- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2429

3 Promising Penny Stocks With Market Caps Under US$400M

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, including mixed stock index performances and fluctuating economic indicators, investors are keenly observing opportunities across various sectors. Penny stocks, though often associated with speculative trading, continue to attract attention when they exhibit robust financial health. These smaller or newer companies can offer unique growth potential and value that larger firms may not provide, making them an intriguing option for those seeking under-the-radar investment opportunities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.54 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.66M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.66 | HK$40.08B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.968 | £152.69M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,802 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Beijing UBOX Online Technology (SEHK:2429)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing UBOX Online Technology Corp. operates vending machines in Mainland China and has a market cap of HK$2.46 billion.

Operations: The company's revenue is derived from its Unmanned Retail Business (CN¥1.96 billion), Merchandise Wholesale (CN¥419.28 million), Vending Machine Sales and Leases (CN¥32.02 million), and Advertising and System Support Services (CN¥119.95 million).

Market Cap: HK$2.46B

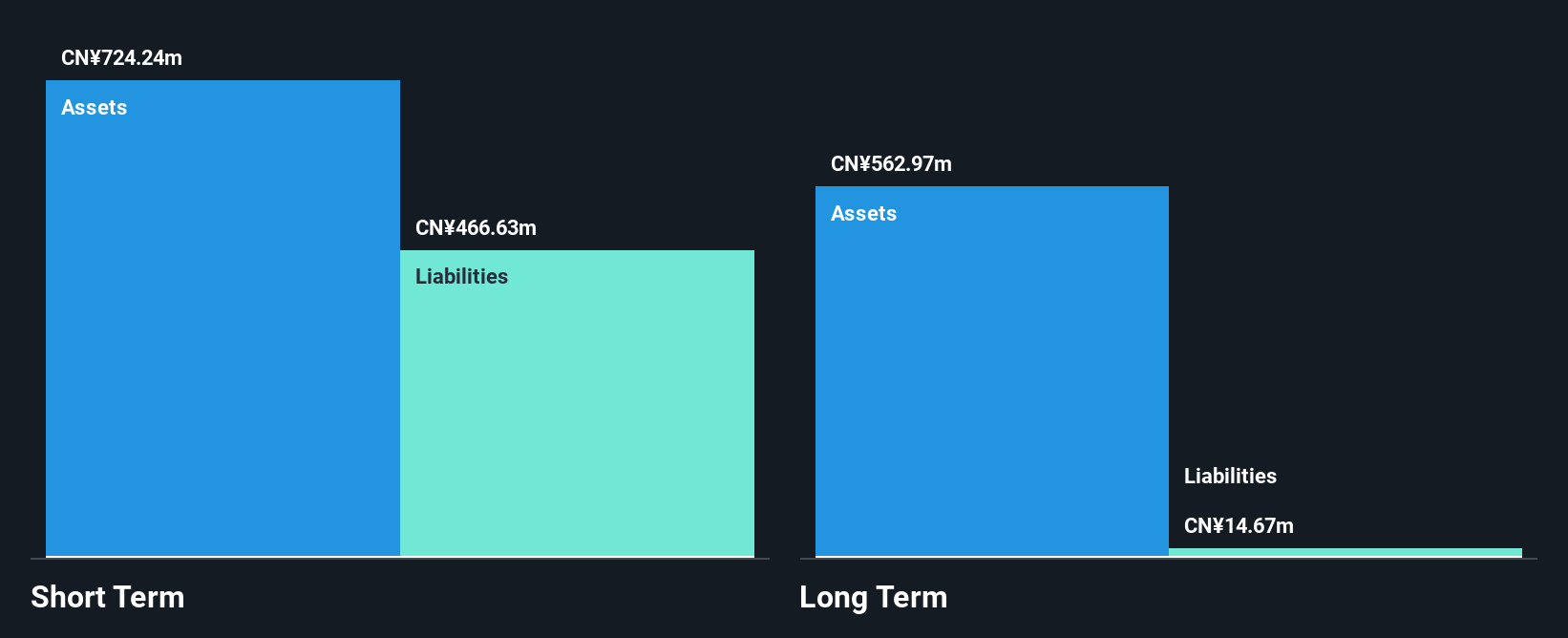

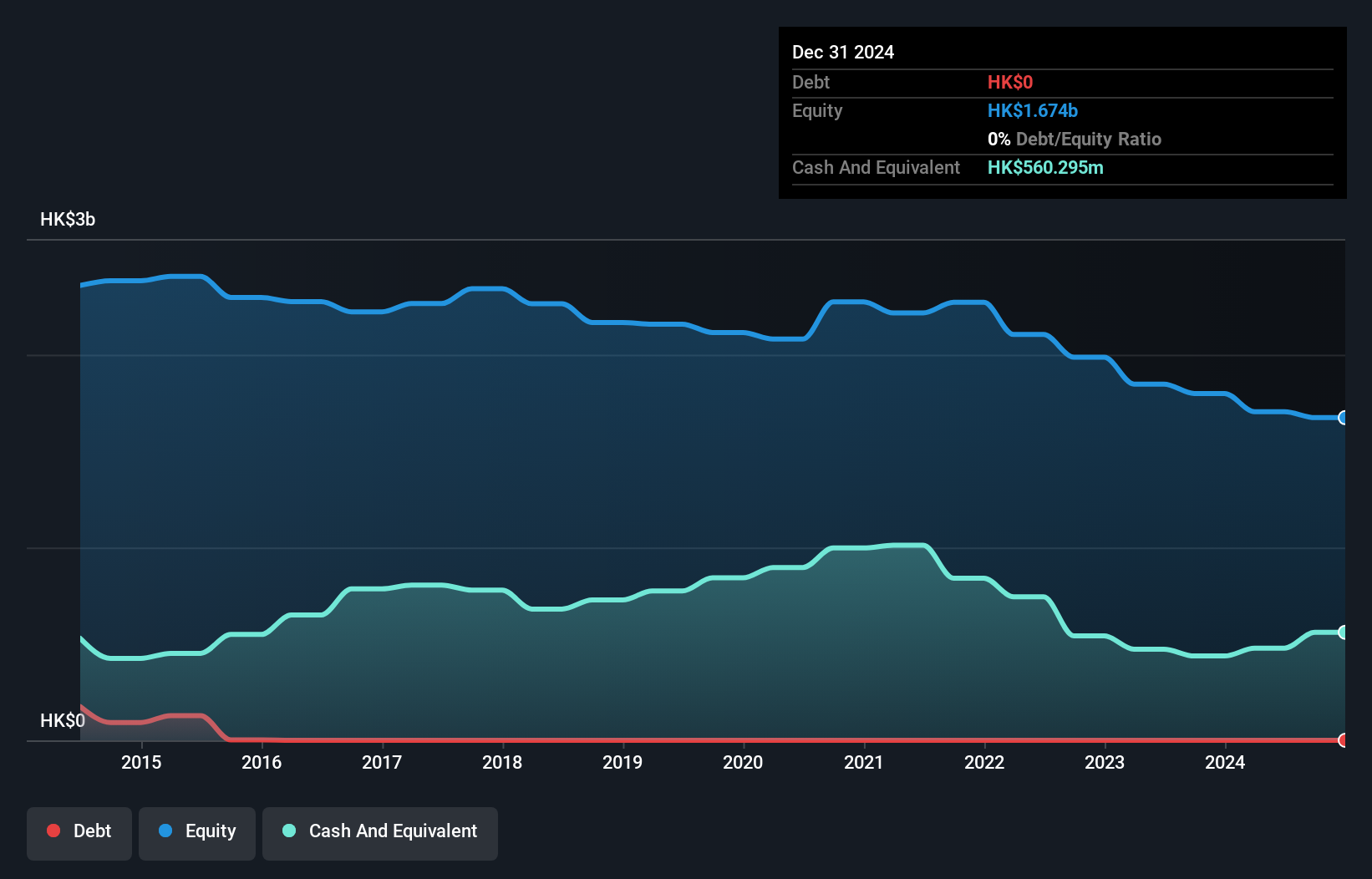

Beijing UBOX Online Technology Corp., with a market cap of HK$2.46 billion, derives significant revenue from its Unmanned Retail Business and Merchandise Wholesale. Despite being unprofitable, the company has reduced losses at 8% annually over five years and maintains more cash than total debt, indicating financial prudence. Its seasoned management team averages 7.2 years in tenure, contributing to strategic stability. The company's short-term assets comfortably cover both short-term and long-term liabilities, providing a solid liquidity position. However, the stock's high volatility could pose risks for investors seeking stable returns in penny stocks markets.

- Click to explore a detailed breakdown of our findings in Beijing UBOX Online Technology's financial health report.

- Evaluate Beijing UBOX Online Technology's historical performance by accessing our past performance report.

Lung Kee Group Holdings (SEHK:255)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lung Kee Group Holdings Limited is an investment holding company that manufactures and markets mold bases and related products in the People’s Republic of China and internationally, with a market cap of HK$688.53 million.

Operations: The company's revenue from Metal Processors and Fabrication amounts to HK$1.53 billion.

Market Cap: HK$688.53M

Lung Kee Group Holdings, with a market cap of HK$688.53 million, generates substantial revenue from its Metal Processors and Fabrication segment, amounting to HK$1.53 billion. Despite being unprofitable with a negative return on equity of -3.81%, the company has reduced its net loss significantly from HK$72 million in 2023 to an expected not more than HK$15 million in 2024 due to improved revenue and profit margins. The company's short-term assets exceed both short-term and long-term liabilities, providing strong liquidity support while remaining debt-free, offering some financial stability amidst its challenges in profitability.

- Get an in-depth perspective on Lung Kee Group Holdings' performance by reading our balance sheet health report here.

- Examine Lung Kee Group Holdings' past performance report to understand how it has performed in prior years.

China Boton Group (SEHK:3318)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Boton Group Company Limited, with a market cap of HK$1.58 billion, manufactures and sells flavors, fragrances, and e-cigarette products across China and internationally.

Operations: The company's revenue is derived from food flavors (CN¥184.96 million), fine fragrances (CN¥173.32 million), flavor enhancers (CN¥776.68 million), e-cigarette products (CN¥831.16 million), and investment properties (CN¥49.30 million).

Market Cap: HK$1.58B

China Boton Group, with a market cap of HK$1.58 billion, shows mixed signals in its financial health and growth potential. The company has seen impressive earnings growth of 396.5% over the past year, largely influenced by a significant one-off gain of CN¥45.1 million. Despite this, its return on equity remains low at 3.5%, and interest coverage is inadequate at 2.8 times EBIT, indicating potential challenges in debt servicing. Short-term assets match short-term liabilities at CN¥1.7 billion each, providing some liquidity cushion while long-term liabilities are well-covered by these assets as well.

- Dive into the specifics of China Boton Group here with our thorough balance sheet health report.

- Learn about China Boton Group's future growth trajectory here.

Where To Now?

- Dive into all 5,802 of the Penny Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing UBOX Online Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2429

Beijing UBOX Online Technology

Operates vending machines in Mainland China.

Excellent balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives