- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1208

MMG (SEHK:1208) Valuation Check Following New Chairman Appointment and Leadership Restructure

Reviewed by Simply Wall St

MMG (SEHK:1208) just overhauled its leadership, installing a new Chairman, reshaping key operational roles, and refreshing board committees. This gives investors fresh angles on governance, strategy, and how the mining group executes globally.

See our latest analysis for MMG.

The leadership shake up lands on top of powerful momentum, with MMG’s 1 month and 3 month share price returns of 30.31% and 54.00% respectively feeding into a standout 1 year total shareholder return of 211.40%. This suggests optimism about both growth prospects and execution risk easing.

If MMG’s run has you rethinking where the next surge might come from, it could be worth scanning fast growing stocks with high insider ownership for other under the radar compounders.

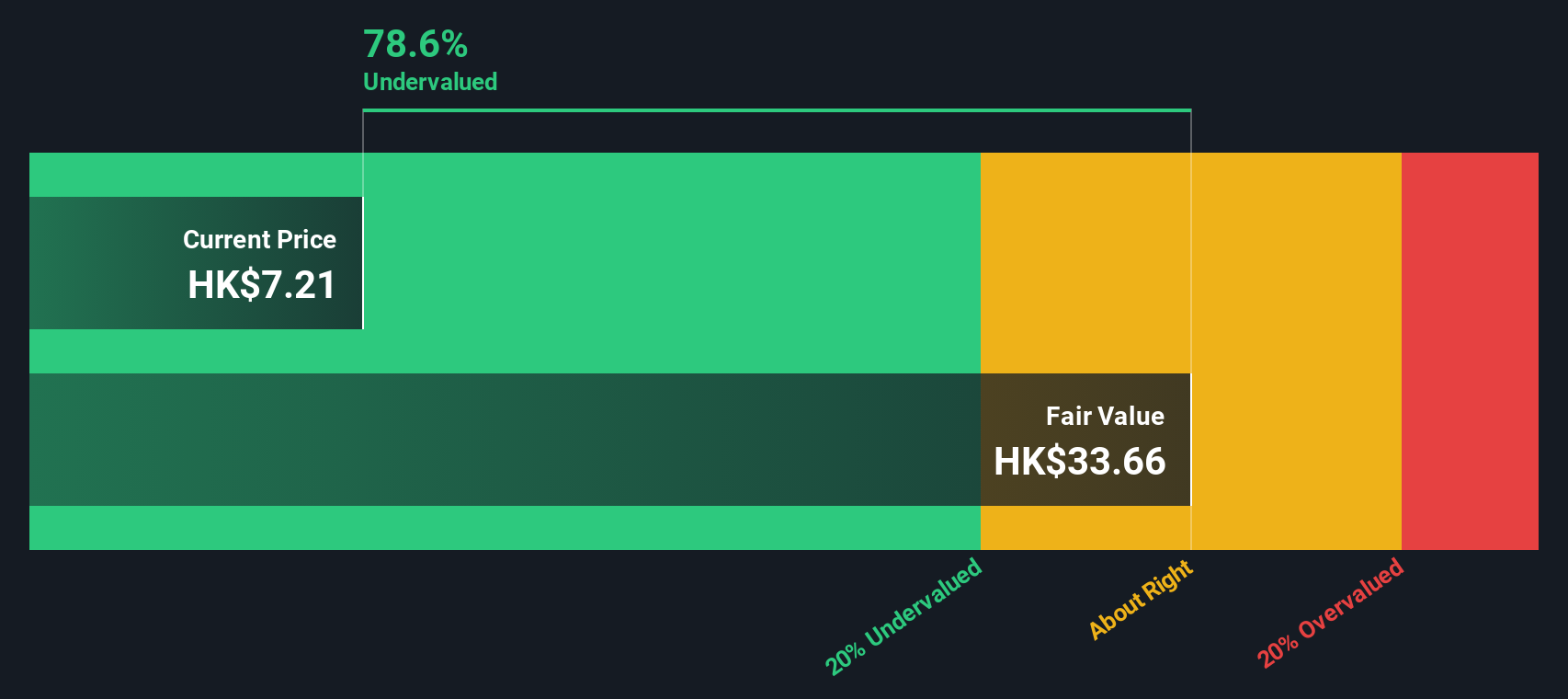

With earnings rising, intrinsic value implying upside, yet the share price already sitting well above analyst targets, investors face a key question: is MMG still mispriced, or is the market already baking in years of growth?

Most Popular Narrative: 37.4% Overvalued

The most widely followed narrative now pegs MMG’s fair value well below its HK$8.47 last close, framing the current rally as stretching ahead of fundamentals.

Heightened global focus on securing critical minerals through long-term contracts and strategic partnerships, coupled with anticipated global copper supply deficits, is expected to sustain elevated prices and demand, positively impacting MMG's revenue and margin outlook over the long term.

Want to see how this copper supercycle story turns into a specific price? The narrative quietly blends stronger growth, fatter margins, and a richer future earnings multiple into one aggressive fair value call. Curious which assumptions do the heavy lifting and how sensitive the outcome is if they slip just a little? Read on to unpack the full playbook behind that target.

Result: Fair Value of $6.16 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent social unrest at Las Bambas and heavy copper dependence could quickly derail those bullish forecasts and reprice MMG’s growth story.

Find out about the key risks to this MMG narrative.

Another View: DCF Points to Deep Value

While the popular narrative sees MMG as 37.4% overvalued at HK$8.47, our DCF model tells a very different story. It points to fair value near HK$42.10 and suggests the shares trade at roughly an 80% discount. Which lens should investors trust when the gap is this wide?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MMG for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MMG Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your MMG research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before this rally runs its course without you, explore your next opportunity using targeted screeners on Simply Wall St that are built to surface high conviction ideas.

- Identify potential multi-baggers early by scanning these 3576 penny stocks with strong financials that combine tiny market caps with surprisingly solid fundamentals.

- Position yourself ahead of the next technological shift by focusing on these 26 AI penny stocks that harness artificial intelligence to scale revenue and margins.

- Find potential mispriced opportunities by filtering for these 906 undervalued stocks based on cash flows where current prices lag behind long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1208

MMG

An investment holding company, engages in the exploration, development, and mining of mineral properties.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026