth expectations, as recent profitability could provide a cushion that bears thought was missing.

- Still, sector pressures, such as slow property and infrastructure demand, mean that recent margin gains will be closely watched for durability.

DCF Valuation Suggests Deep Discount

- The current share price of HK$5.69 is trading at a 72%+ discount to the estimated DCF fair value of HK$20.51. This makes valuation indicators stand out relative to both sector and history.

- This valuation gap raises the question of whether persistent market skepticism is justified, given that recent earnings growth and margin recovery have not translated into improved investor expectations.

- Consensus narrative highlights that, while low valuation multiples and DCF discount point to potential upside, analysts remain wary due to forecasts of negative growth averaging -0.6% per year for the next three years.

- What is notable is that value case arguments are now directly challenged by guidance showing company fundamentals lagging the wider Hong Kong market’s expected 8.6% revenue growth.

Dividend and Financial Health Flagged as Risks

- Statements flag the company's financial position as "not notably strong," while dividend sustainability is raised as a concern for future periods.

- Prevailing analysis notes investors are weighing attractive valuation against ongoing risks around dividend stability and weaker growth outlook.

- Unlike value plays where dividends provide a reliable cushion, flagged sustainability means potential returns could be more volatile than anticipated.

- This risk framework influences both cautious and value-seeking investors, signaling that attractive pricing alone is not a decisive buy signal.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China National Building Material's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While China National Building Material has rebounded in earnings and margins, ongoing concerns about dividend sustainability and financial strength may limit long-term upside.

If you want more reliable income and peace of mind, use these dividend stocks with yields > 3% to focus on companies where strong, sustainable dividends remain a core part of the investment case.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3323

China National Building Material

An investment holding company, engages in building material, new materials, and engineering technical services businesses.

Undervalued with proven track record.

Market Insights

Community Narratives