Is Now The Time To Put MS Group Holdings (HKG:1451) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like MS Group Holdings (HKG:1451). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for MS Group Holdings

MS Group Holdings' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, MS Group Holdings has achieved impressive annual EPS growth of 45%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

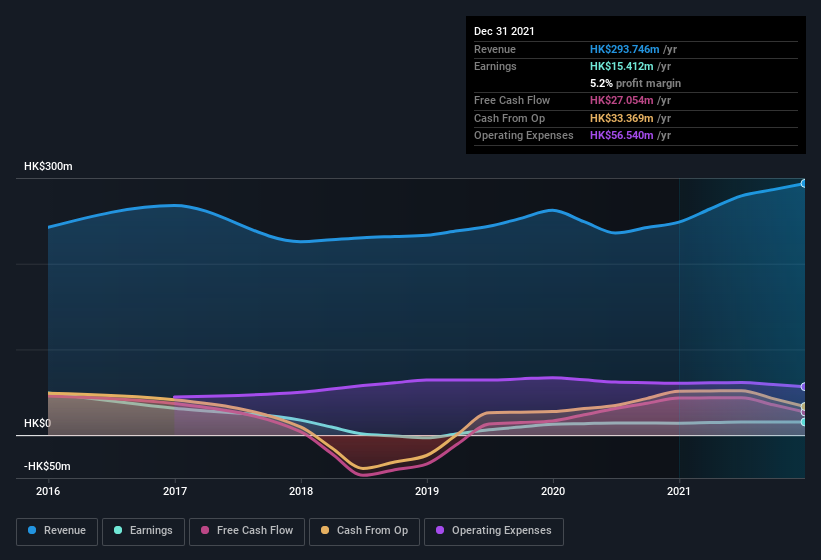

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note MS Group Holdings achieved similar EBIT margins to last year, revenue grew by a solid 18% to HK$294m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since MS Group Holdings is no giant, with a market capitalisation of HK$136m, you should definitely check its cash and debt before getting too excited about its prospects.

Are MS Group Holdings Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in MS Group Holdings will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 75% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Valued at only HK$136m MS Group Holdings is really small for a listed company. That means insiders only have HK$102m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations under HK$1.6b, like MS Group Holdings, the median CEO pay is around HK$1.8m.

The MS Group Holdings CEO received total compensation of just HK$607k in the year to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add MS Group Holdings To Your Watchlist?

MS Group Holdings' earnings have taken off in quite an impressive fashion. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. MS Group Holdings certainly ticks a few boxes, so we think it's probably well worth further consideration. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for MS Group Holdings that you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1451

MS Group Holdings

An investment holding company, engages in the production and sale of plastic and stainless steel sports bottles, and baby feeding accessories in the United States, Italy, the People’s Republic of China, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026