- Hong Kong

- /

- Basic Materials

- /

- SEHK:1313

Is China Resources Cement Holdings Limited (HKG:1313) A Smart Choice For Dividend Investors?

Is China Resources Cement Holdings Limited (HKG:1313) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if China Resources Cement Holdings is a new dividend aristocrat in the making. It sure looks interesting on these metrics - but there's always more to the story . Some simple research can reduce the risk of buying China Resources Cement Holdings for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on China Resources Cement Holdings!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 49% of China Resources Cement Holdings's profits were paid out as dividends in the last 12 months. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Plus, there is room to increase the payout ratio over time.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. China Resources Cement Holdings paid out a conservative 29% of its free cash flow as dividends last year. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Dividend Volatility

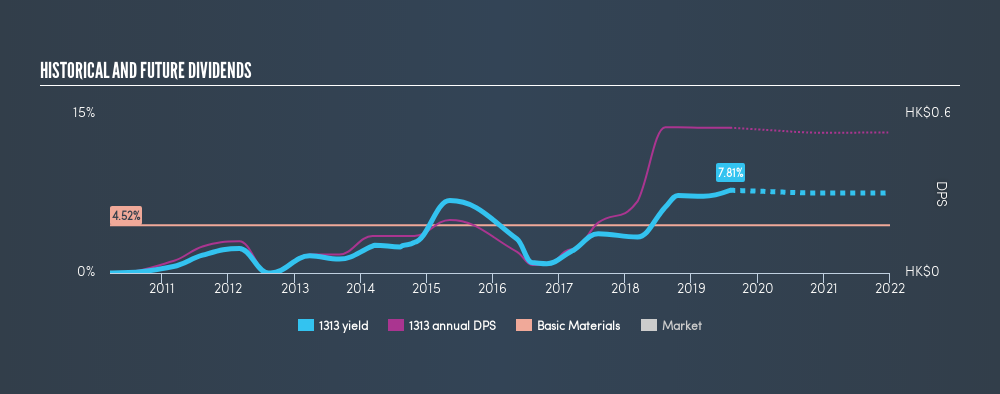

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the last decade of data, we can see that China Resources Cement Holdings paid its first dividend at least eight years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once by more than 20%, and we're cautious about the consistency of its dividend across a full economic cycle. During the past eight-year period, the first annual payment was HK$0.045 in 2011, compared to HK$0.55 last year. Dividends per share have grown at approximately 37% per year over this time. China Resources Cement Holdings's dividend payments have fluctuated, so it hasn't grown 37% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

China Resources Cement Holdings has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, but it might be worth considering if the business has turned a corner.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? It's good to see China Resources Cement Holdings has been growing its earnings per share at 17% a year over the past 5 years. A company paying out less than a quarter of its earnings as dividends, and growing earnings at more than 10% per annum, looks to be right in the cusp of its growth phase. At the right price, we might be interested.

We'd also point out that China Resources Cement Holdings issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

To summarise, shareholders should always check that China Resources Cement Holdings's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. It's great to see that China Resources Cement Holdings is paying out a low percentage of its earnings and cash flow. Second, earnings per share have been essentially flat, and its history of dividend payments is chequered - having cut its dividend at least once in the past. Overall we think China Resources Cement Holdings scores well on our analysis. It's not quite perfect, but we'd definitely be keen to take a closer look.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 18 China Resources Cement Holdings analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1313

China Resources Building Materials Technology Holdings

An investment holding company, manufactures and sells cement, concrete, aggregates, and related products and services in Mainland China.

Moderate growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives