- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2600

Is Chinalco’s (SEHK:2600) Share Tweaks and Rio Tinto Talks Quietly Recasting Its Investment Story?

Reviewed by Sasha Jovanovic

- Aluminum Corporation of China Limited recently held a board meeting on November 25, 2025 to review the repurchase and cancellation of certain unvested restricted shares and adjust the related repurchase price, alongside ongoing collaboration work with Rio Tinto to address shareholding constraints that affect their joint operations.

- This combination of capital management actions and efforts to simplify cross-shareholdings with a major global partner highlights how Chinalco is refining both its ownership structure and internal incentives.

- Against this backdrop, we’ll explore how resolving shareholding constraints with Rio Tinto could reshape Aluminum Corporation of China’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Aluminum Corporation of China's Investment Narrative?

To be a shareholder in Aluminum Corporation of China, you need to believe in a large, integrated aluminium producer that is already profitable, paying regular dividends and still trading on what many see as undemanding earnings multiples despite a very large multi‑year share price run. The key near term catalysts remain execution on earnings, dividend continuity and how management beds down a relatively new executive team. The latest board decision to repurchase and cancel unvested restricted shares fits into that story by tightening capital management and sharpening incentives, but it is unlikely to be a major driver of value on its own. By contrast, the work with Rio Tinto to ease shareholding constraints could become more meaningful if it unlocks cleaner economics in joint ventures or simplifies a complex ownership structure.

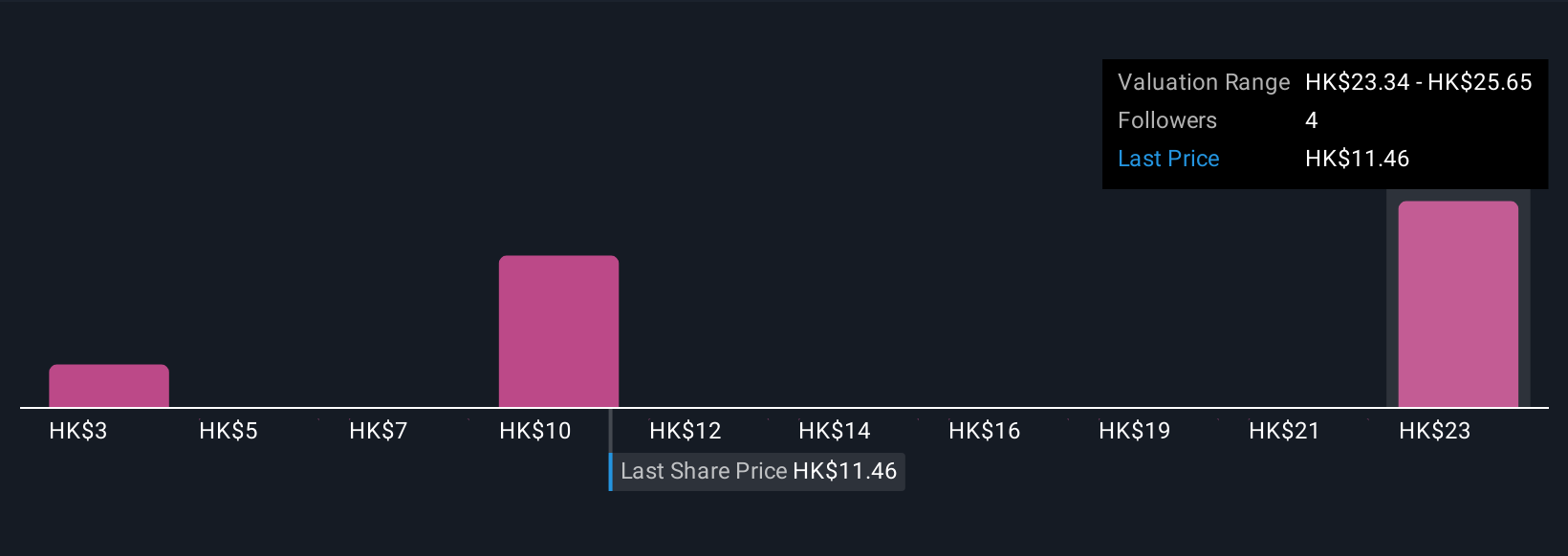

However, concentration risks tied to aluminium prices and policy remain easy to underestimate for shareholders. Aluminum Corporation of China's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Aluminum Corporation of China - why the stock might be worth over 2x more than the current price!

Build Your Own Aluminum Corporation of China Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aluminum Corporation of China research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Aluminum Corporation of China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aluminum Corporation of China's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2600

Aluminum Corporation of China

Primarily engages in the exploration and mining of bauxite, coal, and other resources in the People's Republic of China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026