- Hong Kong

- /

- Paper and Forestry Products

- /

- SEHK:2314

Lee & Man Paper Manufacturing (HKG:2314) Could Be Struggling To Allocate Capital

What underlying fundamental trends can indicate that a company might be in decline? A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This reveals that the company isn't compounding shareholder wealth because returns are falling and its net asset base is shrinking. So after we looked into Lee & Man Paper Manufacturing (HKG:2314), the trends above didn't look too great.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Lee & Man Paper Manufacturing, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0048 = HK$197m ÷ (HK$53b - HK$12b) (Based on the trailing twelve months to June 2023).

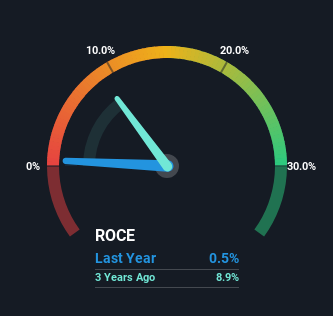

Thus, Lee & Man Paper Manufacturing has an ROCE of 0.5%. Ultimately, that's a low return and it under-performs the Forestry industry average of 7.1%.

Check out our latest analysis for Lee & Man Paper Manufacturing

In the above chart we have measured Lee & Man Paper Manufacturing's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Lee & Man Paper Manufacturing.

What The Trend Of ROCE Can Tell Us

We are a bit worried about the trend of returns on capital at Lee & Man Paper Manufacturing. Unfortunately the returns on capital have diminished from the 19% that they were earning five years ago. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect Lee & Man Paper Manufacturing to turn into a multi-bagger.

In Conclusion...

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. Long term shareholders who've owned the stock over the last five years have experienced a 60% depreciation in their investment, so it appears the market might not like these trends either. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

One more thing: We've identified 2 warning signs with Lee & Man Paper Manufacturing (at least 1 which is a bit concerning) , and understanding these would certainly be useful.

While Lee & Man Paper Manufacturing may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2314

Lee & Man Paper Manufacturing

Engages in the manufacture and trading of packaging papers, pulps, and tissue papers in the People’s Republic of China, Vietnam, Malaysia, Macau, and Hong Kong.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives