Despite delivering investors losses of 54% over the past 1 year, Jia Yao Holdings (HKG:1626) has been growing its earnings

This month, we saw the Jia Yao Holdings Limited (HKG:1626) up an impressive 45%. But that's not enough to compensate for the decline over the last twelve months. Like a receding glacier in a warming world, the share price has melted 54% in that period. The share price recovery is not so impressive when you consider the fall. Arguably, the fall was overdone.

On a more encouraging note the company has added HK$174m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for Jia Yao Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Jia Yao Holdings share price fell, it actually saw its earnings per share (EPS) improve by 232%. Of course, the situation might betray previous over-optimism about growth.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

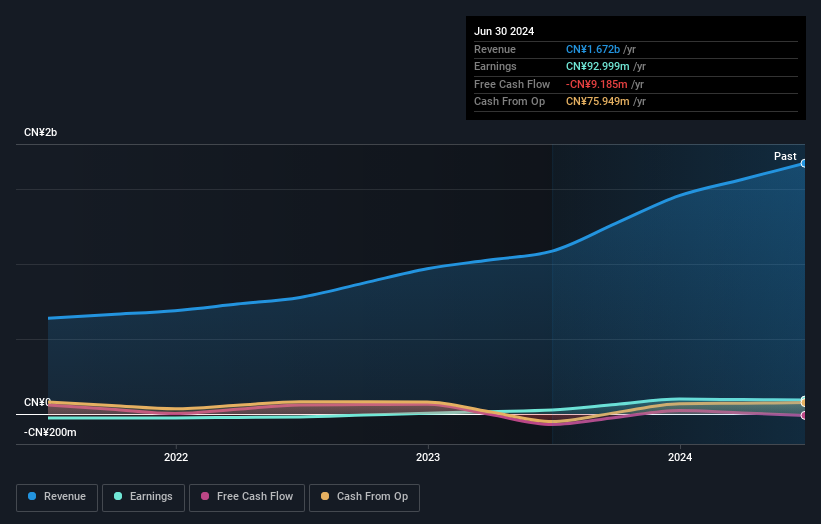

Jia Yao Holdings' revenue is actually up 54% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Jia Yao Holdings' financial health with this free report on its balance sheet.

A Different Perspective

Jia Yao Holdings shareholders are down 54% for the year, but the market itself is up 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 13% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Jia Yao Holdings better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Jia Yao Holdings .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1626

Jia Yao Holdings

An investment holding company, designs, manufactures, prints, and sells paper cigarette and social product paper packages in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives