- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1303

With EPS Growth And More, Huili Resources (Group) (HKG:1303) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Huili Resources (Group) (HKG:1303), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Huili Resources (Group)

Huili Resources (Group)'s Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Huili Resources (Group) to have grown EPS from CN¥0.007 to CN¥0.14 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

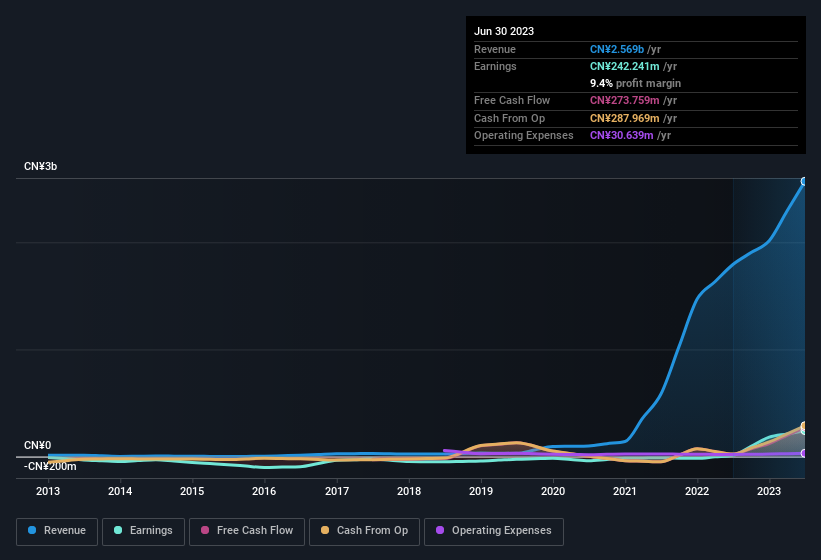

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Huili Resources (Group) shareholders is that EBIT margins have grown from 0.5% to 11% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Huili Resources (Group) is no giant, with a market capitalisation of HK$527m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Huili Resources (Group) Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The real kicker here is that Huili Resources (Group) insiders spent a staggering CN¥74m on acquiring shares in just one year, without single share being sold in the meantime. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. It is also worth noting that it was company insider Yuantao Feng who made the biggest single purchase, worth HK$42m, paying HK$0.25 per share.

The good news, alongside the insider buying, for Huili Resources (Group) bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at CN¥135m. This considerable investment should help drive long-term value in the business. Those holdings account for over 26% of the company; visible skin in the game.

Is Huili Resources (Group) Worth Keeping An Eye On?

Huili Resources (Group)'s earnings per share have been soaring, with growth rates sky high. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Huili Resources (Group) deserves timely attention. It is worth noting though that we have found 3 warning signs for Huili Resources (Group) that you need to take into consideration.

The good news is that Huili Resources (Group) is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Huili Resources (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1303

Huili Resources (Group)

An investment holding, engages in mining, processing, and selling mineral ores in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026