Did China XLX Fertiliser's (SEHK:1866) Large Share Buyback Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- China XLX Fertiliser Ltd. (SEHK:1866) recently commenced a share repurchase program, authorized to buy back up to 128,324,100 shares, representing 10% of its issued share capital, using internal and/or external funds, with repurchased shares set for immediate cancellation in accordance with regulations.

- This move is intended to enhance earnings per share and net tangible asset per share, signaling management's focus on shareholder value and operational confidence.

- We'll consider how the buyback authorization and management's focus on boosting per-share metrics shape China XLX Fertiliser's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is China XLX Fertiliser's Investment Narrative?

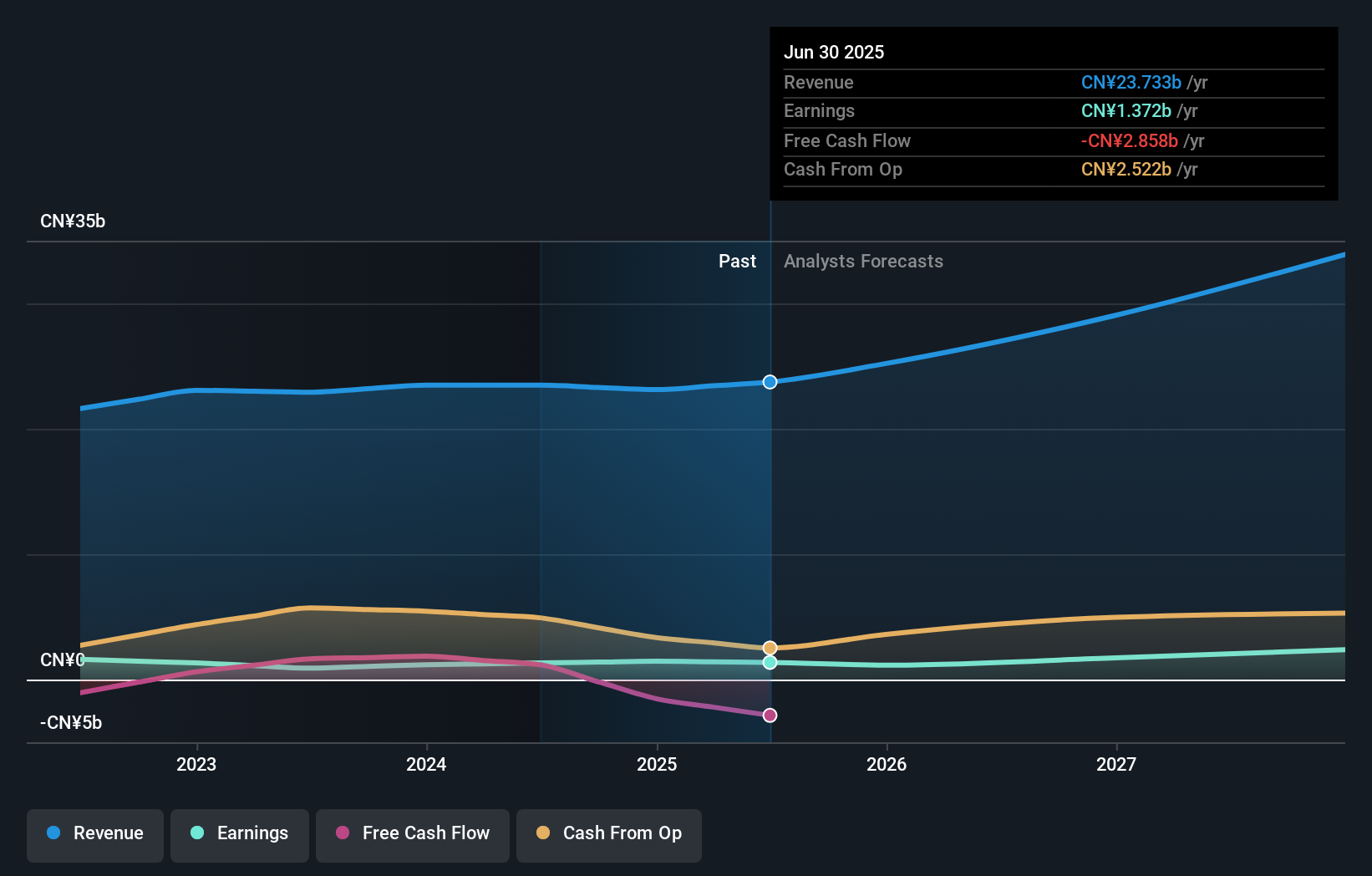

Any investor interested in China XLX Fertiliser today is likely focused on its ability to sustain profit growth and consistently reward shareholders. The company's bold share buyback, aiming to cancel up to 10% of its share base, is an unmistakable signal from management: they’re intent on improving per-share returns and supporting share price performance, at least in the short term. While this could provide a buffer to recent price volatility and add momentum to catalysts like the upcoming Q3 earnings release or further dividend announcements, it’s worth remembering that the firm’s declining half-year net income and continued insider selling may offset some of these positives. Plus, the buyback relies on both internal and external funding, which could impact financial flexibility if profit growth doesn’t pick up. For now, the buyback is a clear sign of management’s confidence, yet the long-term outlook will still rest heavily on earnings quality and the company’s management stability. However, rising debt exposure to fund buybacks is a risk investors should watch closely.

China XLX Fertiliser's shares are on the way up, but they could be overextended by 42%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on China XLX Fertiliser - why the stock might be worth 11% less than the current price!

Build Your Own China XLX Fertiliser Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China XLX Fertiliser research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free China XLX Fertiliser research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China XLX Fertiliser's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1866

China XLX Fertiliser

An investment holding company, engages in the development, manufacture, and sale of urea primarily in Mainland China and internationally.

Reasonable growth potential with slight risk.

Market Insights

Community Narratives