- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1378

Here's Why Shareholders Will Not Be Complaining About China Hongqiao Group Limited's (HKG:1378) CEO Pay Packet

The performance at China Hongqiao Group Limited (HKG:1378) has been quite strong recently and CEO Bo Zhang has played a role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 06 May 2021. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is not extravagant.

View our latest analysis for China Hongqiao Group

Comparing China Hongqiao Group Limited's CEO Compensation With the industry

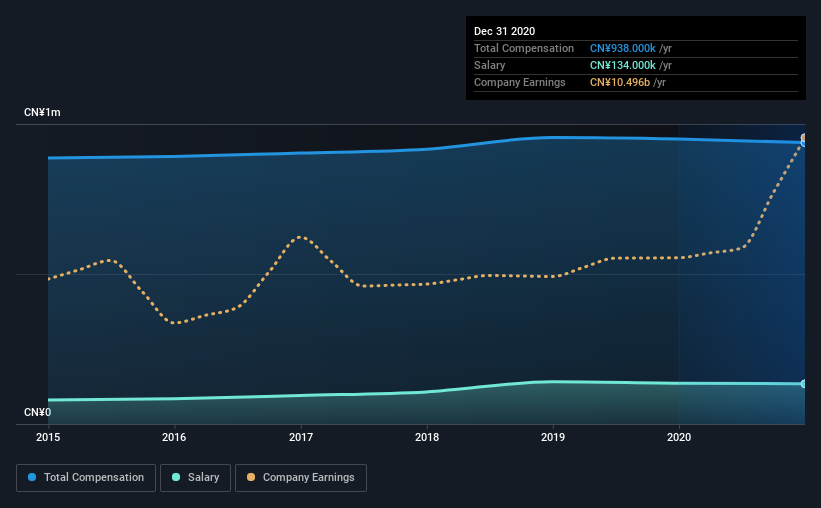

At the time of writing, our data shows that China Hongqiao Group Limited has a market capitalization of HK$109b, and reported total annual CEO compensation of CN¥938k for the year to December 2020. That's mostly flat as compared to the prior year's compensation. While we always look at total compensation first, our analysis shows that the salary component is less, at CN¥134k.

On comparing similar companies in the industry with market capitalizations above HK$62b, we found that the median total CEO compensation was CN¥937k. So it looks like China Hongqiao Group compensates Bo Zhang in line with the median for the industry. Moreover, Bo Zhang also holds HK$110m worth of China Hongqiao Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥134k | CN¥136k | 14% |

| Other | CN¥804k | CN¥814k | 86% |

| Total Compensation | CN¥938k | CN¥950k | 100% |

On an industry level, roughly 82% of total compensation represents salary and 18% is other remuneration. China Hongqiao Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at China Hongqiao Group Limited's Growth Numbers

China Hongqiao Group Limited has seen its earnings per share (EPS) increase by 20% a year over the past three years. Its revenue is up 2.3% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has China Hongqiao Group Limited Been A Good Investment?

Boasting a total shareholder return of 78% over three years, China Hongqiao Group Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 4 warning signs for China Hongqiao Group that investors should think about before committing capital to this stock.

Switching gears from China Hongqiao Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading China Hongqiao Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1378

China Hongqiao Group

An investment holding company, manufactures and sells aluminum products in the People's Republic of China and Indonesia.

Flawless balance sheet, undervalued and pays a dividend.