Investors Give Precious Dragon Technology Holdings Limited (HKG:1861) Shares A 58% Hiding

Precious Dragon Technology Holdings Limited (HKG:1861) shares have had a horrible month, losing 58% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 18% share price drop.

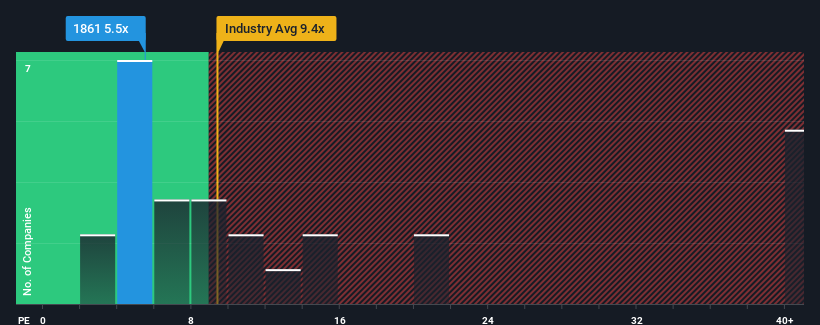

Although its price has dipped substantially, Precious Dragon Technology Holdings' price-to-earnings (or "P/E") ratio of 5.5x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 20x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Precious Dragon Technology Holdings over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Precious Dragon Technology Holdings

Is There Any Growth For Precious Dragon Technology Holdings?

Precious Dragon Technology Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.5%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 78% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is predicted to deliver 22% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Precious Dragon Technology Holdings' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Precious Dragon Technology Holdings' P/E?

Precious Dragon Technology Holdings' recently weak share price has pulled its P/E below most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Precious Dragon Technology Holdings currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Precious Dragon Technology Holdings (1 is potentially serious!) that we have uncovered.

If these risks are making you reconsider your opinion on Precious Dragon Technology Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1861

Precious Dragon Technology Holdings

Engages in the design, development, manufacturing, and sale of aerosol and non-aerosol products for applications in automotive beauty and maintenance products.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.