- Hong Kong

- /

- Basic Materials

- /

- SEHK:2233

What Is West China Cement's (HKG:2233) P/E Ratio After Its Share Price Rocketed?

It's great to see West China Cement (HKG:2233) shareholders have their patience rewarded with a 32% share price pop in the last month. Looking back a bit further, we're also happy to report the stock is up 66% in the last year.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So some would prefer to hold off buying when there is a lot of optimism towards a stock. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

See our latest analysis for West China Cement

Does West China Cement Have A Relatively High Or Low P/E For Its Industry?

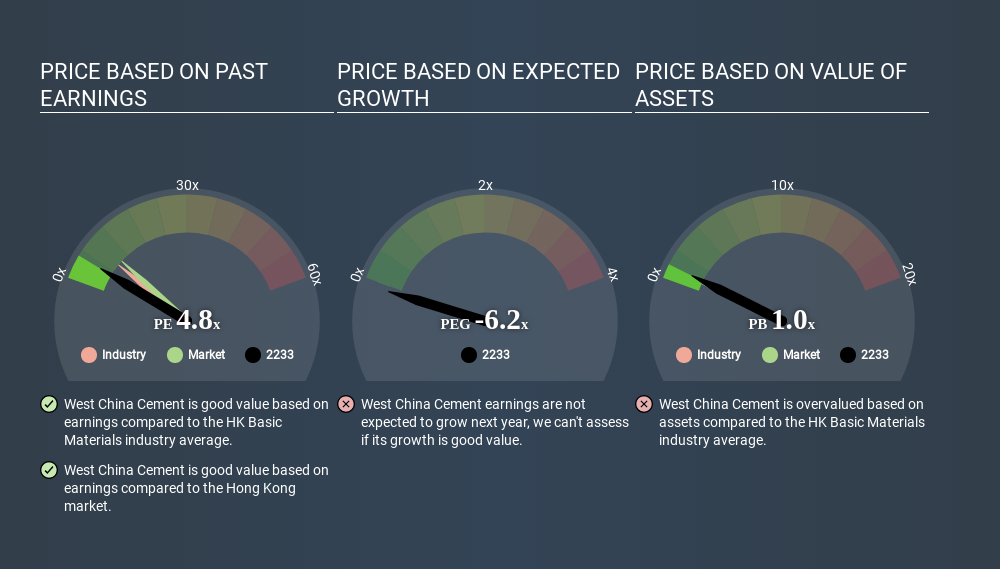

We can tell from its P/E ratio of 4.81 that sentiment around West China Cement isn't particularly high. We can see in the image below that the average P/E (8.3) for companies in the basic materials industry is higher than West China Cement's P/E.

Its relatively low P/E ratio indicates that West China Cement shareholders think it will struggle to do as well as other companies in its industry classification. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

In the last year, West China Cement grew EPS like Taylor Swift grew her fan base back in 2010; the 55% gain was both fast and well deserved. The cherry on top is that the five year growth rate was an impressive 111% per year. So I'd be surprised if the P/E ratio was not above average.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

How Does West China Cement's Debt Impact Its P/E Ratio?

West China Cement's net debt is 23% of its market cap. That's enough debt to impact the P/E ratio a little; so keep it in mind if you're comparing it to companies without debt.

The Bottom Line On West China Cement's P/E Ratio

West China Cement has a P/E of 4.8. That's below the average in the HK market, which is 9.7. The company does have a little debt, and EPS growth was good last year. If it continues to grow, then the current low P/E may prove to be unjustified. What is very clear is that the market has become less pessimistic about West China Cement over the last month, with the P/E ratio rising from 3.6 back then to 4.8 today. For those who like to invest in turnarounds, that might mean it's time to put the stock on a watchlist, or research it. But others might consider the opportunity to have passed.

Investors should be looking to buy stocks that the market is wrong about. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: West China Cement may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:2233

West China Cement

An investment holding company, manufactures and sells cement and cement products in the People’s Republic of China, Mozambique, Ethiopia, Democratic Republic of Congo, Other African countries, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion