- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1258

With A 26% Price Drop For China Nonferrous Mining Corporation Limited (HKG:1258) You'll Still Get What You Pay For

China Nonferrous Mining Corporation Limited (HKG:1258) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 20%.

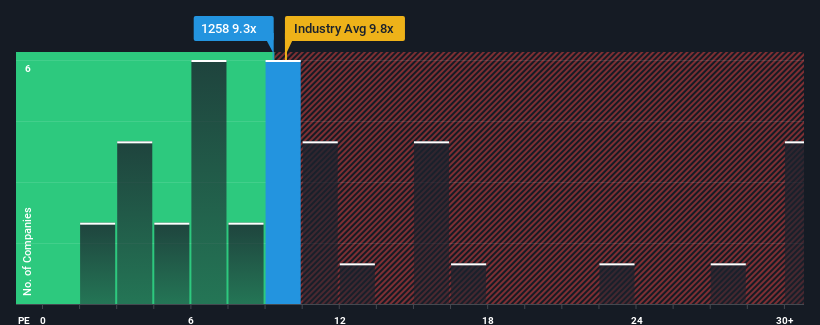

In spite of the heavy fall in price, it's still not a stretch to say that China Nonferrous Mining's price-to-earnings (or "P/E") ratio of 9.3x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

There hasn't been much to differentiate China Nonferrous Mining's and the market's earnings growth lately. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

See our latest analysis for China Nonferrous Mining

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like China Nonferrous Mining's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 4.3%. Pleasingly, EPS has also lifted 99% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 16% each year over the next three years. With the market predicted to deliver 15% growth per year, the company is positioned for a comparable earnings result.

With this information, we can see why China Nonferrous Mining is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

With its share price falling into a hole, the P/E for China Nonferrous Mining looks quite average now. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of China Nonferrous Mining's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about these 2 warning signs we've spotted with China Nonferrous Mining.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1258

China Nonferrous Mining

An investment holding company, engages in the exploration, mining, ore processing, leaching, smelting, and sale of copper and cobalt in Zambia and the Democratic Republic of Congo.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives