- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1712

Dragon Mining's (HKG:1712) Promising Earnings May Rest On Soft Foundations

Dragon Mining Limited's (HKG:1712) stock was strong after they recently reported robust earnings. We did some analysis and think that investors are missing some details hidden beneath the profit numbers.

View our latest analysis for Dragon Mining

Zooming In On Dragon Mining's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

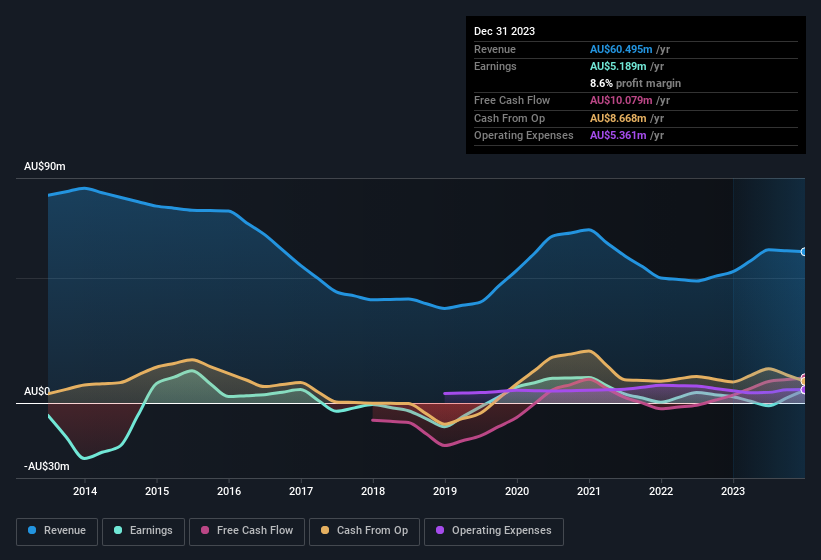

Dragon Mining has an accrual ratio of -0.11 for the year to December 2023. That indicates that its free cash flow was a fair bit more than its statutory profit. Indeed, in the last twelve months it reported free cash flow of AU$10m, well over the AU$5.19m it reported in profit. Dragon Mining's free cash flow improved over the last year, which is generally good to see. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Dragon Mining.

How Do Unusual Items Influence Profit?

Surprisingly, given Dragon Mining's accrual ratio implied strong cash conversion, its paper profit was actually boosted by AU$7.8m in unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. Dragon Mining had a rather significant contribution from unusual items relative to its profit to December 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Dragon Mining's Profit Performance

In conclusion, Dragon Mining's accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Having considered these factors, we don't think Dragon Mining's statutory profits give an overly harsh view of the business. So while earnings quality is important, it's equally important to consider the risks facing Dragon Mining at this point in time. In terms of investment risks, we've identified 2 warning signs with Dragon Mining, and understanding these bad boys should be part of your investment process.

Our examination of Dragon Mining has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1712

Dragon Mining

Engages in the exploration, evaluation, and development of gold projects in the Nordic region.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026