- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1553

Maike Tube Industry Holdings' (HKG:1553) Upcoming Dividend Will Be Larger Than Last Year's

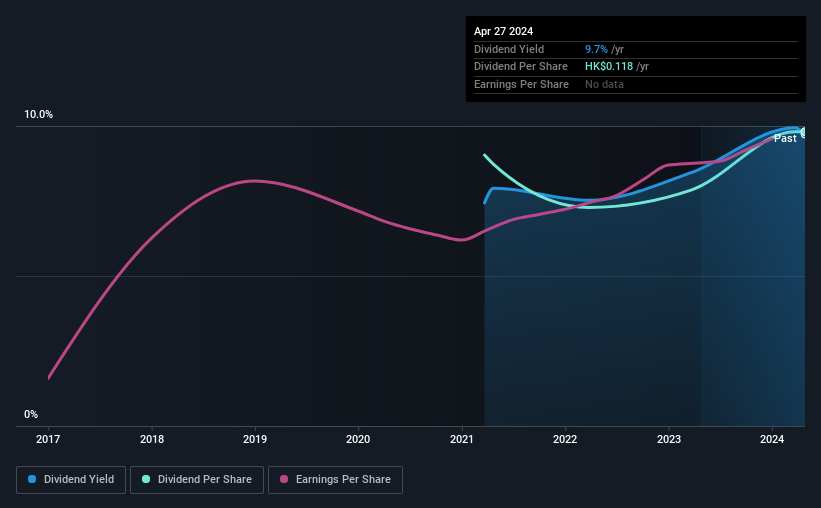

The board of Maike Tube Industry Holdings Limited (HKG:1553) has announced that it will be paying its dividend of CN¥0.12 on the 8th of July, an increased payment from last year's comparable dividend. This will take the annual payment to 9.7% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for Maike Tube Industry Holdings

Maike Tube Industry Holdings' Earnings Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, Maike Tube Industry Holdings' earnings easily covered the dividend, but free cash flows were negative. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

If the trend of the last few years continues, EPS will grow by 3.2% over the next 12 months. Assuming the dividend continues along recent trends, we think the payout ratio could be 33% by next year, which is in a pretty sustainable range.

Maike Tube Industry Holdings Is Still Building Its Track Record

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. The annual payment during the last 3 years was CN¥0.1 in 2021, and the most recent fiscal year payment was CN¥0.109. This means that it has been growing its distributions at 2.8% per annum over that time. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Maike Tube Industry Holdings May Find It Hard To Grow The Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, Maike Tube Industry Holdings has only grown its earnings per share at 3.2% per annum over the past five years. Earnings growth is slow, but on the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Maike Tube Industry Holdings' payments are rock solid. While Maike Tube Industry Holdings is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 2 warning signs for Maike Tube Industry Holdings that investors should take into consideration. Is Maike Tube Industry Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1553

Maike Tube Industry Holdings

An investment holding company, manufactures and sells steel pipe products and prefabricated pipe nipple products in the People’s Republic of China, the United States, rest of the Americas, rest of Asia, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives