WH Group (SEHK:288) Eyes Expansion with New Markets and Tech Investments Amid Rising Costs

Reviewed by Simply Wall St

WH Group (SEHK:288) continues to solidify its market position with significant revenue growth in the packaged meats segment, particularly in the U.S. and China, driven by strategic operational improvements and product innovation. Despite trading at a favorable P/E ratio of 11.3x, below the industry average, the company faces challenges such as rising costs and competitive pressures that necessitate strategic agility. The company report will explore these developments, examine growth opportunities in new markets, and assess potential risks, including economic headwinds and regulatory changes.

Click here to discover the nuances of WH Group with our detailed analytical report.

Innovative Factors Supporting WH Group

Strong revenue growth in the packaged meats segment underscores WH Group's solid market position, particularly in the U.S. and China, as noted by Hall Mark. This reflects effective strategies and confidence in market share. The company's commitment to operational excellence is evident through ongoing improvements in production, which have significantly enhanced margins, according to Charles Shane Smith. Furthermore, the focus on continuous product innovation, as highlighted by Lijun Guo, positions WH Group favorably against competitors by meeting evolving consumer preferences. Financially, the company is trading at a P/E ratio of 11.3x, below the industry average, suggesting a favorable valuation.

Challenges Constraining WH Group's Potential

WH Group faces challenges such as rising costs that could impact margins if not managed effectively, as acknowledged by Shane Smith. The competitive pressures in the market require constant vigilance and adaptation, as stated by Hall Mark, indicating a need for strategic agility. Additionally, some segments are not meeting growth expectations, necessitating a reevaluation of strategies to ensure balanced growth, as mentioned by Charles Shane Smith. The company's earnings growth has been negative over the past year, complicating comparisons with historical performance.

Growth Avenues Awaiting WH Group

The exploration of new markets presents a significant growth opportunity for WH Group, with increasing demand for its products in emerging regions, as noted by Lijun Guo. Technological investments to enhance production capabilities are prioritized, as Shane Smith emphasized, aiming to maintain competitiveness in a rapidly evolving industry. Furthermore, enhancing digital marketing efforts to reach a broader audience is a key focus for customer acquisition, as discussed by Hall Mark, reflecting a modern approach to expanding the customer base.

Key Risks and Challenges That Could Impact WH Group's Success

Economic headwinds pose potential risks to consumer spending, as Lijun Guo highlighted, emphasizing the importance of monitoring external factors. Regulatory changes also present challenges, with significant implications for operations, as Charles Shane Smith noted. Additionally, ongoing supply chain disruptions remain a concern, requiring robust management strategies to mitigate these risks, as stated by Hall Mark.

Conclusion

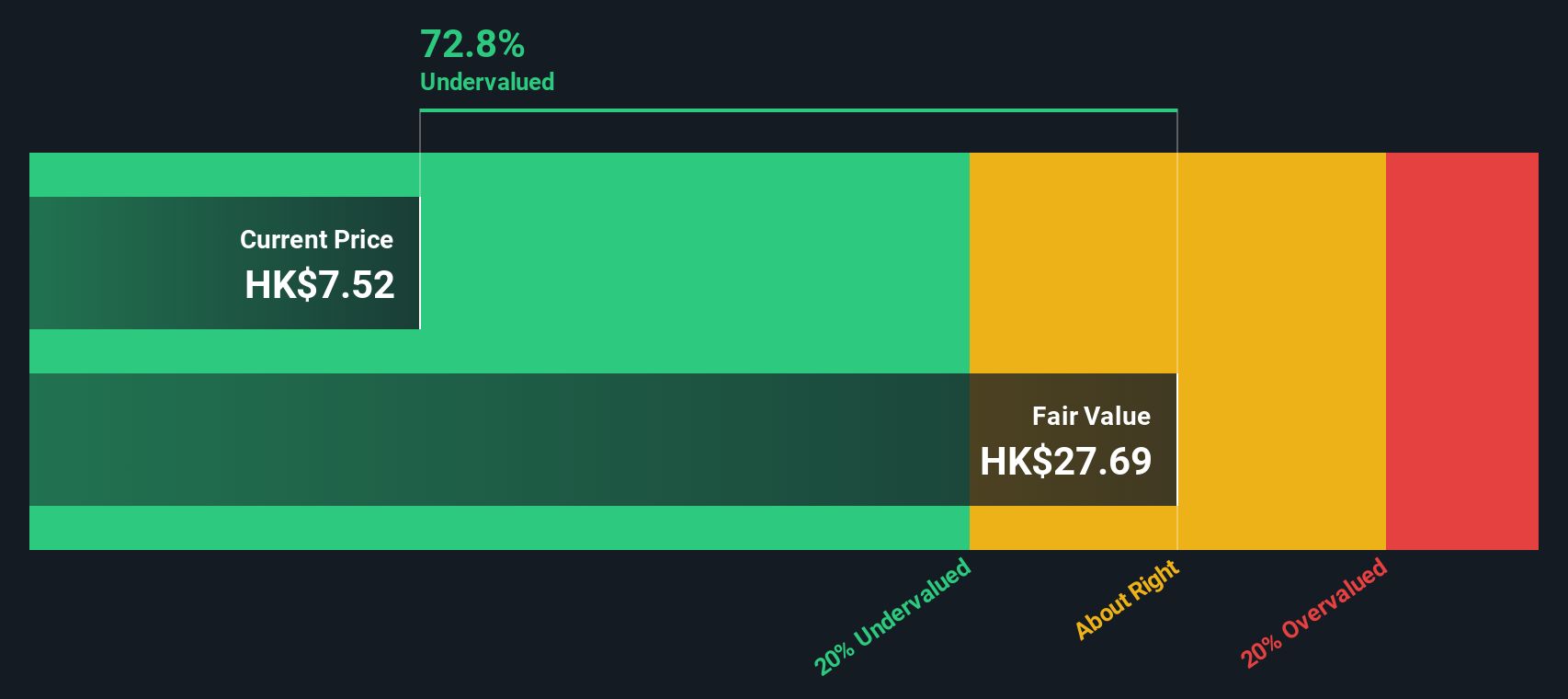

WH Group's strong revenue growth in the packaged meats segment highlights its solid market position in key regions like the U.S. and China, driven by effective strategies and a focus on operational excellence. However, challenges such as rising costs and competitive pressures necessitate strategic agility to maintain margins and growth. The company's exploration of new markets and technological investments are promising avenues for expansion, positioning it to capitalize on emerging demand. Despite recent earnings growth challenges, WH Group's favorable P/E ratio of 11.3x, below the industry average, suggests it is currently trading at an attractive valuation, offering potential upside as it navigates these opportunities and risks.

Taking Advantage

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if WH Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:288

WH Group

An investment holding company, produces and sells packaged meats and pork in China, North America, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives