- Hong Kong

- /

- Basic Materials

- /

- SEHK:1313

Market Still Lacking Some Conviction On China Resources Building Materials Technology Holdings Limited (HKG:1313)

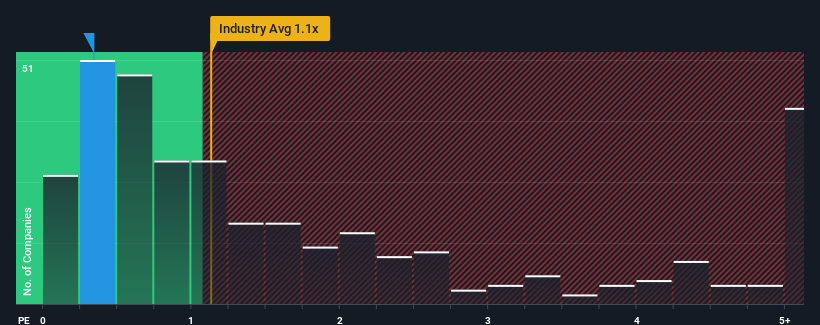

There wouldn't be many who think China Resources Building Materials Technology Holdings Limited's (HKG:1313) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Basic Materials industry in Hong Kong is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for China Resources Building Materials Technology Holdings

How Has China Resources Building Materials Technology Holdings Performed Recently?

Recent times haven't been great for China Resources Building Materials Technology Holdings as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think China Resources Building Materials Technology Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

China Resources Building Materials Technology Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 31%. This means it has also seen a slide in revenue over the longer-term as revenue is down 34% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth will show minor resilience over the next year growing only by 3.8%. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 4.6%, that would be a solid result.

Even though the growth is only slight, it's peculiar that China Resources Building Materials Technology Holdings' P/S sits in line with the majority of other companies given the industry is set for a decline. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We note that even though China Resources Building Materials Technology Holdings trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 3 warning signs for China Resources Building Materials Technology Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1313

China Resources Building Materials Technology Holdings

An investment holding company, manufactures and sells cement, concrete, aggregates, and related products and services in Mainland China.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives