Returns At China Boton Group (HKG:3318) Appear To Be Weighed Down

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. In light of that, when we looked at China Boton Group (HKG:3318) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for China Boton Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.076 = CN¥328m ÷ (CN¥6.5b - CN¥2.2b) (Based on the trailing twelve months to December 2022).

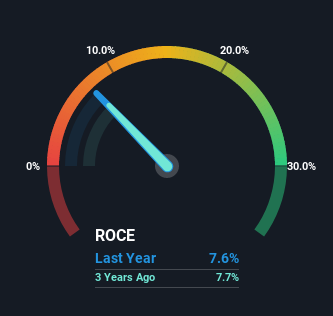

Therefore, China Boton Group has an ROCE of 7.6%. In absolute terms, that's a low return and it also under-performs the Chemicals industry average of 15%.

See our latest analysis for China Boton Group

Historical performance is a great place to start when researching a stock so above you can see the gauge for China Boton Group's ROCE against it's prior returns. If you're interested in investigating China Boton Group's past further, check out this free graph of past earnings, revenue and cash flow.

SWOT Analysis for China Boton Group

- Debt is well covered by earnings.

- Earnings declined over the past year.

- 3318's financial characteristics indicate limited near-term opportunities for shareholders.

- Lack of analyst coverage makes it difficult to determine 3318's earnings prospects.

- Debt is not well covered by operating cash flow.

How Are Returns Trending?

Things have been pretty stable at China Boton Group, with its capital employed and returns on that capital staying somewhat the same for the last five years. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. So don't be surprised if China Boton Group doesn't end up being a multi-bagger in a few years time.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 34% of total assets, this reported ROCE would probably be less than7.6% because total capital employed would be higher.The 7.6% ROCE could be even lower if current liabilities weren't 34% of total assets, because the the formula would show a larger base of total capital employed. With that in mind, just be wary if this ratio increases in the future, because if it gets particularly high, this brings with it some new elements of risk.

In Conclusion...

In summary, China Boton Group isn't compounding its earnings but is generating stable returns on the same amount of capital employed. Unsurprisingly then, the total return to shareholders over the last five years has been flat. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

Like most companies, China Boton Group does come with some risks, and we've found 2 warning signs that you should be aware of.

While China Boton Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3318

China Boton Group

Manufactures and sells flavors, fragrances, and e-cigarette products in the People’s Republic of China, Europe, the United States, the rest of Asia, and internationally.

Imperfect balance sheet with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion