- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1818

Does Zhaojin Mining Industry's (HKG:1818) CEO Salary Compare Well With The Performance Of The Company?

This article will reflect on the compensation paid to Xin Dong who has served as CEO of Zhaojin Mining Industry Company Limited (HKG:1818) since 2018. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Zhaojin Mining Industry

How Does Total Compensation For Xin Dong Compare With Other Companies In The Industry?

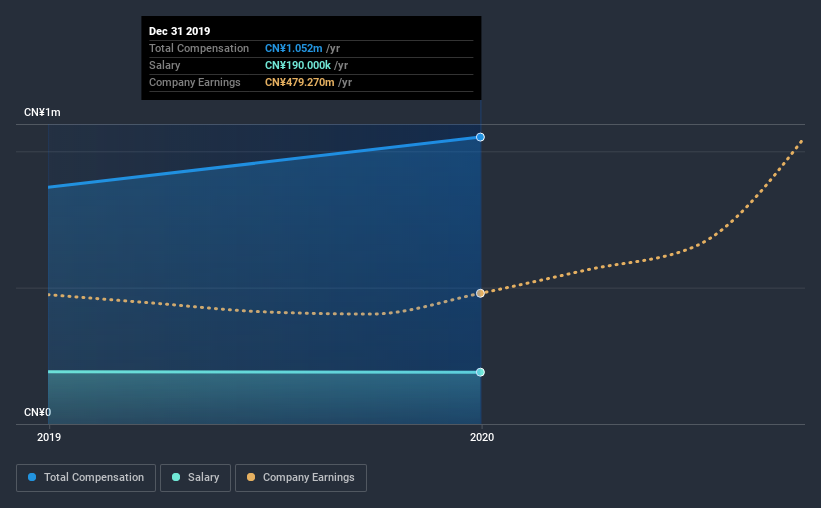

According to our data, Zhaojin Mining Industry Company Limited has a market capitalization of HK$29b, and paid its CEO total annual compensation worth CN¥1.1m over the year to December 2019. Notably, that's an increase of 21% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at CN¥190k.

For comparison, other companies in the same industry with market capitalizations ranging between HK$16b and HK$50b had a median total CEO compensation of CN¥938k. From this we gather that Xin Dong is paid around the median for CEOs in the industry. Furthermore, Xin Dong directly owns HK$2.7m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥190k | CN¥192k | 18% |

| Other | CN¥862k | CN¥676k | 82% |

| Total Compensation | CN¥1.1m | CN¥868k | 100% |

Speaking on an industry level, nearly 84% of total compensation represents salary, while the remainder of 16% is other remuneration. Zhaojin Mining Industry sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Zhaojin Mining Industry Company Limited's Growth

Zhaojin Mining Industry Company Limited's earnings per share (EPS) grew 20% per year over the last three years. It achieved revenue growth of 11% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Zhaojin Mining Industry Company Limited Been A Good Investment?

Boasting a total shareholder return of 52% over three years, Zhaojin Mining Industry Company Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As we noted earlier, Zhaojin Mining Industry pays its CEO in line with similar-sized companies belonging to the same industry. The company is growing EPS and total shareholder returns have been pleasing. Although the pay is close to the industry median, overall performance is excellent, so we don't think the CEO is paid too generously. In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Zhaojin Mining Industry that you should be aware of before investing.

Switching gears from Zhaojin Mining Industry, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Zhaojin Mining Industry, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Zhaojin Mining Industry, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhaojin Mining Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1818

Zhaojin Mining Industry

An investment holding company, engages in exploration, mining, processing, smelting, and sale of gold and other metallic products in the People’s Republic of China and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives