- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2899

I Ran A Stock Scan For Earnings Growth And Zijin Mining Group (HKG:2899) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Zijin Mining Group (HKG:2899). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Zijin Mining Group

How Quickly Is Zijin Mining Group Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Zijin Mining Group grew its EPS by 17% per year. That's a pretty good rate, if the company can sustain it.

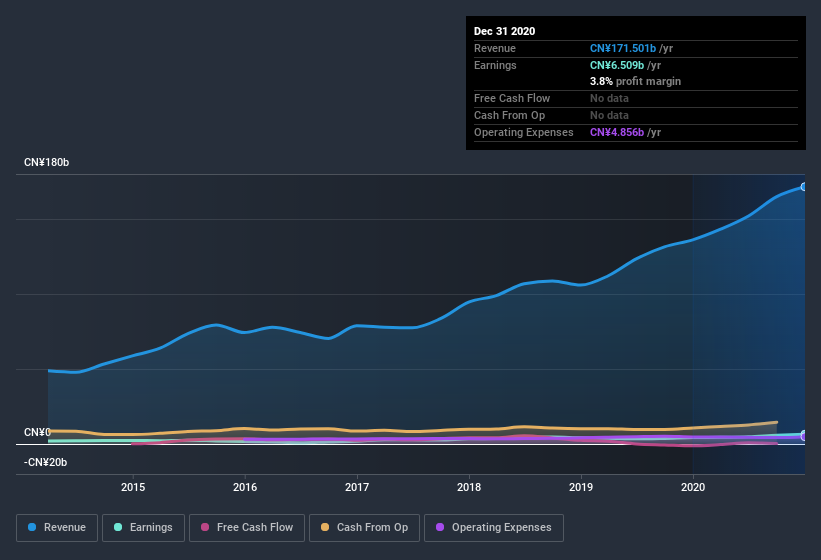

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Zijin Mining Group's EBIT margins were flat over the last year, revenue grew by a solid 26% to CN¥172b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Zijin Mining Group's future profits.

Are Zijin Mining Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One shining light for Zijin Mining Group is the serious outlay one insider has made to buy shares, in the last year. In one fell swoop, Executive Chairman of the Board Jinghe Chen, spent HK$16m, at a price of HK$5.48 per share. It doesn't get much better than that, in terms of large investments from insiders.

Along with the insider buying, another encouraging sign for Zijin Mining Group is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth CN¥1.3b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Laichang Zou, is paid less than the median for similar sized companies. For companies with market capitalizations over CN¥52b, like Zijin Mining Group, the median CEO pay is around CN¥5.5m.

The Zijin Mining Group CEO received CN¥3.5m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Zijin Mining Group Deserve A Spot On Your Watchlist?

One positive for Zijin Mining Group is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Zijin Mining Group , and understanding them should be part of your investment process.

As a growth investor I do like to see insider buying. But Zijin Mining Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Zijin Mining Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zijin Mining Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2899

Zijin Mining Group

A mining company, engages in the exploration, mining, processing, refining, and sale of gold, non-ferrous metals, and other mineral resources in Mainland China and internationally.

Outstanding track record and good value.

Similar Companies

Market Insights

Community Narratives